Enlarge image

LOW AND MODERATE

New Hampshire

202 3 INCOME HOMEOWNERS

Department of PROPERTY TAX RELIEF

Revenue Administration DP-8

GENERAL INSTRUCTIONS

HOW DO I QUALIFY?

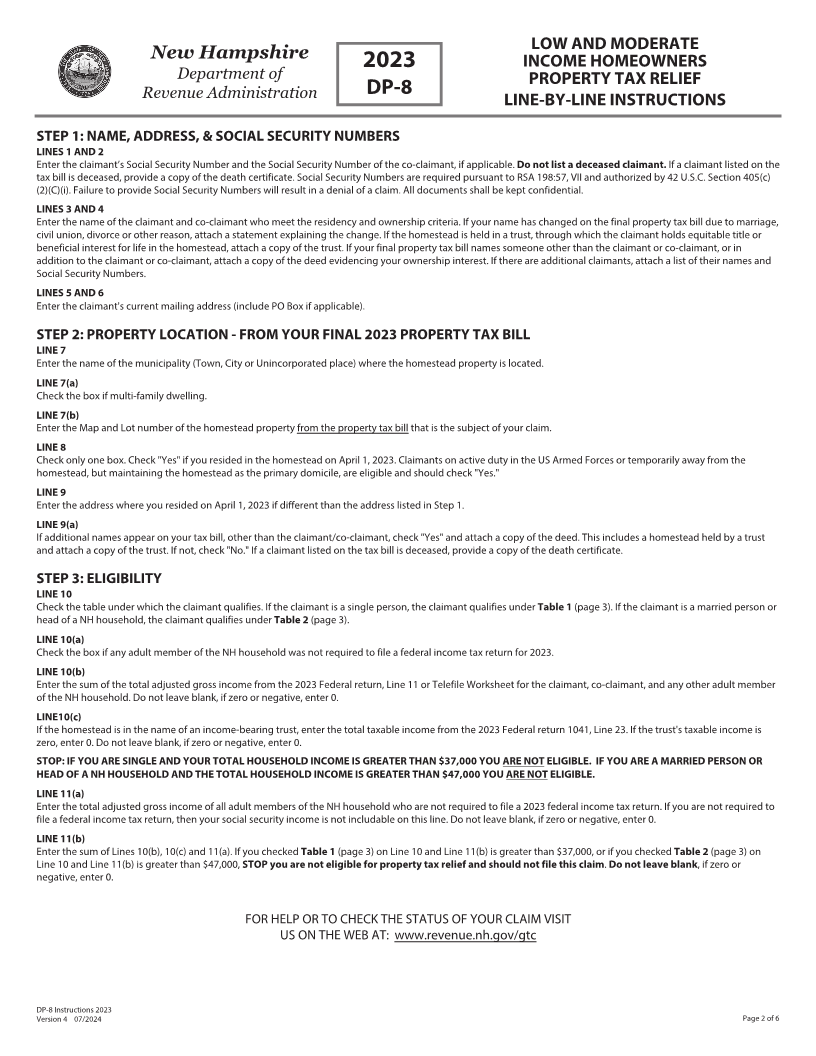

How do I qualify for Low and Moderate Income Homeowners Property Tax Relief? You must own or have an interest in a homestead subject to the State Education

Property Tax and reside in such homestead on April 1 of the year for which the claim for relief is made and have a total household income of (1) $37,000 or less if a

single person or (2) $47,000 or less if married or head of a NH household.

ATTACHMENTS

This completed claim must be submitted with copies of your 2023 federal income tax return, the entire actual final 2023 property tax bill indicating assessed value

(this is the tax bill that was mailed to you between October and December of 2023 in most cases), a copy of your trust document if property is held by a trust and

any explanatory statements, if necessary. This claim for relief must be postmarked no earlier than May 1, 2024 and no later than June 30, 2024.

DEFINITIONS

"HOMESTEAD" means the dwelling owned by a claimant or, in the case of a multi-unit dwelling, the portion of the dwelling which is owned and used as the claimant's

principal place of residence and the claimant's domicile for purposes of RSA 654:1. "Homestead'' shall not include land and buildings taxed under RSA 79-A or land and

buildings or the portion of land and buildings rented or used for commercial or industrial purposes. The term "owned'' includes:

a) A vendee in possession under a land contract;

b) One or more joint tenants or tenants in common; or

c) A person who has equitable title, or the beneficial interest for life in the homestead.

"HOUSEHOLD INCOME" means the sum of the adjusted gross income for federal income tax purposes of the claimant and any adult member of the claimant's

household who resides in the homestead for which a claim is made. "Household income'' shall also include all income of any trust through which the claimant holds

equitable title, or the beneficial interest for life, in the homestead.

"HEAD OF A NEW HAMPSHIRE HOUSEHOLD" means any person filing a federal income tax return as head of household or 2 or more adults who jointly share the

benefit of the homestead. "New Hampshire Household" shall not include those adults who share the homestead under a landlord-tenant relationship.

"ADULT" means a person who has attained the age of 18 years.

APPEALS

If your claim for tax relief is rejected in whole or in part, you may appeal in writing within 30 days from the date of the notice of rejection or the notice of relief to the

Board of Tax and Land Appeals (BTLA). Please contact the BTLA for filing instructions.

NEED HELP?

Call for Low and Moderate Income Homeowners Property Tax Relief Assistance at (603) 230-5920. For more information or to check the status of your claim, visit us on

the web at www.revenue.nh.gov/gtc. Hearing or speech impaired individuals may call TDD Access: Relay NH 1-800-735-2964.

LINE-BY-LINE INSTRUCTIONS

Continue onto page 2 for line-by-line instructions.

DP-8 Instructions 2023

Version 4 07/2024 Page 1of 6