Enlarge image

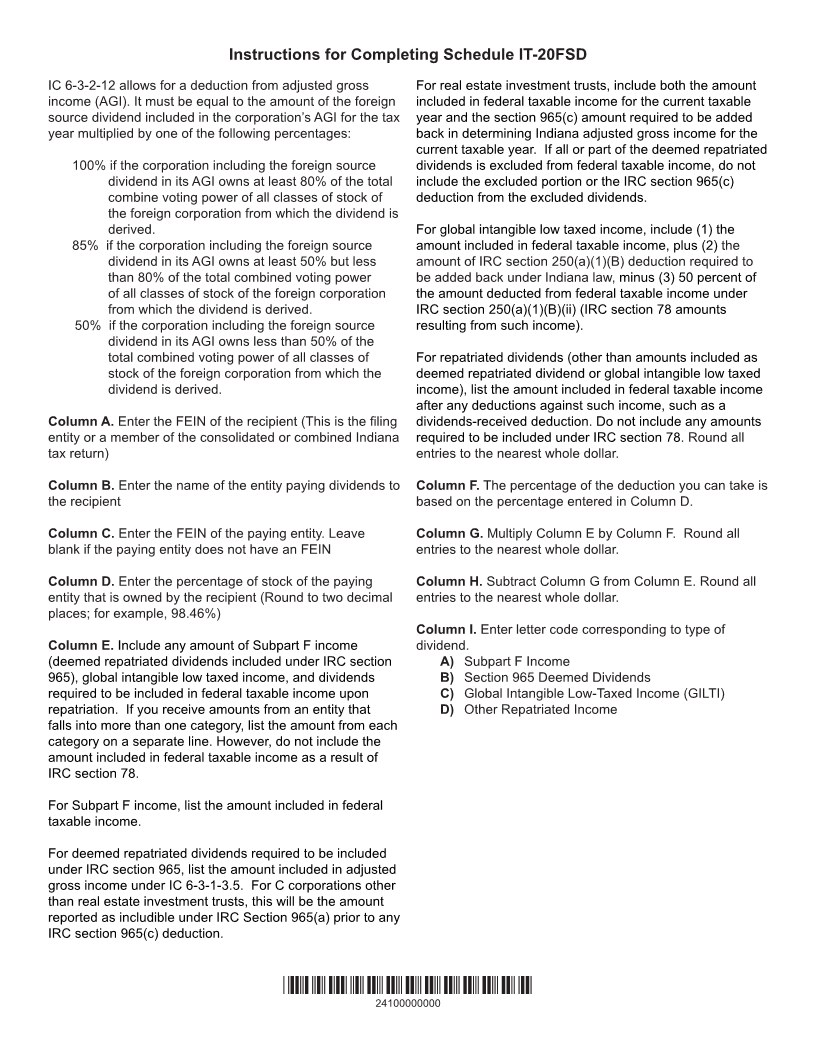

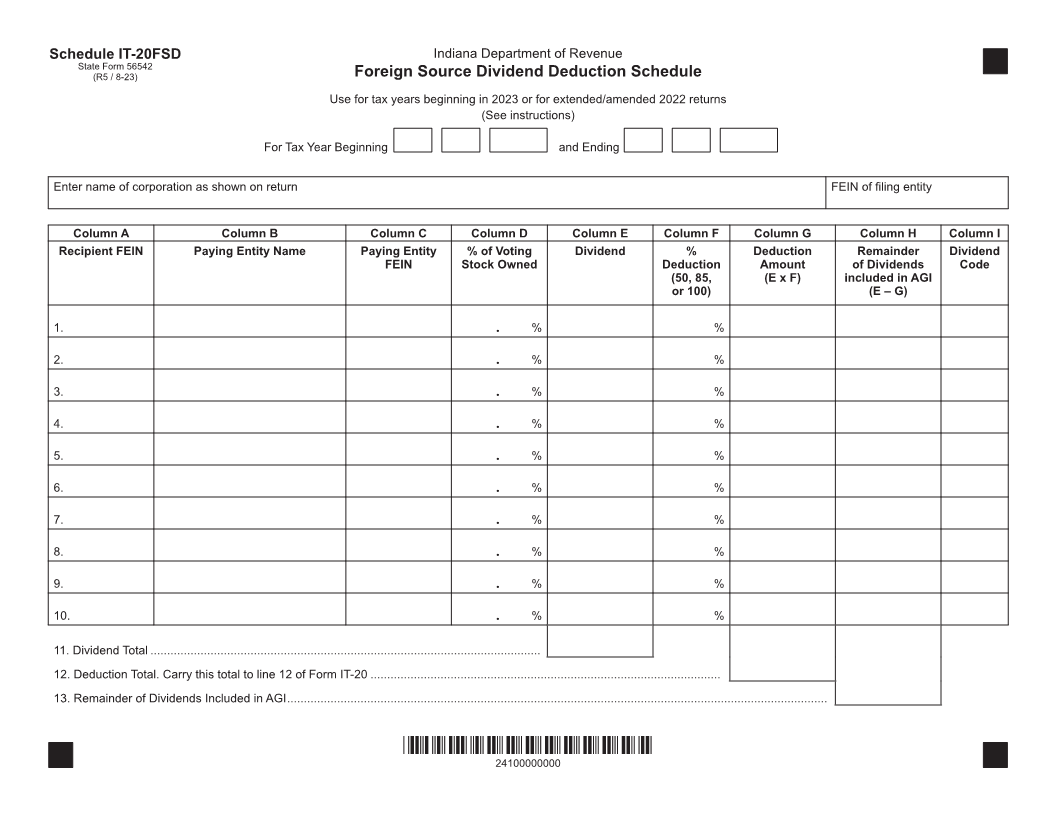

Schedule IT-20FSD Indiana Department of Revenue

State Form 56542

(R5 / 8-23) Foreign Source Dividend Deduction Schedule

Use for tax years beginning in 2023 or for extended/amended 2022 returns

(See instructions)

For Tax Year Beginning and Ending

Enter name of corporation as shown on return FEIN of filing entity

Column A Column B Column C Column D Column E Column F Column G Column H Column I

Recipient FEIN Paying Entity Name Paying Entity % of Voting Dividend % Deduction Remainder Dividend

FEIN Stock Owned Deduction Amount of Dividends Code

(50, 85, (E x F) included in AGI

or 100) (E – G)

1. . % %

2. . % %

3. . % %

4. . % %

5. . % %

6. . % %

7. . % %

8. . % %

9. . % %

10. . % %

11. Dividend Total .....................................................................................................................

12. Deduction Total. Carry this total to line 12 of Form IT-20 .........................................................................................................

13. Remainder of Dividends Included in AGI ..................................................................................................................................................................

*24100000000*

24100000000