Enlarge image

Print Form Reset Form

New Hampshire 202 3

Department of *000BET2311862*

Revenue Administration BET 000BET2311862

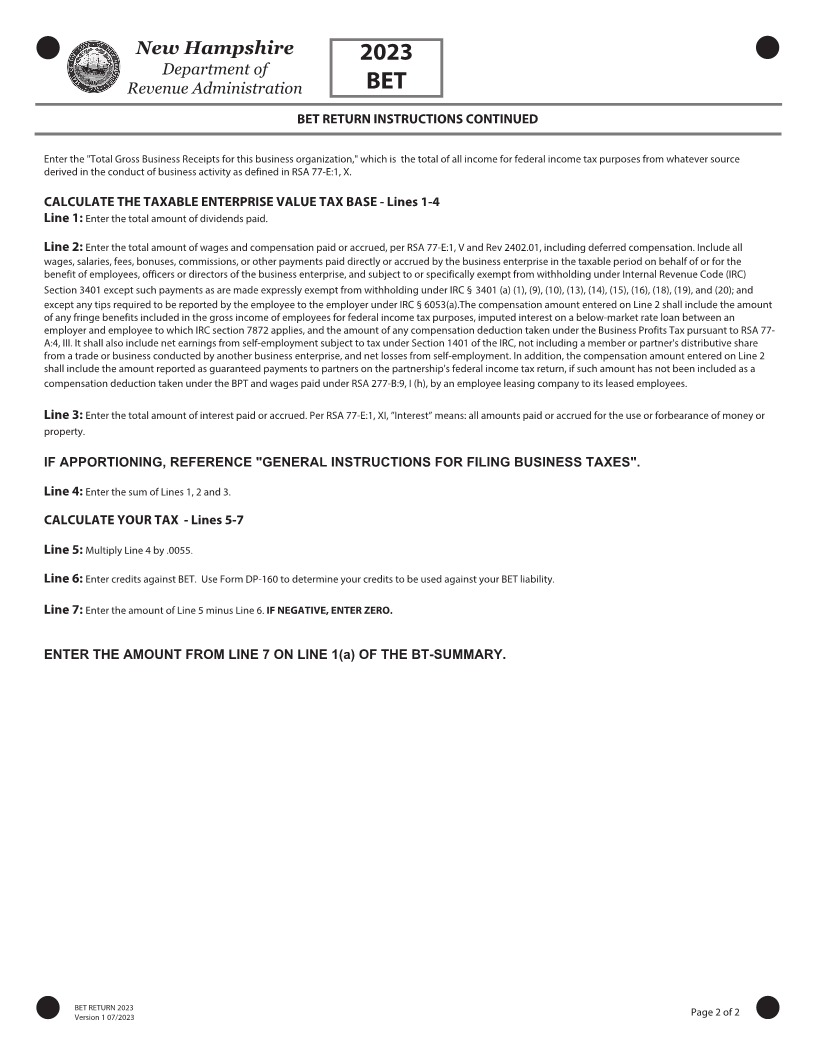

BUSINESS ENTERPRISE TAX RETURN

Taxpayer Name

ABC CORPORATION

Taxpayer Identification Number MMDDYYYY MMDDYYYY

For the CALENDAR year 202 3 or

4 5 6 4 9 5 4 9 6 other taxable period beginning: 0 1 0 1 2 0 2 3 and ending: 1 2 3 1 2 0 2 3

You are required to file this return if the gross business receipts were greater

Check here if required to file Form BET-80

than $281,000 or the enterprise value tax base is greater than $281,000.

Round to the nearest whole dollar

Total Gross Business Receipts for this business organization 9 0 3 6 2 4 4 7

1. Dividends Paid 1 2 8 2 5 0 0

2. Compensation and Wages Paid or Accrued 2 1 7 3 3 8 9 2 2

3. Interest Paid or Accrued 3 5 6 3 7 8 0

4. Taxable Enterprise Value Tax Base (Sum of Lines 1, 2, and 3) 4 1 8 1 8 5 2 0 2

5. New Hampshire Business Enterprise Tax (BET) (Line 4 multiplied by .0055) before credits 5 1 0 0 0 1 9

6. Enter credits against BET. Use DP-160 to determine credit against BET 6 1 0 6 8 0

7. Enter Tax Due (Line 5 minus 6). If negative, enter Zero. Report on BT-SUMMARY Line 1(a) TAX DUE 7 8 9 3 3 9

BET RETURN INSTRUCTIONS

FORM BET is required for all Corporations, Partnerships, Proprietorships, Fiduciaries, Trusts, Non-Profits, LLCs, and Combined Groups to report Business Enterprise

Tax.

TAXABLE PERIOD, NAME, AND TAXPAYER IDENTIFICATION NUMBER

Enter the beginning and ending dates of the taxable period.

Enter the Corporate, Partnership, Proprietorship, Fiduciary, Trust, Non-Profit, or LLC name in the appropriate space provided. Combined filers enter the Principal New

Hampshire Business Organization's name. Enter the FEIN, SSN, or DIN in the space provided.

TAXPAYER IDENTIFICATION

The Commissioner of the Department of Revenue is authorized pursuant to RSA21:J27-a to require submission of an SSN, FEIN, or any other identifying number used

in filing or preparing federal tax documents. If you do not have any such identifying number, or share one with another taxpayer, then, under N.H. Code of Admin.

Rules, Rev 2903.01, you must obtain a Department Identification Number (DIN). If you have a DIN, use it on all New Hampshire filings. To ensure that your filings and

payments are applied to the correct account, the sequence of names and taxpayer ID numbers on all filings must be consistent. The failure to provide a taxpayer

identification number may result in the rejection of filed documents. Failure to timely file documents complete with a consistent taxpayer identification number

may result in the imposition of penalties and interest, the disallowance of claimed exemptions, exclusions, credits, deductions, or an adjustment that may result in

increased tax liability.

BET RETURN 202 3 Page 1 of 2

Version 1 07/2023