Enlarge image

Form 83-391-23-3-1-000 (Rev. 10/23)

06 07 08 09 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 80

04 Mississippi 04

05 Insurance Company Income Tax Return 05

06 833912331000 2023 06

07 07

08 Tax Year Beginning 99999999 Tax Year Ending 99999999 08

09 09

10 FEIN 999999999 Mississippi Secretary of State ID 9999999999 10

11 11

12 Legal Name and DBA CHECK ALL THAT APPLY 12

13 X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9 13

14 Address X Amended Return X Accident and Health 14

15 X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9 15

16 X Final Return X Fire and Casualty 16

17 X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9 17

18 City State Zip +4 Life Insurance 18

X

19 X9X9X9X9X9X9X9X9X9X9X9X9X9X9 XX 999999999 X Accrual Basis 19

20 20

21 County Code 99 NAICS Code 99999 X Receipts and 21

22 Disbursements Basis 22

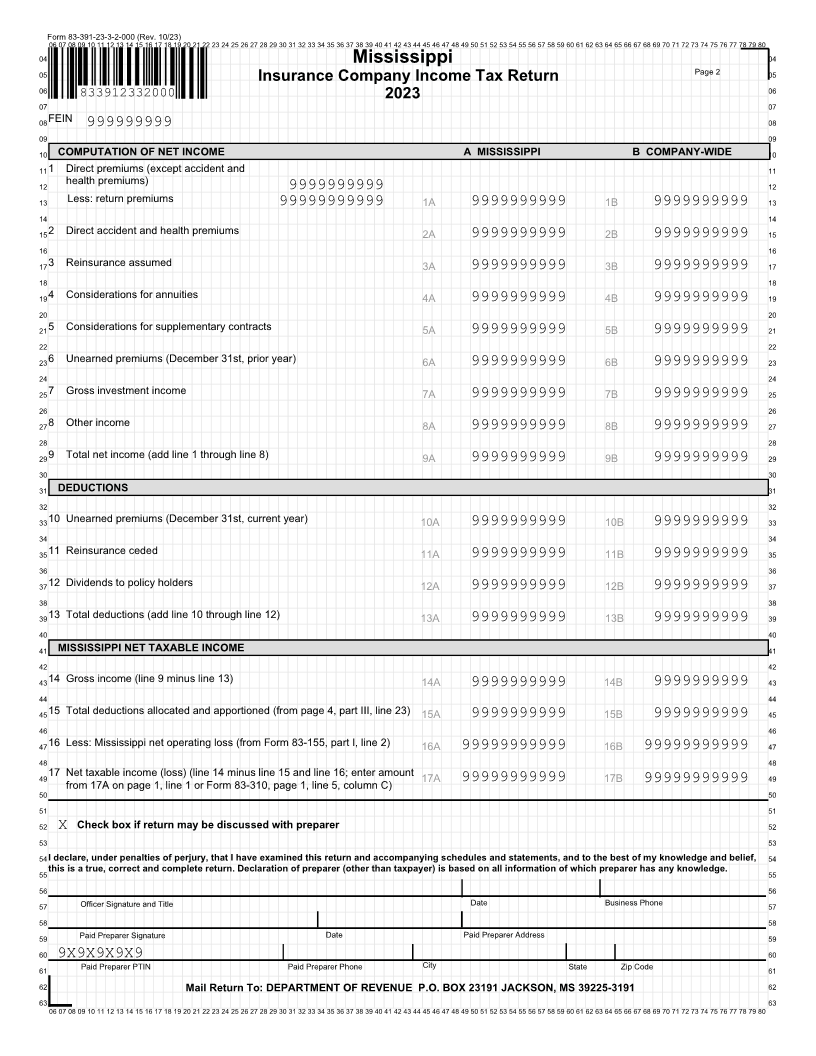

23 COMPUTATION OF TAX (ROUND TO THE NEAREST DOLLAR) 23

24 24

25 X Combined income tax return (enter FEIN of reporting company) 999999999 25

26 26

27 1 Mississippi net taxable income (from page 2, line 17A or Form 83-310, page 1, line 5, column C) 1 99999999999 27

28 28

29 2 Income tax 2 9999999999 29

30 30

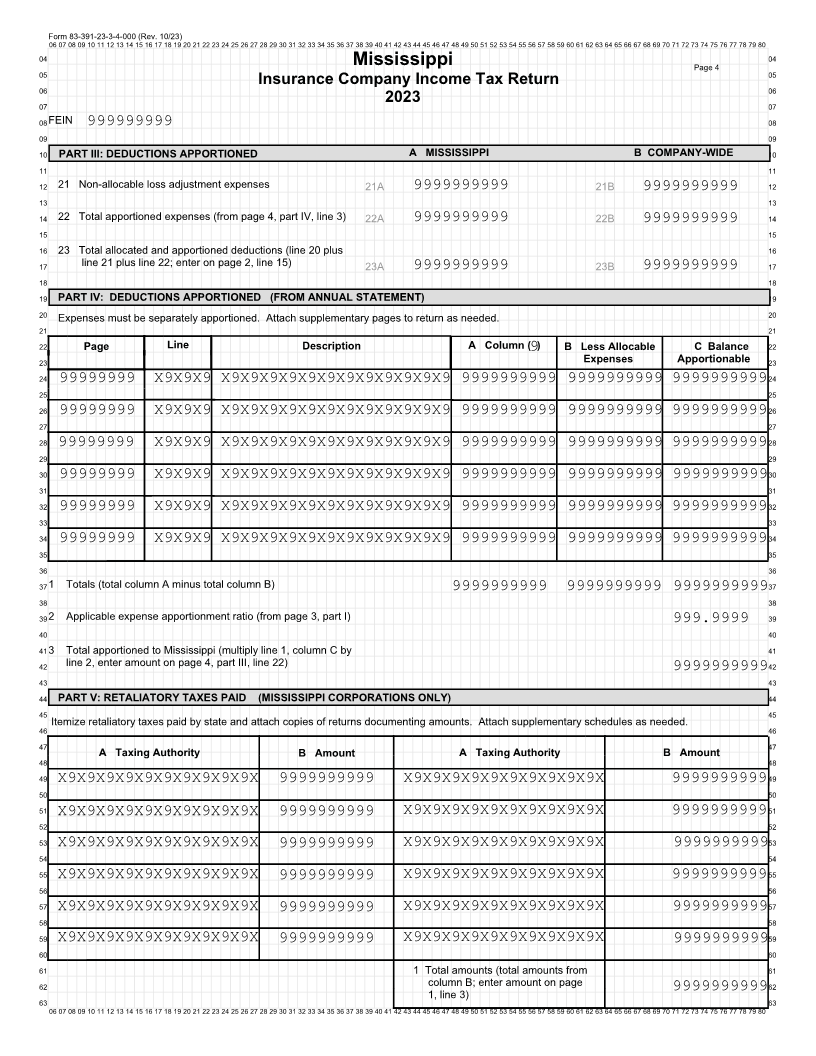

31 3 Retaliatory taxes paid to other states (Mississippi corporations only; from page 4, part V, line 1) 3 9999999999 31

32 32

33 4 Income tax credits (from Form 83-401, line 3 or Form 83-310, page 1, line 5, column B) 4 9999999999 33

34 34

35 5 Net income tax due (line 2 minus line 3 and line 4) 5 9999999999 35

36 36

37 PAYMENTS AND TAX DUE 37

38 38

39 6 Overpayment from prior year 6 9999999999 39

40 40

41 7 Estimated tax payments and payment with extension 7 9999999999 41

42 42

43 8 Total payments (line 6 plus line 7) 8 9999999999 43

44 44

45 9 Net total income tax due (line 5 minus line 8) 9 9999999999 45

46 46

47 10 Interest and penalty on underestimated income tax payments (from Form 83-305, line 19) 10 9999999999 47

48 48

49 11 Late payment interest 11 9999999999 49

50 50

51 12 Late payment penalty 12 9999999999 51

52 52

53 13 Late filing penalty (minimum $100) 13 9999999999 53

54 54

55 14 Total balance due (if line 5 is larger than line 8, add lines 9 through 13) 14 9999999999 55

56 56

57 15 Total overpayment (if line 8 is larger than line 5, subtract line 5 from line 8) 15 9999999999 57

58 58

59 16 Total overpayment credited to next year (from line 15) 16 9999999999 59

60 60

61 17 Total overpayment refunded (line 15 minus line 16) 17 9999999999 61

62 62

63 63

06 07 08 09 10 11 12 13 14 15 16 17See instructions for electronic payment options or attach check or money order for balance due. 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 80