Enlarge image

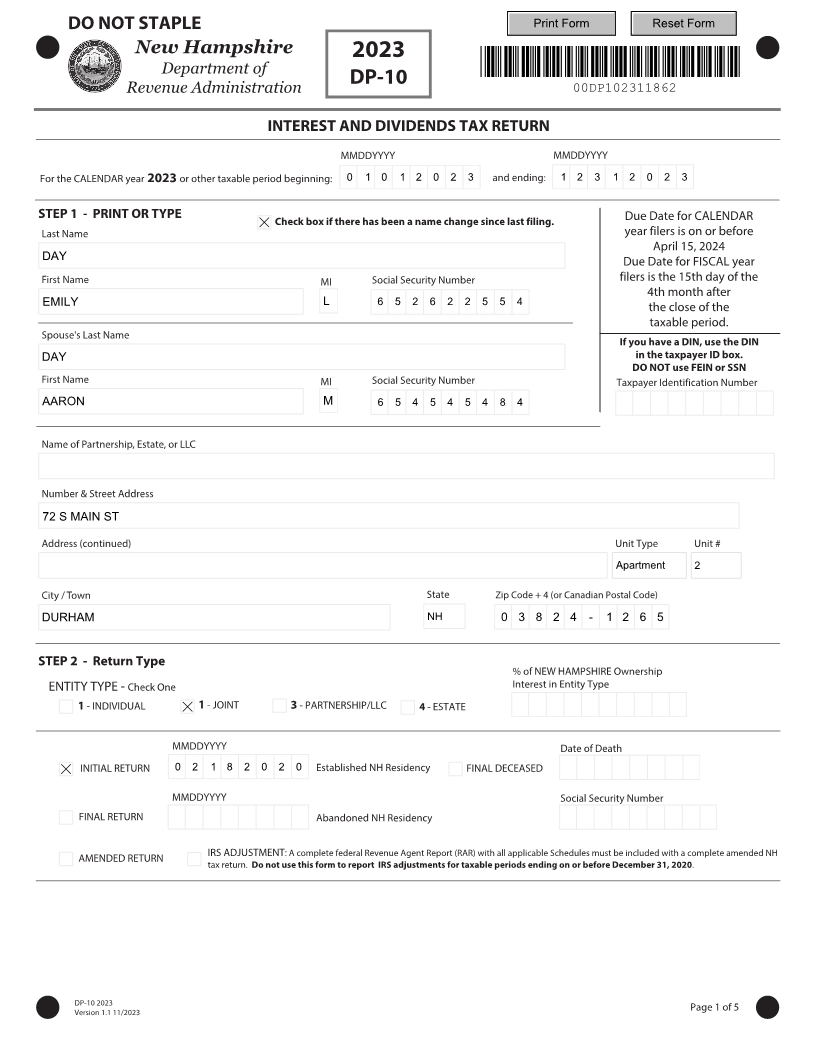

DO NOT STAPLE Print Form Reset Form

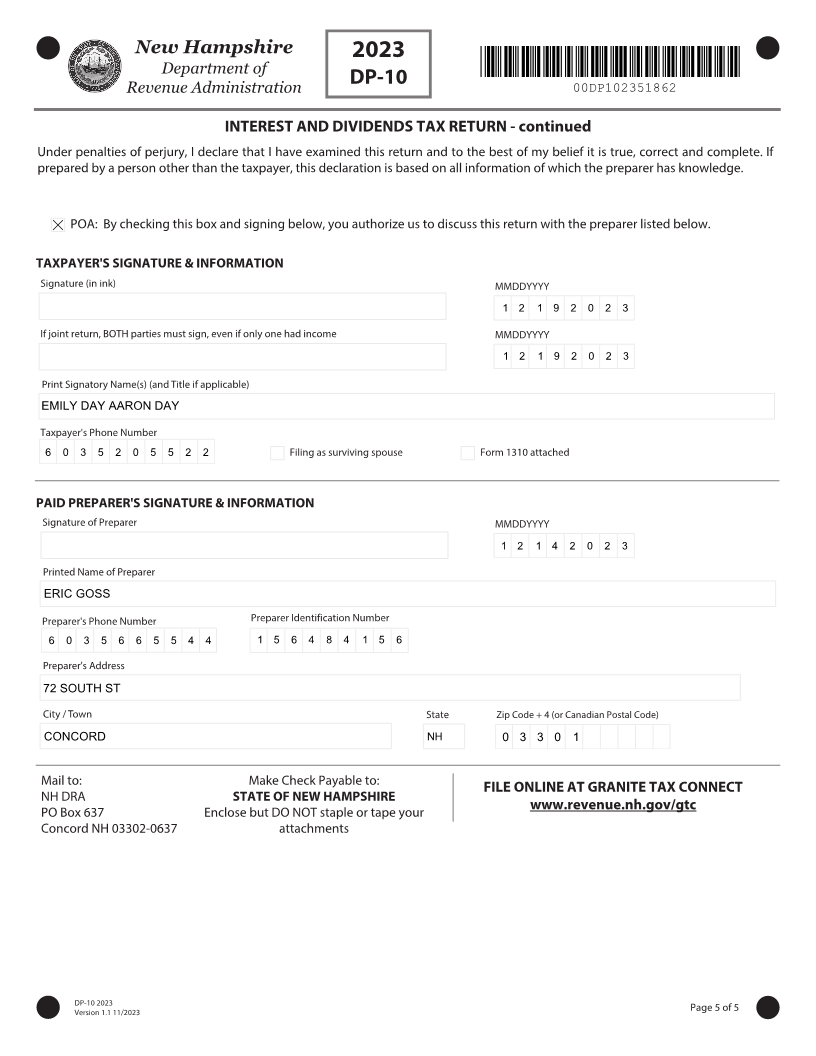

New Hampshire 202 3

Department of *00DP102311862*

DP-10

Revenue Administration 00DP102311862

INTEREST AND DIVIDENDS TAX RETURN

MMDDYYYY MMDDYYYY

For the CALENDAR year 202 3 or other taxable period beginning: 0 1 0 1 2 0 2 3 and ending: 1 2 3 1 2 0 2 3

STEP 1 - PRINT OR TYPE Check box if there has been a name change since last filing. Due Date for CALENDAR

Last Name year filers is on or before

April 15, 202 4

DAY Due Date for FISCAL year

First Name MI Social Security Number filers is the 15th day of the

4th month after

EMILY L 6 5 2 6 2 2 5 5 4 the close of the

taxable period.

Spouse's Last Name

If you have a DIN, use the DIN

DAY in the taxpayer ID box.

DO NOT use FEIN or SSN

First Name MI Social Security Number Taxpayer Identification Number

AARON M 6 5 4 5 4 5 4 8 4

Name of Partnership, Estate, or LLC

Number & Street Address

72 S MAIN ST

Address (continued) Unit Type Unit #

Apartment 2

City / Town State Zip Code + 4 (or Canadian Postal Code)

DURHAM NH 0 3 8 2 4 - 1 2 6 5

STEP 2 - Return Type

% of NEW HAMPSHIRE Ownership

ENTITY TYPE - Check One Interest in Entity Type

1 - INDIVIDUAL 1 - JOINT 3 - PARTNERSHIP/LLC 4 - ESTATE

MMDDYYYY Date of Death

INITIAL RETURN 0 2 1 8 2 0 2 0 Established NH Residency FINAL DECEASED

MMDDYYYY Social Security Number

FINAL RETURN Abandoned NH Residency

AMENDED RETURN IRS ADJUSTMENT: A complete federal Revenue Agent Report (RAR) with all applicable Schedules must be included with a complete amended NH

tax return. Do not use this form to report IRS adjustments for taxable periods ending on or before December 31, 2020.

DP-10 202 3 Page 1 of 5

Version 1.1 11/2023