Enlarge image

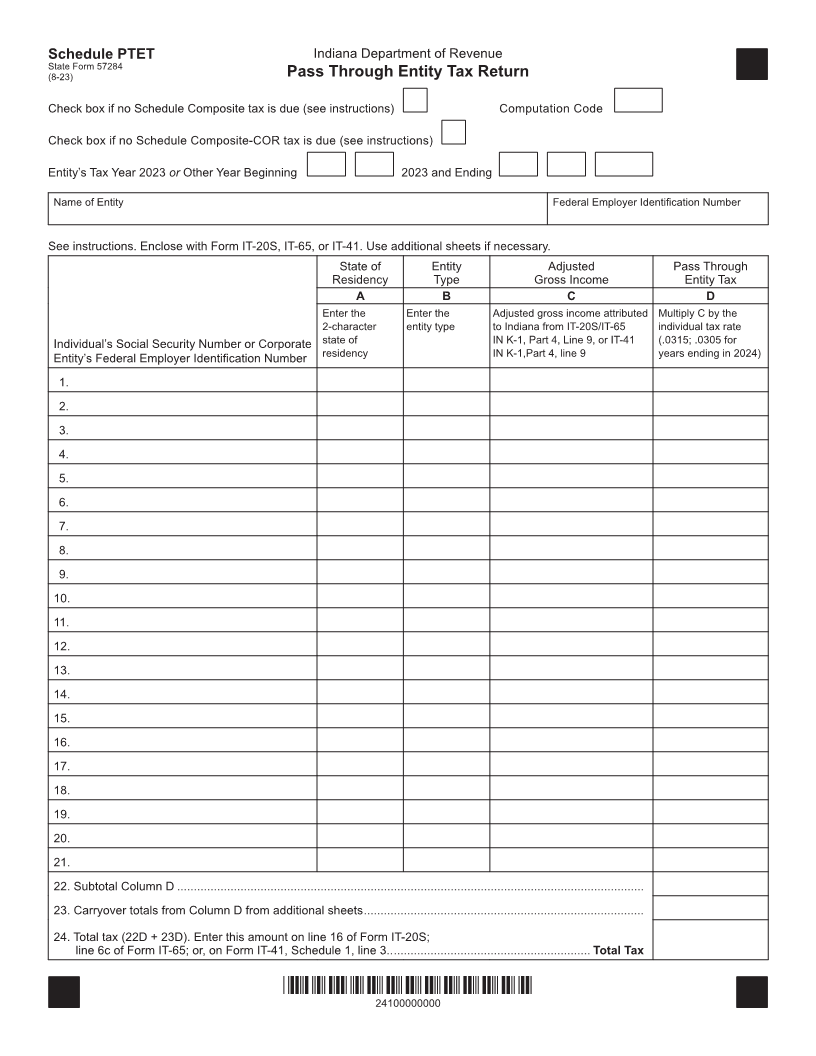

Schedule PTET Indiana Department of Revenue

State Form 57284

(8-23) Pass Through Entity Tax Return

Check box if no Schedule Composite tax is due (see instructions) Computation Code

Check box if no Schedule Composite-COR tax is due (see instructions)

Entity’s Tax Year 2023 or Other Year Beginning 2023 and Ending

Name of Entity Federal Employer Identification Number

See instructions. Enclose with Form IT-20S, IT-65, or IT-41. Use additional sheets if necessary.

State of Entity Adjusted Pass Through

Residency Type Gross Income Entity Tax

A B C D

Enter the Enter the Adjusted gross income attributed Multiply C by the

2-character entity type to Indiana from IT-20S/IT-65 individual tax rate

Individual’s Social Security Number or Corporate state of IN K-1, Part 4, Line 9, or IT-41 (.0315; .0305 for

Entity’s Federal Employer Identification Number residency IN K-1,Part 4, line 9 years ending in 2024)

1.

2.

3.

4.

5.

6.

7.

8.

9.

10.

11.

12.

13.

14.

15.

16.

17.

18.

19.

20.

21.

22. Subtotal Column D ............................................................................................................................................

23. Carryover totals from Column D from additional sheets ....................................................................................

24. Total tax (22D + 23D). Enter this amount on line 16 of Form IT-20S;

line 6c of Form IT-65; or, on Form IT-41, Schedule 1, line 3.. ........................................................... Total Tax

*24100000000*

24100000000