Enlarge image

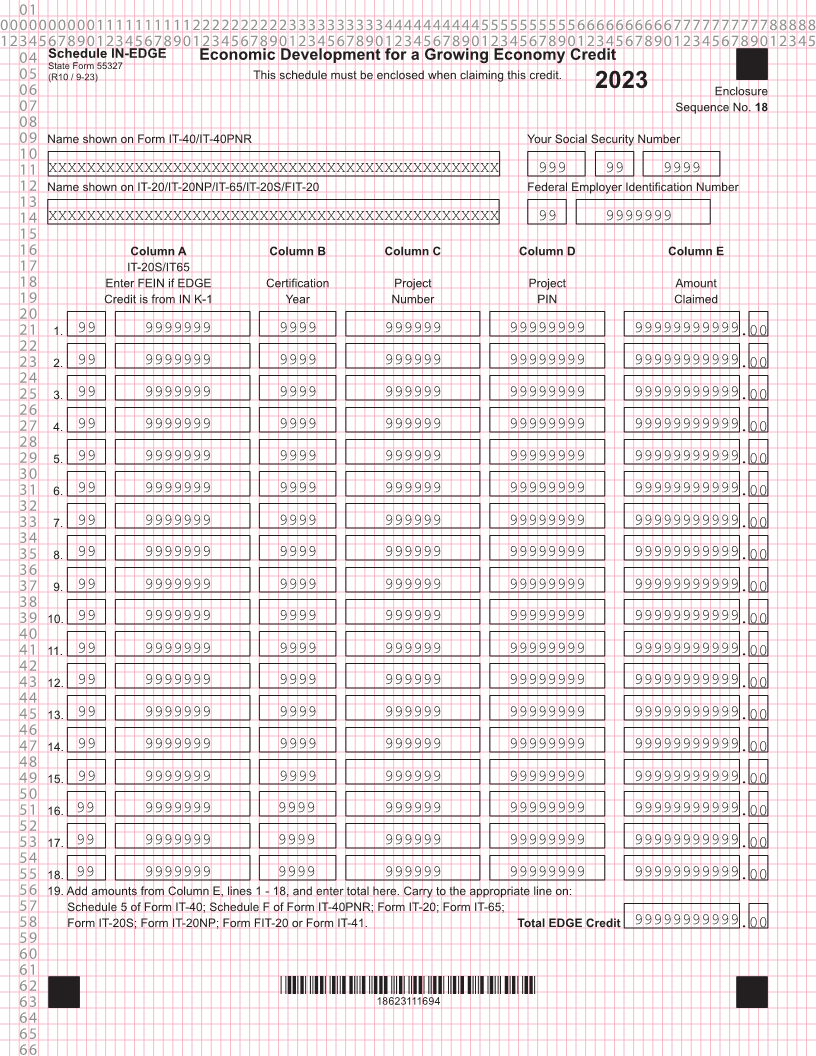

01 0000000000111111111122222222223333333333444444444455555555556666666666777777777788888 1234567890123456789012345678901234567890123456789012345678901234567890123456789012345 04 Schedule IN-EDGE Economic Development for a Growing Economy Credit State Form 55327 05 (R10 / 9-23) This schedule must be enclosed when claiming this credit. 06 2023 Enclosure 07 Sequence No. 18 08 09 Name shown on Form IT-40/IT-40PNR Your Social Security Number 10 11 XXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXX 999 99 9999 12 Name shown on IT-20/IT-20NP/IT-65/IT-20S/FIT-20 Federal Employer Identification Number 13 14 XXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXX 99 9999999 15 16 Column A Column B Column C Column D Column E 17 IT-20S/IT65 18 Enter FEIN if EDGE Certification Project Project Amount 19 Credit is from IN K-1 Year Number PIN Claimed 20 21 1. 99 9999999 9999 999999 99999999 99999999999.00 22 23 2. 99 9999999 9999 999999 99999999 99999999999.00 24 25 3. 99 9999999 9999 999999 99999999 99999999999.00 26 27 4. 99 9999999 9999 999999 99999999 99999999999.00 28 29 5. 99 9999999 9999 999999 99999999 99999999999.00 30 31 6. 99 9999999 9999 999999 99999999 99999999999.00 32 33 7. 99 9999999 9999 999999 99999999 99999999999.00 34 35 8. 99 9999999 9999 999999 99999999 99999999999.00 36 37 9. 99 9999999 9999 999999 99999999 99999999999.00 38 39 10. 99 9999999 9999 999999 99999999 99999999999.00 40 41 11. 99 9999999 9999 999999 99999999 99999999999.00 42 43 12. 99 9999999 9999 999999 99999999 99999999999.00 44 45 13. 99 9999999 9999 999999 99999999 99999999999.00 46 47 14. 99 9999999 9999 999999 99999999 99999999999.00 48 49 15. 99 9999999 9999 999999 99999999 99999999999.00 50 51 16. 99 9999999 9999 999999 99999999 99999999999.00 52 53 17. 99 9999999 9999 999999 99999999 99999999999.00 54 55 18. 99 9999999 9999 999999 99999999 99999999999.00 56 19. Add amounts from Column E, lines 1 - 18, and enter total here. Carry to the appropriate line on: 57 Schedule 5 of Form IT-40; Schedule F of Form IT-40PNR; Form IT-20; Form IT-65; 58 Form IT-20S; Form IT-20NP; Form FIT-20 or Form IT-41. Total EDGE Credit 99999999999.00 59 60 61 62 *18623111694* 63 18623111694 64 65 66