Enlarge image

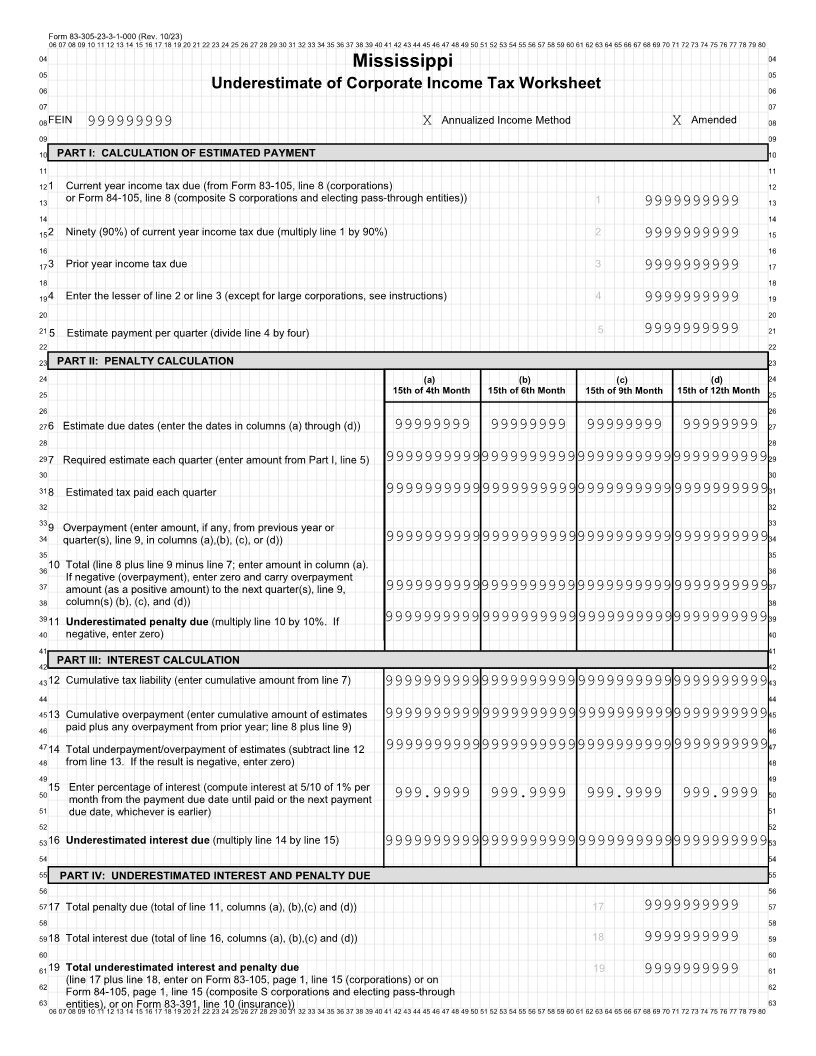

Form 83-305-23-3-1-000 (Rev. 10/23)

06 07 08 09 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 80

04 04

Mississippi

05 05

06 Underestimate of Corporate Income Tax Worksheet 06

07 07

08FEIN 999999999 X Annualized Income Method X Amended 08

09 09

10 PART I: CALCULATION OF ESTIMATED PAYMENT 10

11 11

121 Current year income tax due (from Form 83-105, line 8 (corporations) 12

13 or Form 84-105, line 8 (composite S corporations and electing pass-through entities)) 1 9999999999 13

14 14

152 Ninety (90%) of current year income tax due (multiply line 1 by 90%) 2 9999999999 15

16 16

173 Prior year income tax due 3 9999999999 17

18 18

194 Enter the lesser of line 2 or line 3 (except for large corporations, see instructions) 4 9999999999 19

20 20

21 5 Estimate payment per quarter (divide line 4 by four) 5 9999999999 21

22 22

23 PART II: PENALTY CALCULATION 23

24 (a) (b) (c) (d) 24

25 15th of 4th Month 15th of 6th Month 15th of 9th Month 15th of 12th Month 25

26 26

276 Estimate due dates (enter the dates in columns (a) through (d)) 99999999 99999999 99999999 99999999 27

28 28

297 Required estimate each quarter (enter amount from Part I, line 5) 99999999999999999999 9999999999 9999999999 29

30 30

318 Estimated tax paid each quarter 999999999999999999999999999999 999999999931

32 32

339 Overpayment (enter amount, if any, from previous year or 33

34 quarter(s), line 9, in columns (a),(b), (c), or (d)) 999999999999999999999999999999 999999999934

35 35

3610 Total (line 8 plus line 9 minus line 7; enter amount in column (a). 36

If negative (overpayment), enter zero and carry overpayment

37 amount (as a positive amount) to the next quarter(s), line 9, 99999999999999999999 9999999999 999999999937

38 column(s) (b), (c), and (d)) 38

3911 Underestimated penalty due (multiply line 10 by 10%. If 9999999999 999999999999999999999999999999 39

40 negative, enter zero) 40

41 41

42 PART III: INTEREST CALCULATION 42

4312 Cumulative tax liability (enter cumulative amount from line 7) 9999999999 9999999999 99999999999999999999 43

44 44

4513 Cumulative overpayment (enter cumulative amount of estimates 9999999999 999999999999999999999999999999 45

46 paid plus any overpayment from prior year; line 8 plus line 9) 46

4714 Total underpayment/overpayment of estimates (subtract line 12 999999999999999999999999999999 999999999947

48 from line 13. If the result is negative, enter zero) 48

49 49

5015 Enter percentage of interest (compute interest at 5/10 of 1% per 50

month from the payment due date until paid or the next payment 999.9999 999.9999 999.9999 999.9999

51 due date, whichever is earlier) 51

52 52

5316 Underestimated interest due (multiply line 14 by line 15) 9999999999 9999999999 99999999999999999999 53

54 54

55 PART IV: UNDERESTIMATED INTEREST AND PENALTY DUE 55

56 56

5717 Total penalty due (total of line 11, columns (a), (b),(c) and (d)) 17 9999999999 57

58 58

5918 Total interest due (total of line 16, columns (a), (b),(c) and (d)) 18 9999999999 59

60 60

6119 Total underestimated interest and penalty due 19 9999999999 61

62 (line 17 plus line 18, enter on Form 83-105, page 1, line 15 (corporations) or on 62

Form 84-105, page 1, line 15 (composite S corporations and electing pass-through

63 63

06 07 entities), or on Form 83-391, line 10 (insurance)) 08 09 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 80