Enlarge image

DO NOT ATTACH TO RETURN Print Form Reset Form

New Hampshire

Department of AU-208 *0AU2082211862*

Revenue Administration

0AU2082311862

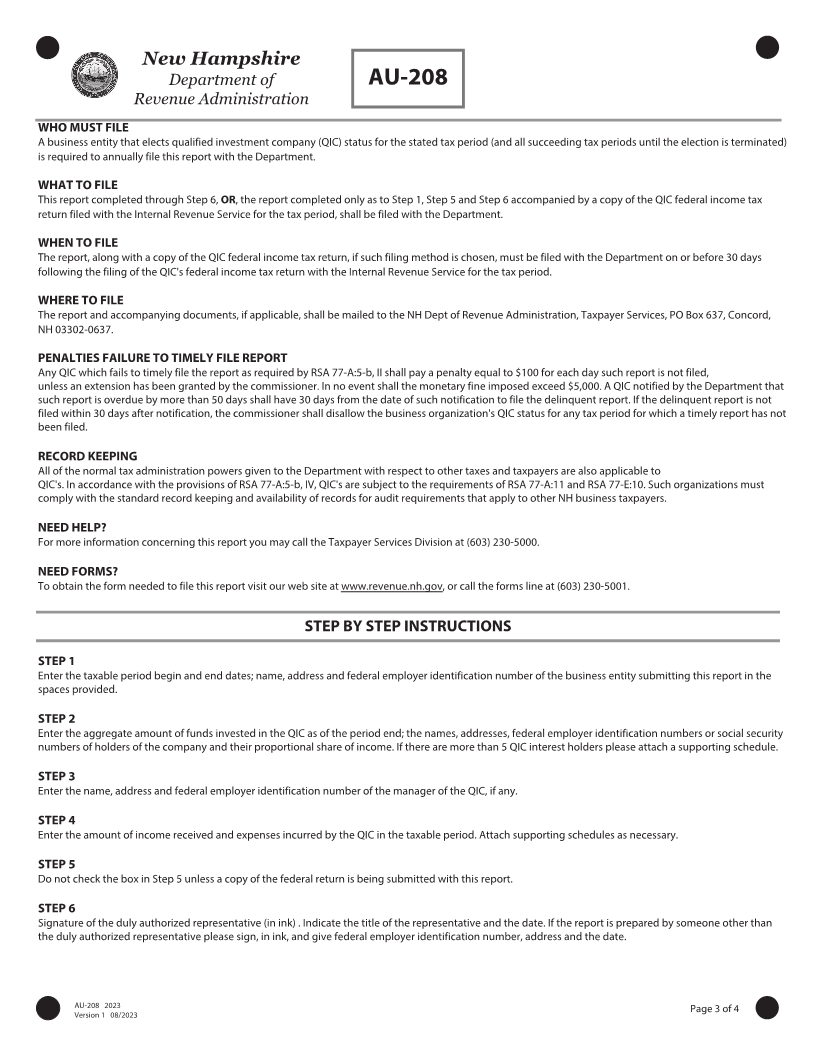

QUALIFIED INVESTMENT COMPANY (QIC) REPORT

STEP 1 - PRINT OR TYPE MMDDYYYY MMDDYYYY

For the taxable period beginning: 0 1 0 1 2 0 2 3 and ending: 1 2 3 1 2 0 2 3

Name of Business Entity Taxpayer Identification Number

BEACHES CANOPY LLC 4 5 6 4 5 6 4 5 1

Number & Street Address City / Town

12541 NEGRIL HWY HOOKSETT

Address (continued) State Zip Code + 4 (or Canadian Postal Code)

NH 0 3 1 0 6 - 1 2 3 4

STEP 2

Aggregate Amount of Funds Invested as of Period End $ 6 5 0 0 0

QIC Interest Holders (If more than 5 QIC Interest Holders attach a supplmental schedule)

Individual or Business Name Taxpayer Identification Number

SARA SMITH 4 5 6 4 6 4 6 5 1

Number & Street Address Proportional Share of Income

45 SCHOOL ST UNIT 7 1 5 0 0 0

City / Town State Zip Code + 4 (or Canadian Postal Code)

CONCORD NH 0 3 3 0 1

Individual or Business Name Taxpayer Identification Number

EVAN AKERS 4 7 8 7 8 7 8 7 8

Number & Street Address Proportional Share of Income

12 BASKETBALL RD 2 0 0 0 0

City / Town State Zip Code + 4 (or Canadian Postal Code)

SALEM NH 0 3 0 7 9 - 1 2 1 2

Individual or Business Name Taxpayer Identification Number

WALTER WALKER 5 6 5 6 5 6 5 6 5

Number & Street Address Proportional Share of Income

32 RED ROSE LN 3 0 0 0 0

City / Town State Zip Code + 4 (or Canadian Postal Code)

CONCORD NH 0 3 3 0 2

Individual or Business Name Taxpayer Identification Number

Number & Street Address Proportional Share of Income

City / Town State Zip Code + 4 (or Canadian Postal Code)

Individual or Business Name Taxpayer Identification Number

Number & Street Address Proportional Share of Income

City / Town State Zip Code + 4 (or Canadian Postal Code)

AU-208 202 3 Page 1 of 4

Version 1 8 0 /2023