Enlarge image

01

0000000000111111111122222222223333333333444444444455555555556666666666777777777788888

1234567890123456789012345678901234567890123456789012345678901234567890123456789012345

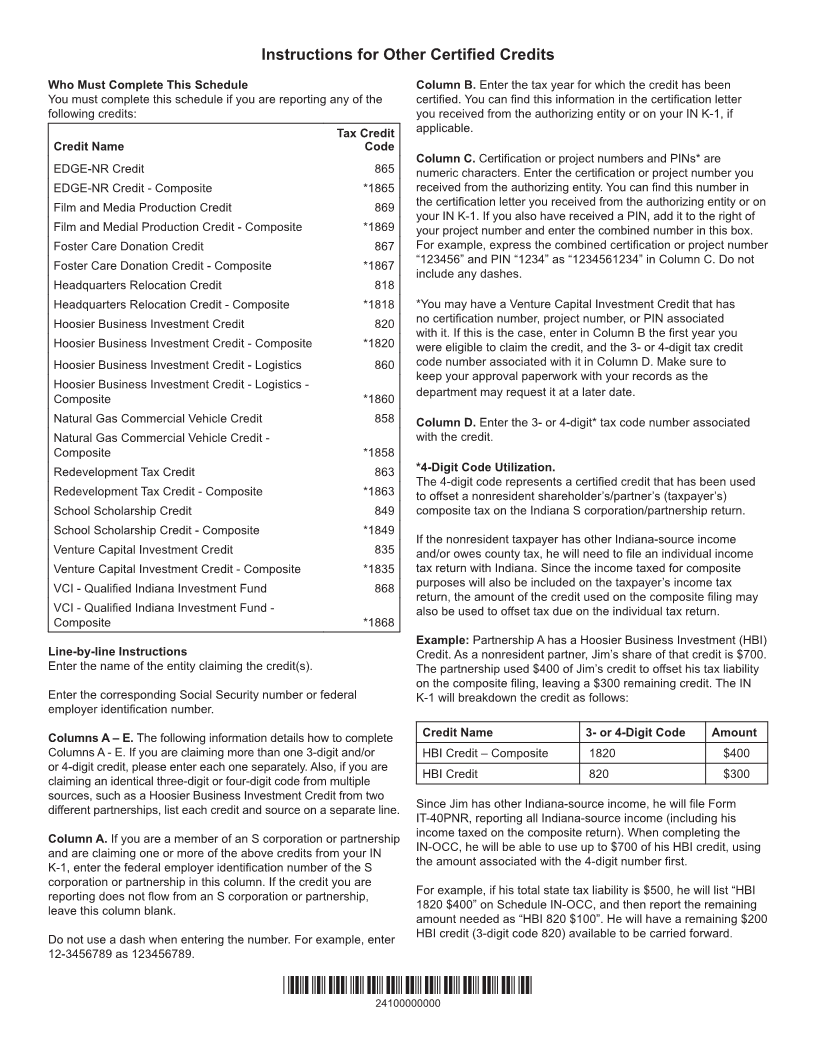

04 Schedule IN-OCC Enclosure

05 State Form 55629 Other Certified Credits Sequence No. 25

(R9 / 9-23)

06 2023

07

08

09 Name shown on Form IT-40/IT-40PNR Your Social Security Number

10

11 XXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXX 999 99 9999

12 Name shown on IT-20/IT-20NP/IT-65/IT-20S/FIT-20/IT-41 Federal Employer Identification Number

13

14 XXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXX 999999999

15

Complete this schedule if you are reporting any of the following credits: EDGE-NR Credit; EDGE-NR Credit -Composite; Film and Media Production

16 Credit; Film and Medial Production Credit - Composite; Foster Care Donation Credit; Foster Care Donation Credit - Composite; Headquarters

17 Relocation Credit; Headquarters Relocation Credit - Composite Hoosier Business Investment Credit; Hoosier Business Investment Credit - Composite;

18 Hoosier Business Investment Credit - Logistics; Hoosier Business Investment Credit - Logistics - Composite; Natural Gas Commercial Vehicle Credit;

19 Natural Gas Commercial Vehicle Credit - Composite; Redevelopment Tax Credit; Redevelopment Tax Credit - Composite; School Scholarship Credit;

20 School Scholarship Credit - Composite; Venture Capital Investment Credit; Venture Capital Investment Credit - Composite; VCI - Qualified Indiana

Investment Fund; VCI - Qualified Indiana Investment Fund - Composite.

21

22 Column A Column B Column C Column D Column E

23 IT-20S/IT65 Certification/

24 Enter FEIN if Credit Certification Project Tax Credit Amount

25 is from IN K-1 Year Number Code Claimed

26

27 1. 999999999 9999 9999999999999999 9999 1 99999999999 .00

28

29 2. 999999999 9999 9999999999999999 9999 2 99999999999 .00

30

31 3. 999999999 9999 9999999999999999 9999 3 99999999999 .00

32

33 4. 999999999 9999 9999999999999999 9999 4 99999999999 .00

34

35 5. 999999999 9999 9999999999999999 9999 5 99999999999 .00

36

37 6. 999999999 9999 9999999999999999 9999 6 99999999999 .00

38

39 7. 999999999 9999 9999999999999999 9999 7 99999999999 .00

40

41 8. 999999999 9999 9999999999999999 9999 8 99999999999 .00

42

43 9. 999999999 9999 9999999999999999 9999 9 99999999999 .00

44

45 10. 999999999 9999 9999999999999999 9999 10 99999999999 .00

46

47 11. 999999999 9999 9999999999999999 9999 11 99999999999 .00

48

49 12. 999999999 9999 9999999999999999 9999 12 99999999999 .00

50

51 13. 999999999 9999 9999999999999999 9999 13 99999999999 .00

52

53 14. 999999999 9999 9999999999999999 9999 14 99999999999 .00

54

55 15. 999999999 9999 9999999999999999 9999 15 99999999999 .00

56

57 16. Add amounts from Column E, lines 1 - 15, and enter total here. Carry to the

58 appropriate line on: Schedule 6; Schedule G; Form IT-20; Form IT-20NP; Form IT-41; or

59 Form FIT-20 (Form IT-65 and Form IT-20S filers must see special reporting instructions) ____Total 16 99999999999.00

60

61

62 *21523111694*

63 21523111694

64

65

66