Enlarge image

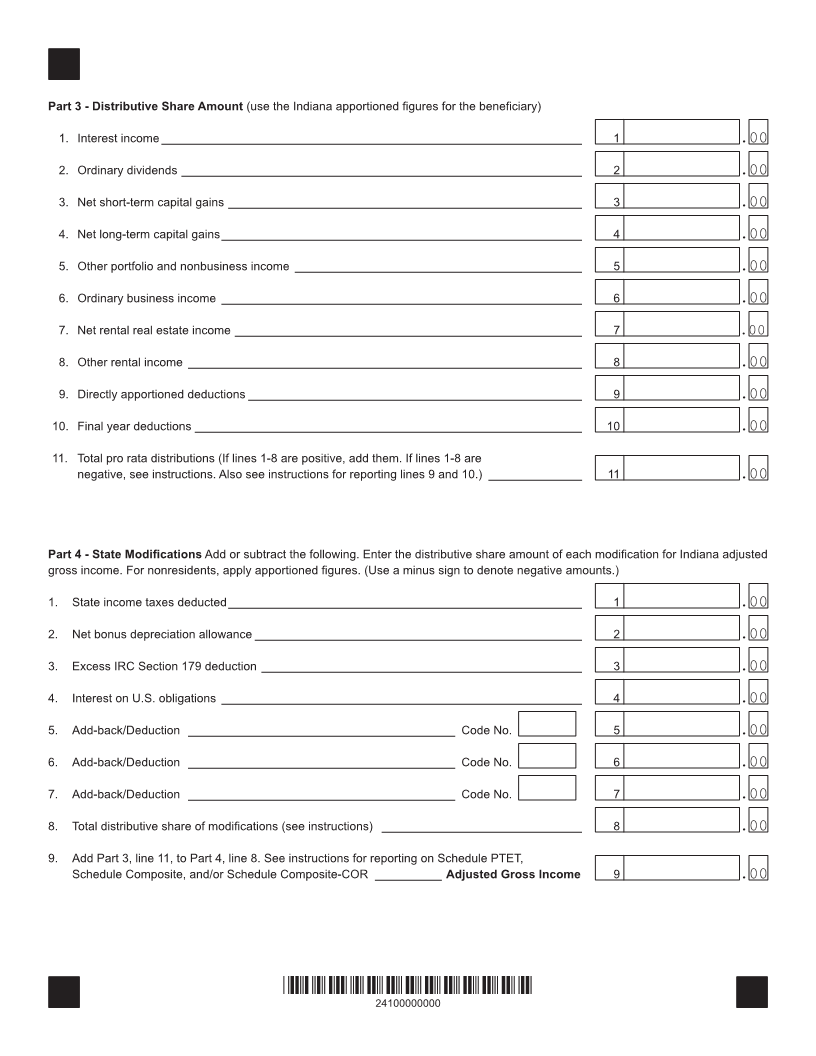

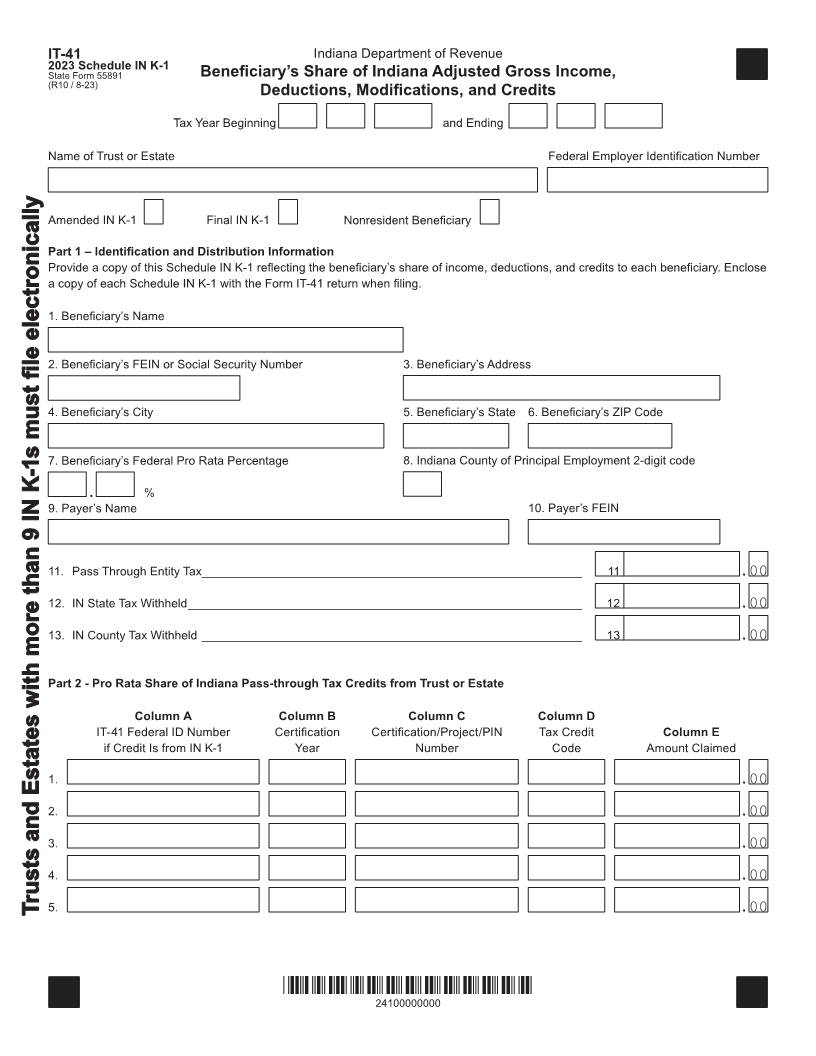

IT-41 Indiana Department of Revenue 2023 Schedule IN K-1 State Form 55891 Beneficiary’s Share of Indiana Adjusted Gross Income, (R10 / 8-23) Deductions, Modifications, and Credits Tax Year Beginning and Ending Name of Trust or Estate Federal Employer Identification Number Amended IN K-1 Final IN K-1 Nonresident Beneficiary icallyically nnPart 1 – Identification and Distribution Information Provide a copy of this Schedule IN K-1 reflecting the beneficiary’s share of income, deductions, and credits to each beneficiary. Enclose a copy of each Schedule IN K-1 with the Form IT-41 return when filing. ctroctro elle1. Beneficiary’s Name e e ee l2. Beneficiary’s FEIN or Social Security Number 3. Beneficiary’s Address 4. Beneficiary’s City 5. Beneficiary’s State 6. Beneficiary’s ZIP Code 7. Beneficiary’s Federal Pro Rata Percentage 8. Indiana County of Principal Employment 2-digit code . % 9. Payer’s Name 10. Payer’s FEIN IN K-1s must fil IN K-1s must fi 9 9 nn 11. Pass Through Entity Tax_________________________________________________________ 11 .00 tha tha ee12. IN State Tax Withheld ___________________________________________________________ 12 .00 13. IN County Tax Withheld _________________________________________________________ 13 .00 ith morith morPart 2 - Pro Rata Share of Indiana Pass-through Tax Credits from Trust or Estate ww s s Column A Column B Column C Column D ee IT-41 Federal ID Number Certification Certification/Project/PIN Tax Credit Column E if Credit Is from IN K-1 Year Number Code Amount Claimed 1. .00 d Estatd Estat nn2. .00 3. .00 4. .00 Trusts aTrusts a5. .00 *24100000000* 24100000000