Enlarge image

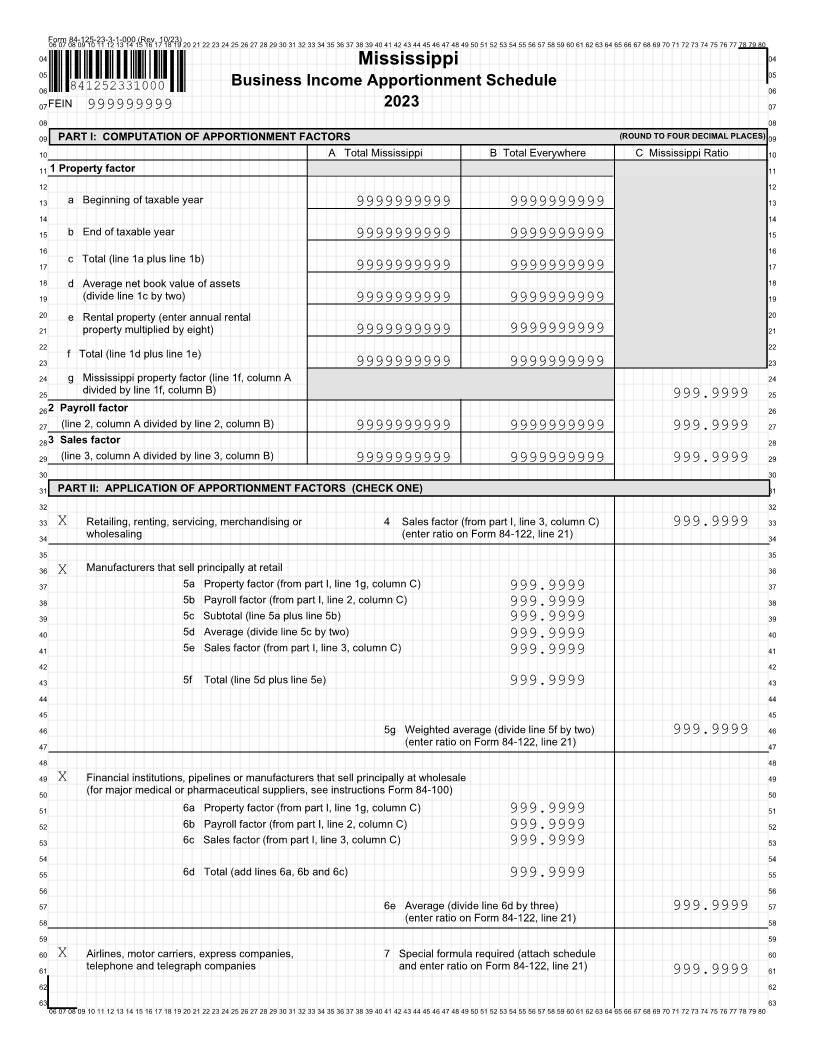

Form 84-125-23-3-1-000 (Rev. 10/23)06 07 08 09 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 80

04 Mississippi 04

05 05

06 841252331000 Business Income Apportionment Schedule 06

07FEIN 999999999 2023 07

08 08

09 PART I: COMPUTATION OF APPORTIONMENT FACTORS (ROUND TO FOUR DECIMAL PLACES) 09

10 A Total Mississippi B Total Everywhere C Mississippi Ratio 10

11 1 Property factor 11

12 12

13 a Beginning of taxable year 9999999999 9999999999 13

14 14

15 b End of taxable year 9999999999 9999999999 15

16 16

17 c Total (line 1a plus line 1b) 17

9999999999 9999999999

18 d Average net book value of assets 18

19 (divide line 1c by two) 9999999999 9999999999 19

20 e Rental property (enter annual rental 20

21 property multiplied by eight) 9999999999 9999999999 21

22 22

f Total (line 1d plus line 1e)

23 9999999999 9999999999 23

24 g Mississippi property factor (line 1f, column A 24

25 divided by line 1f, column B) 25

999.9999

262 Payroll factor 26

27 (line 2, column A divided by line 2, column B) 9999999999 9999999999 999.9999 27

283 Sales factor 28

29 (line 3, column A divided by line 3, column B) 9999999999 9999999999 999.9999 29

30 30

31 PART II: APPLICATION OF APPORTIONMENT FACTORS (CHECK ONE) 31

32 32

33 X Retailing, renting, servicing, merchandising or 4 Sales factor (from part I, line 3, column C) 999.9999 33

34 wholesaling (enter ratio on Form 84-122, line 21) 34

35 35

36 X Manufacturers that sell principally at retail 36

37 5a Property factor (from part I, line 1g, column C) 999.9999 37

38 5b Payroll factor (from part I, line 2, column C) 999.9999 38

39 5c Subtotal (line 5a plus line 5b) 999.9999 39

40 5d Average (divide line 5c by two) 999.9999 40

41 5e Sales factor (from part I, line 3, column C) 999.9999 41

42 42

43 5f Total (line 5d plus line 5e) 999.9999 43

44 44

45 45

46 5g Weighted average (divide line 5f by two) 999.9999 46

47 (enter ratio on Form 84-122, line 21) 47

48 48

49 X Financial institutions, pipelines or manufacturers that sell principally at wholesale 49

50 (for major medical or pharmaceutical suppliers, see instructions Form 84-100) 50

51 6a Property factor (from part I, line 1g, column C) 999.9999 51

52 6b Payroll factor (from part I, line 2, column C) 999.9999 52

53 6c Sales factor (from part I, line 3, column C) 999.9999 53

54 54

55 6d Total (add lines 6a, 6b and 6c) 999.9999 55

56 56

57 6e Average (divide line 6d by three) 999.9999 57

58 (enter ratio on Form 84-122, line 21) 58

59 59

60 X Airlines, motor carriers, express companies, 7 Special formula required (attach schedule 60

61 telephone and telegraph companies and enter ratio on Form 84-122, line 21) 61

999.9999

62 62

63 63

06 07 08 09 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 80