Enlarge image

DO NOT STAPLE Print Form Reset Form

New Hampshire

202 3

Department of *0BTSUM2311862*

Revenue Administration BT-SUMMARY

0BTSUM2311862

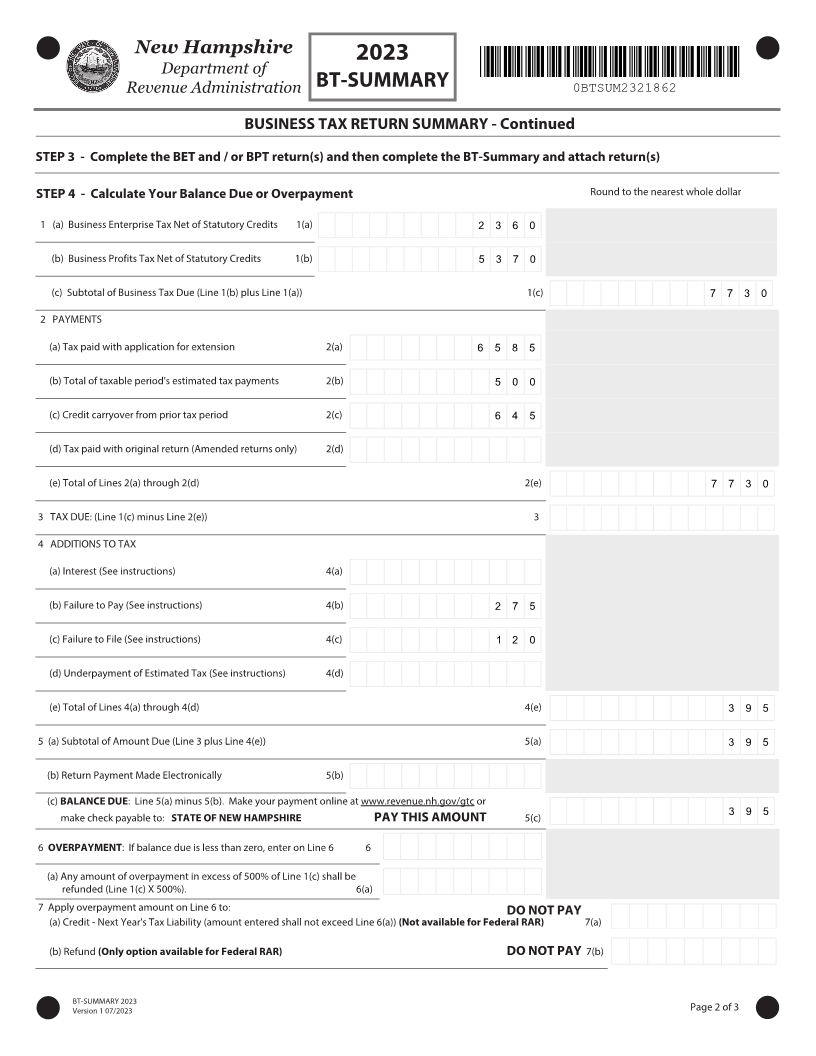

BUSINESS TAX RETURN SUMMARY

STEP 1 - PRINT OR TYPE MMDDYYYY MMDDYYYY

For the CALENDAR year 202 3 or other taxable period beginning: 0 1 0 1 2 0 2 3 and ending: 1 2 3 1 2 0 2 3

Check box if there has been a name change since last filing. List former name.

Proprietor's Last Name

If issued a DIN,

LANDEN use the DIN in the

First Name MI Social Security Number appropriate taxpayer

identification box.

ERIC S 1 2 3 4 5 6 7 8 9 DO NOT enter SSN or FEIN if

you have a DIN

Corporate, Partnership, Estate, Trust, Non-Profit or LLC Name

Taxpayer Identification Number Principal Business Activity Code (Federal)

Number & Street Address

Address (continued) Unit Type Unit #

1067 PINE HILL RD Unit 5

City / Town State Zip Code + 4 (or Canadian Postal Code)

SALEM NH 0 3 0 7 9 - 3 2 5 1

STEP 2 - Return Type and Federal Information Are you required to file a BET Return (Gross Business Receipts

Yes No

over $281,000, or Enterprise Value Tax Base over $281,000)?

If you checked "yes" to one or both of the first two Are you required to file a BPT Return (Gross Business Income over $103,000)? Yes No

questions, you must file the completed corresponding

return(s) with this BT-Summary. Do you file a Form 990/990T? Yes No

Do you file a Federal Form 8023, Federal Form 8883 and/or have checked box

10b on Schedule B of Federal Form 1065? Yes No

Is the business organization filing its return on an IRS approved 52/53 week

Yes No

tax year?

2 - CORPORATION 3 - PARTNERSHIP 1 - PROPRIETORSHIP AMENDED RETURN

OR LLC

6 - COMBINED GROUP 5 - NON-PROFIT 4 - FIDUCIARY FINAL RETURN

IRS Adjustment: A complete federal Revenue Agent Report (RAR) with all applicable Schedules must be included with a complete amended NH tax

return. Do not use this form to report IRS adjustments for taxable periods ending on or before December 31, 2020.

BT-SUMMARY 202 3

Version 1 07 /2023

Page 1 of 3