Enlarge image

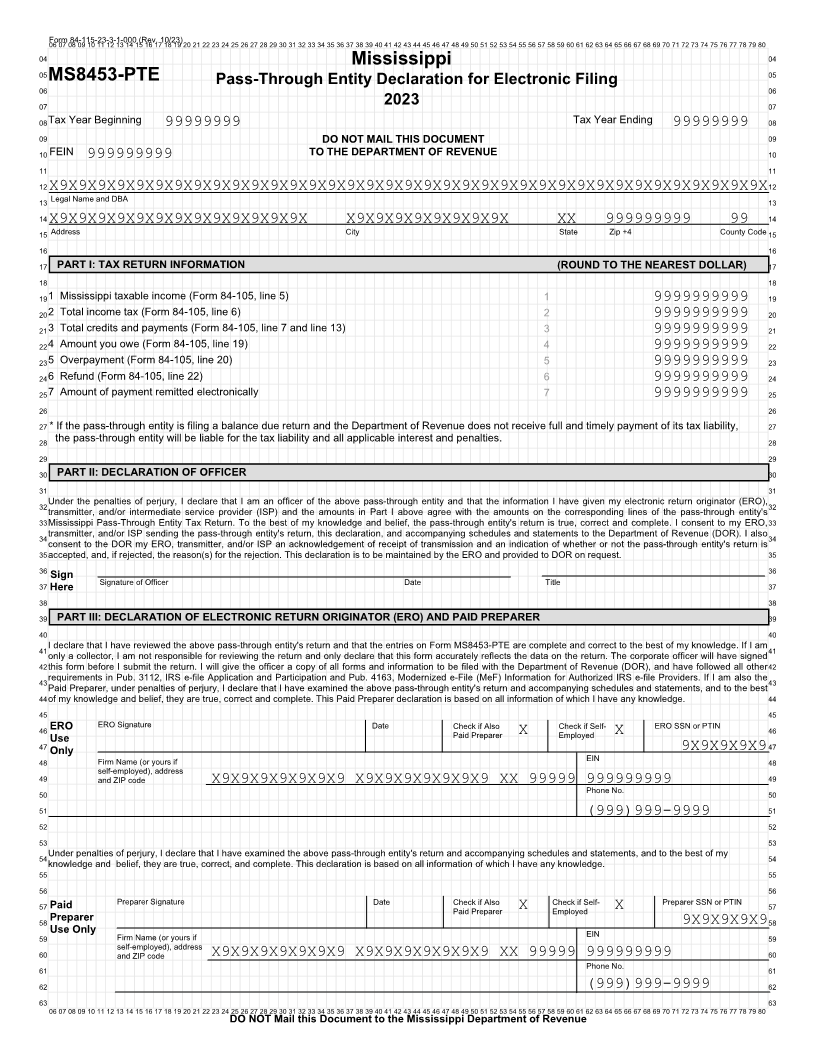

06Form 84-115-23-3-1-000 (Rev. 10/23)07 08 09 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 80

04 Mississippi 04

05MS8453-PTE Pass-Through Entity Declaration for Electronic Filing 05

06 06

07 2023 07

08Tax Year Beginning 99999999 Tax Year Ending 99999999 08

09 DO NOT MAIL THIS DOCUMENT 09

10 FEIN 999999999 TO THE DEPARTMENT OF REVENUE 10

11 11

12 X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X 12

13 Legal Name and DBA 13

14 X9X9X9X9X9X9X9X9X9X9X9X9X9X X9X9X9X9X9X9X9X9X XX 999999999 99 14

15 Address City State Zip +4 County Code 15

16 16

17 PART I: TAX RETURN INFORMATION (ROUND TO THE NEAREST DOLLAR) 17

18 18

191 Mississippi taxable income (Form 84-105, line 5) 1 9999999999 19

202 Total income tax (Form 84-105, line 6) 2 9999999999 20

213 Total credits and payments (Form 84-105, line 7 and line 13) 3 9999999999 21

224 Amount you owe (Form 84-105, line 19) 4 9999999999 22

235 Overpayment (Form 84-105, line 20) 5 9999999999 23

246 Refund (Form 84-105, line 22) 6 9999999999 24

257 Amount of payment remitted electronically 7 9999999999 25

26 26

27 * If the pass-through entity is filing a balance due return and the Department of Revenue does not receive full and timely payment of its tax liability, 27

28 the pass-through entity will be liable for the tax liability and all applicable interest and penalties. 28

29 29

30 PART II: DECLARATION OF OFFICER 30

31 31

32Under the penalties of perjury, I declare that I am an officer of the above pass-through entity and that the information I have given my electronic return originator (ERO), 32

transmitter, and/or intermediate service provider (ISP) and the amounts in Part I above agree with the amounts on the corresponding lines of the pass-through entity's

33Mississippi Pass-Through Entity Tax Return. To the best of my knowledge and belief, the pass-through entity's return is true, correct and complete. I consent to my ERO, 33

34transmitter, and/or ISP sending the pass-through entity's return, this declaration, and accompanying schedules and statements to the Department of Revenue (DOR). I also 34

consent to the DOR my ERO, transmitter, and/or ISP an acknowledgement of receipt of transmission and an indication of whether or not the pass-through entity's return is

35accepted, and, if rejected, the reason(s) for the rejection. This declaration is to be maintained by the ERO and provided to DOR on request. 35

36 Sign 36

37 Here Signature of Officer Date Title 37

38 38

39 PART lll: DECLARATION OF ELECTRONIC RETURN ORIGINATOR (ERO) AND PAID PREPARER 39

40 40

41I declare that I have reviewed the above pass-through entity's return and that the entries on Form MS8453-PTE are complete and correct to the best of my knowledge. If I am 41

only a collector, I am not responsible for reviewing the return and only declare that this form accurately reflects the data on the return. The corporate officer will have signed

42this form before I submit the return. I will give the officer a copy of all forms and information to be filed with the Department of Revenue (DOR), and have followed all other 42

43requirements in Pub. 3112, IRS e-file Application and Participation and Pub. 4163, Modernized e-File (MeF) Information for Authorized IRS e-file Providers. If I am also the 43

Paid Preparer, under penalties of perjury, I declare that I have examined the above pass-through entity's return and accompanying schedules and statements, and to the best

44of my knowledge and belief, they are true, correct and complete. This Paid Preparer declaration is based on all information of which I have any knowledge. 44

45 45

46 ERO ERO Signature Date Check if Also Check if Self- ERO SSN or PTIN 46

Use Paid Preparer X Employed X

9X9X9X9X9

47 Only Firm Name (or yours if EIN 47

48 48

self-employed), address

49 and ZIP code X9X9X9X9X9X9X9 X9X9X9X9X9X9X9 XX 99999 999999999 49

50 Phone No. 50

51 (999)999-9999 51

52 52

53 53

54Under penalties of perjury, I declare that I have examined the above pass-through entity's return and accompanying schedules and statements, and to the best of my 54

knowledge and belief, they are true, correct, and complete. This declaration is based on all information of which I have any knowledge.

55 55

56 56

57 Paid Preparer Signature Date Check if Also Check if Self- Preparer SSN or PTIN 57

Paid Preparer X Employed X

58 Preparer 9X9X9X9X9 58

Use Only

59 Firm Name (or yours if EIN 59

self-employed), address

60 and ZIP code X9X9X9X9X9X9X9 X9X9X9X9X9X9X9 XX 99999 999999999 60

61 Phone No. 61

62 (999)999-9999 62

63 63

06 07 08 09 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 80

DO NOT Mail this Document to the Mississippi Department of Revenue