Enlarge image

Print This Page Reset Pages

New Hampshire 202

Department of 4

Revenue Administration DP-10-ES

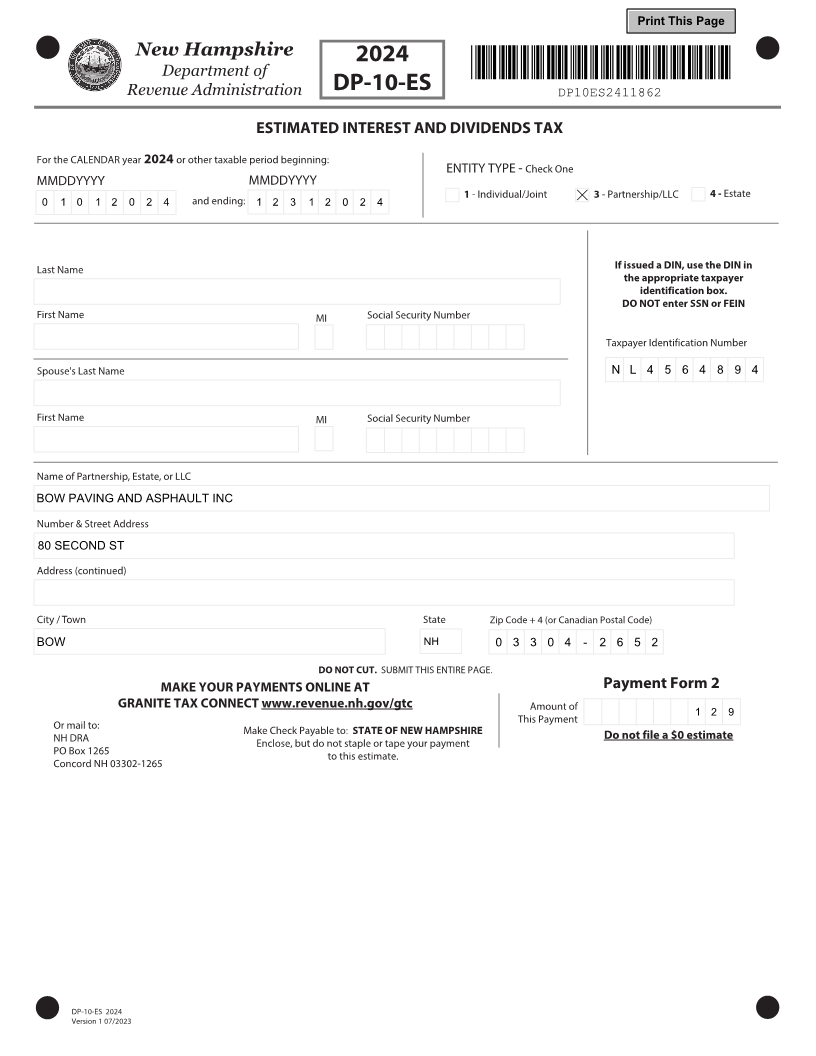

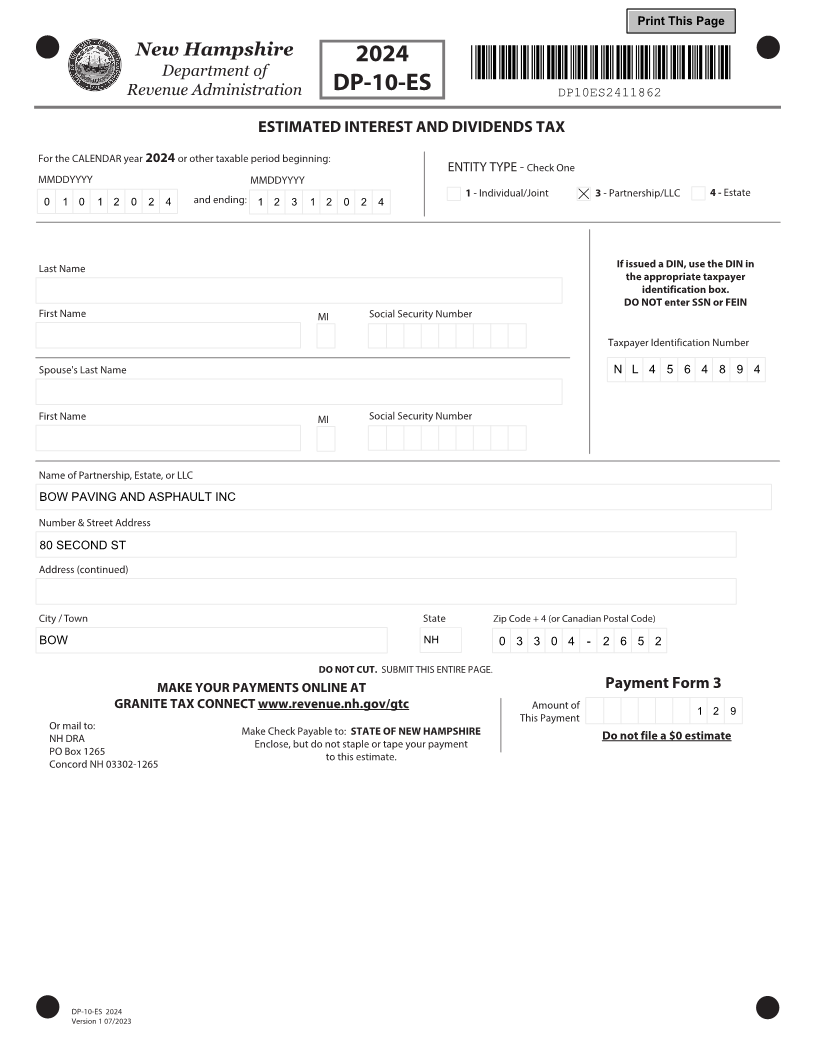

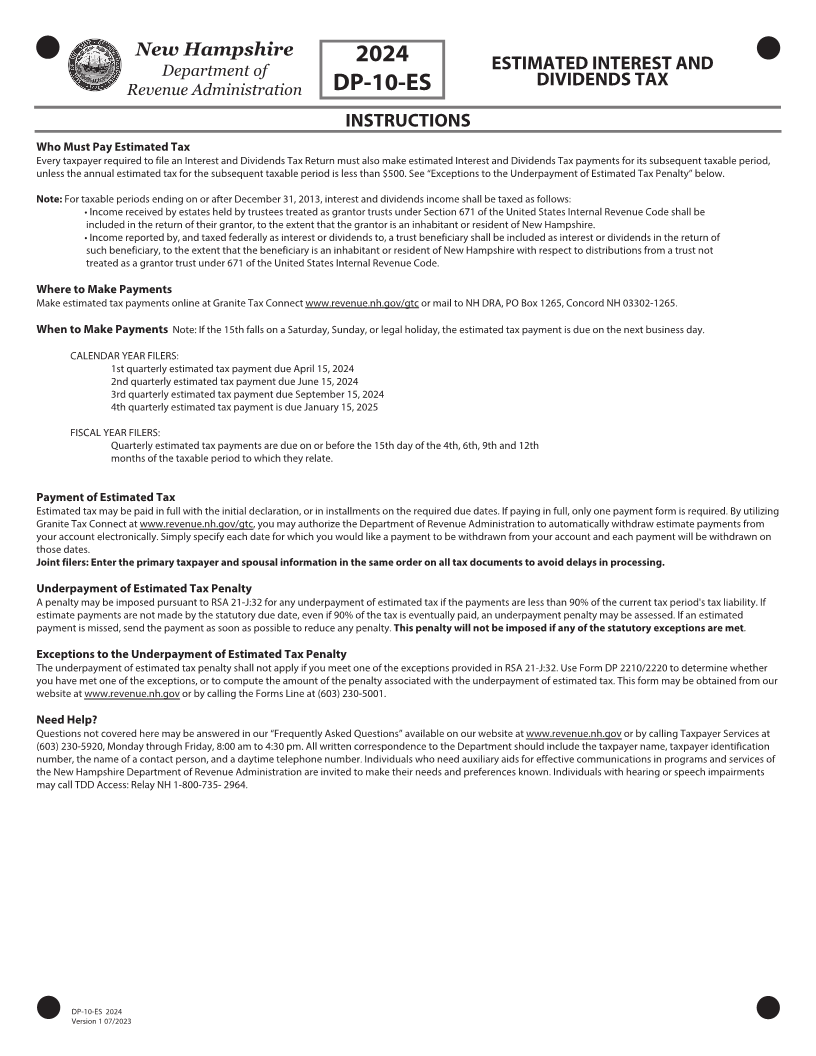

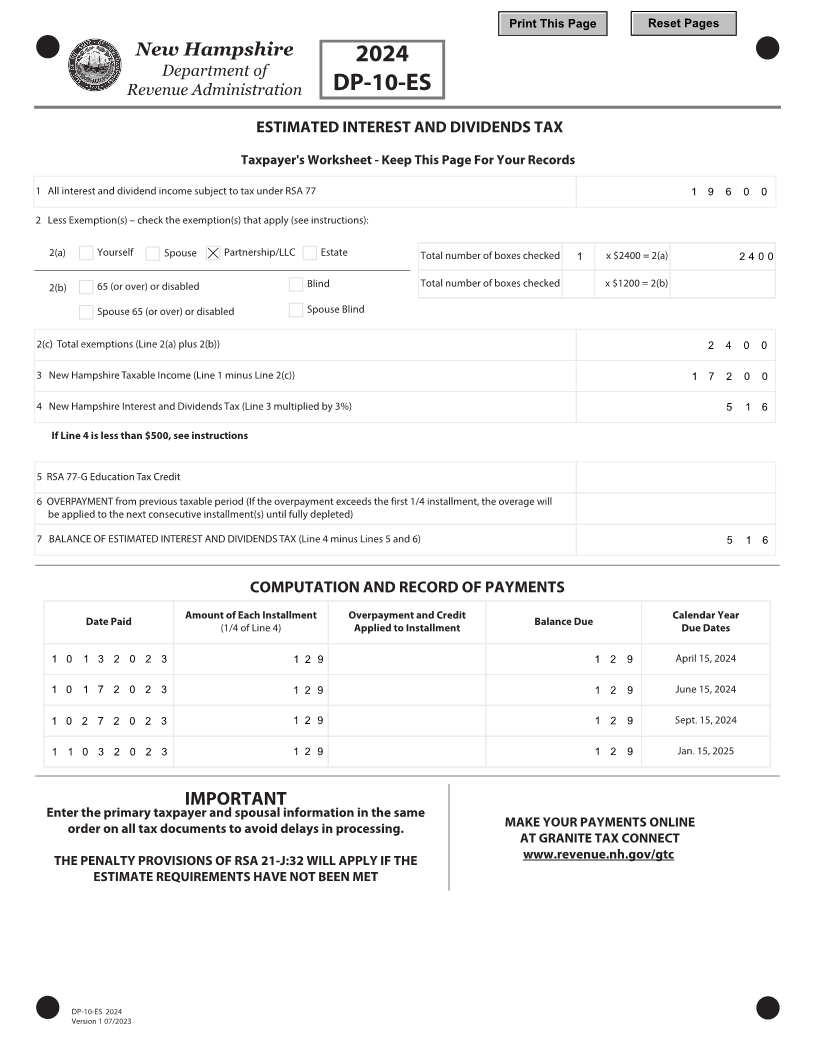

ESTIMATED INTEREST AND DIVIDENDS TAX

Taxpayer's Worksheet - Keep This Page For Your Records

1 All interest and dividend income subject to tax under RSA 77 1 9 6 0 0

2 Less Exemption(s) – check the exemption(s) that apply (see instructions):

2(a) Yourself Spouse Partnership/LLC Estate Total number of boxes checked 1 x $2400 = 2(a) 2 4 0 0

2(b) 65 (or over) or disabled Blind Total number of boxes checked x $1200 = 2(b)

Spouse 65 (or over) or disabled Spouse Blind

2(c) Total exemptions (Line 2(a) plus 2(b)) 2 4 0 0

3 New Hampshire Taxable Income (Line 1 minus Line 2(c)) 1 7 2 0 0

4 New Hampshire Interest and Dividends Tax (Line 3 multiplied by 3 %) 5 1 6

If Line 4 is less than $500, see instructions

5 RSA 77-G Education Tax Credit

6 OVERPAYMENT from previous taxable period (If the overpayment exceeds the first 1/4 installment, the overage will

be applied to the next consecutive installment(s) until fully depleted)

7 BALANCE OF ESTIMATED INTEREST AND DIVIDENDS TAX (Line 4 minus Lines 5 and 6) 5 1 6

COMPUTATION AND RECORD OF PAYMENTS

Date Paid Amount of Each Installment Overpayment and Credit Balance Due Calendar Year

(1/4 of Line 4) Applied to Installment Due Dates

1 0 1 3 2 0 2 3 1 2 9 1 2 9 April 15, 2024

1 0 1 7 2 0 2 3 1 2 9 1 2 9 June 15, 2024

1 0 2 7 2 0 2 3 1 2 9 1 2 9 Sept. 15, 2024

1 1 0 3 2 0 2 3 1 2 9 1 2 9 Jan. 15, 2025

IMPORTANT

Enter the primary taxpayer and spousal information in the same

order on all tax documents to avoid delays in processing. MAKE YOUR PAYMENTS ONLINE

AT GRANITE TAX CONNECT

THE PENALTY PROVISIONS OF RSA 21-J:32 WILL APPLY IF THE www.revenue.nh.gov/gtc

ESTIMATE REQUIREMENTS HAVE NOT BEEN MET

VersionDP-10-ES 1 0202 7 /2024 3