Enlarge image

DO NOT STAPLE Print Form Reset Form

New Hampshire 202 3

Department of *00DP102311862*

DP-10

Revenue Administration 00DP102311862

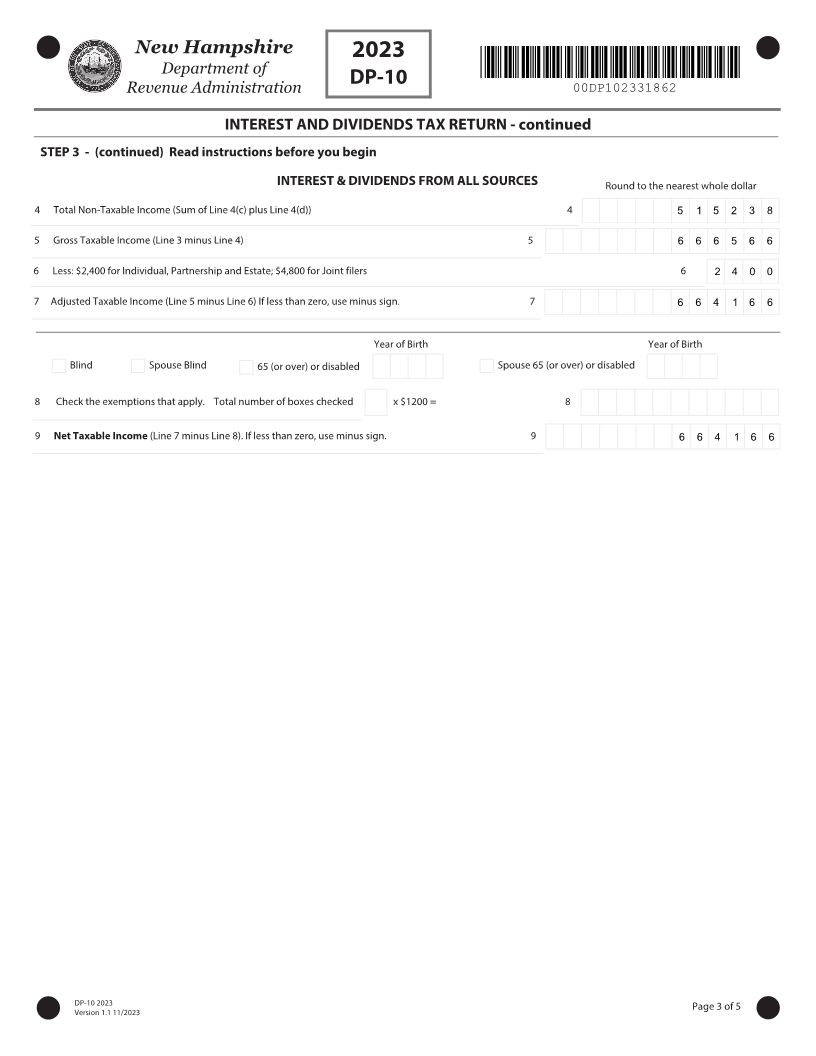

INTEREST AND DIVIDENDS TAX RETURN

MMDDYYYY MMDDYYYY

For the CALENDAR year 202 3 or other taxable period beginning: 0 1 0 1 2 0 2 3 and ending: 1 2 3 1 2 0 2 3

STEP 1 - PRINT OR TYPE Check box if there has been a name change since last filing. Due Date for CALENDAR

Last Name year filers is on or before

April 15, 202 4

Due Date for FISCAL year

First Name MI Social Security Number filers is the 15th day of the

4th month after

the close of the

taxable period.

Spouse's Last Name

If you have a DIN, use the DIN

in the taxpayer ID box.

DO NOT use FEIN or SSN

First Name MI Social Security Number Taxpayer Identification Number

S M 4 5 6 4 9 5 1

Name of Partnership, Estate, or LLC

GREEN SINGER LLC

Number & Street Address

123 MAIN ST

Address (continued) Unit Type Unit #

City / Town State Zip Code + 4 (or Canadian Postal Code)

DURHAM NH 0 3 8 2 4 - 1 2 6 5

STEP 2 - Return Type

% of NEW HAMPSHIRE Ownership

ENTITY TYPE - Check One Interest in Entity Type

1 - INDIVIDUAL 1 - JOINT 3 - PARTNERSHIP/LLC 4 - ESTATE 0 . 7 5 0 0 0 0

MMDDYYYY Date of Death

INITIAL RETURN 0 5 1 5 2 0 2 1 Established NH Residency FINAL DECEASED

MMDDYYYY Social Security Number

FINAL RETURN Abandoned NH Residency

AMENDED RETURN IRS ADJUSTMENT: A complete federal Revenue Agent Report (RAR) with all applicable Schedules must be included with a complete amended NH

tax return. Do not use this form to report IRS adjustments for taxable periods ending on or before December 31, 2020.

DP-10 202 3 Page 1 of 5

Version 1.1 11/2023