Enlarge image

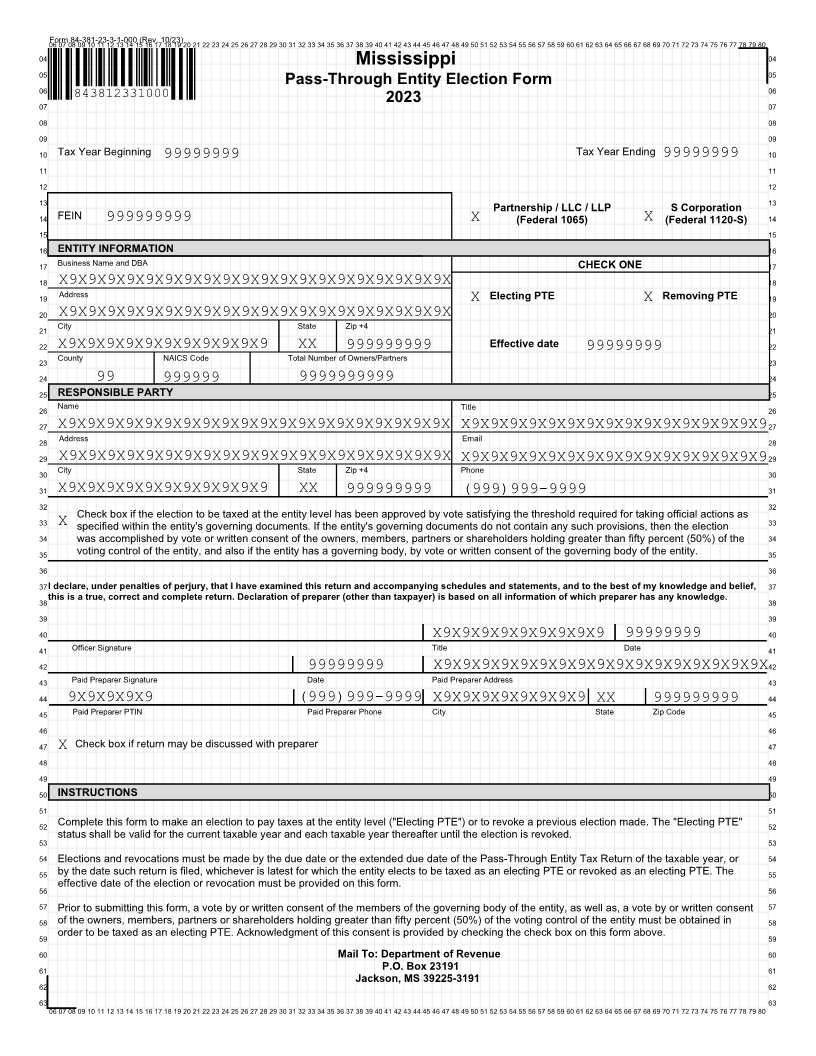

06Form 84-381-23-3-1-000 (Rev. 10/23)07 08 09 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 80

04 Mississippi 04

05 05

Pass-Through Entity Election Form

06 843812331000 2023 06

07 07

08 08

09 09

10 Tax Year Beginning 99999999 Tax Year Ending 99999999 10

11 11

12 12

13 Partnership / LLC / LLP S Corporation 13

14 FEIN 999999999 X (Federal 1065) X (Federal 1120-S) 14

15 15

16 ENTITY INFORMATION 16

17 Business Name and DBA CHECK ONE 17

18 X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X 18

19 Address X Electing PTE X Removing PTE 19

20 X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X 20

21 City State Zip +4 21

22 X9X9X9X9X9X9X9X9X9X9X9 XX 999999999 Effective date 99999999 22

23 County NAICS Code Total Number of Owners/Partners 23

24 99 999999 9999999999 24

25 RESPONSIBLE PARTY 25

26 Name Title 26

27 X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9 27

28 Address Email 28

29 X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9 29

30 City State Zip +4 Phone 30

31 X9X9X9X9X9X9X9X9X9X9X9 XX 999999999 (999)999-9999 31

32 32

Check box if the election to be taxed at the entity level has been approved by vote satisfying the threshold required for taking official actions as

33 X specified within the entity's governing documents. If the entity's governing documents do not contain any such provisions, then the election 33

34 was accomplished by vote or written consent of the owners, members, partners or shareholders holding greater than fifty percent (50%) of the 34

35 voting control of the entity, and also if the entity has a governing body, by vote or written consent of the governing body of the entity. 35

36 36

37I declare, under penalties of perjury, that I have examined this return and accompanying schedules and statements, and to the best of my knowledge and belief, 37

38this is a true, correct and complete return. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge. 38

39 39

40 X9X9X9X9X9X9X9X9X9 99999999 40

41 Officer Signature Title Date 41

42 99999999 X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X42

43 Paid Preparer Signature Date Paid Preparer Address 43

44 9X9X9X9X9 (999)999-9999 X9X9X9X9X9X9X9X9 XX 999999999 44

45 Paid Preparer PTIN Paid Preparer Phone City State Zip Code 45

46 46

47 X Check box if return may be discussed with preparer 47

48 48

49 49

50 INSTRUCTIONS 50

51 51

52 Complete this form to make an election to pay taxes at the entity level ("Electing PTE") or to revoke a previous election made. The "Electing PTE" 52

status shall be valid for the current taxable year and each taxable year thereafter until the election is revoked.

53 53

54 Elections and revocations must be made by the due date or the extended due date of the Pass-Through Entity Tax Return of the taxable year, or 54

55 by the date such return is filed, whichever is latest for which the entity elects to be taxed as an electing PTE or revoked as an electing PTE. The 55

56 effective date of the election or revocation must be provided on this form. 56

57 Prior to submitting this form, a vote by or written consent of the members of the governing body of the entity, as well as, a vote by or written consent 57

58 of the owners, members, partners or shareholders holding greater than fifty percent (50%) of the voting control of the entity must be obtained in 58

59 order to be taxed as an electing PTE. Acknowledgment of this consent is provided by checking the check box on this form above. 59

60 Mail To: Department of Revenue 60

61 P.O. Box 23191 61

Jackson, MS 39225-3191

62 62

63 63

06 07 08 09 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 80