Enlarge image

New Hampshire 202 4

Department of Print This Page Reset Pages

Revenue Administration DP-110-ES

ESTIMATED RAILROAD TAX

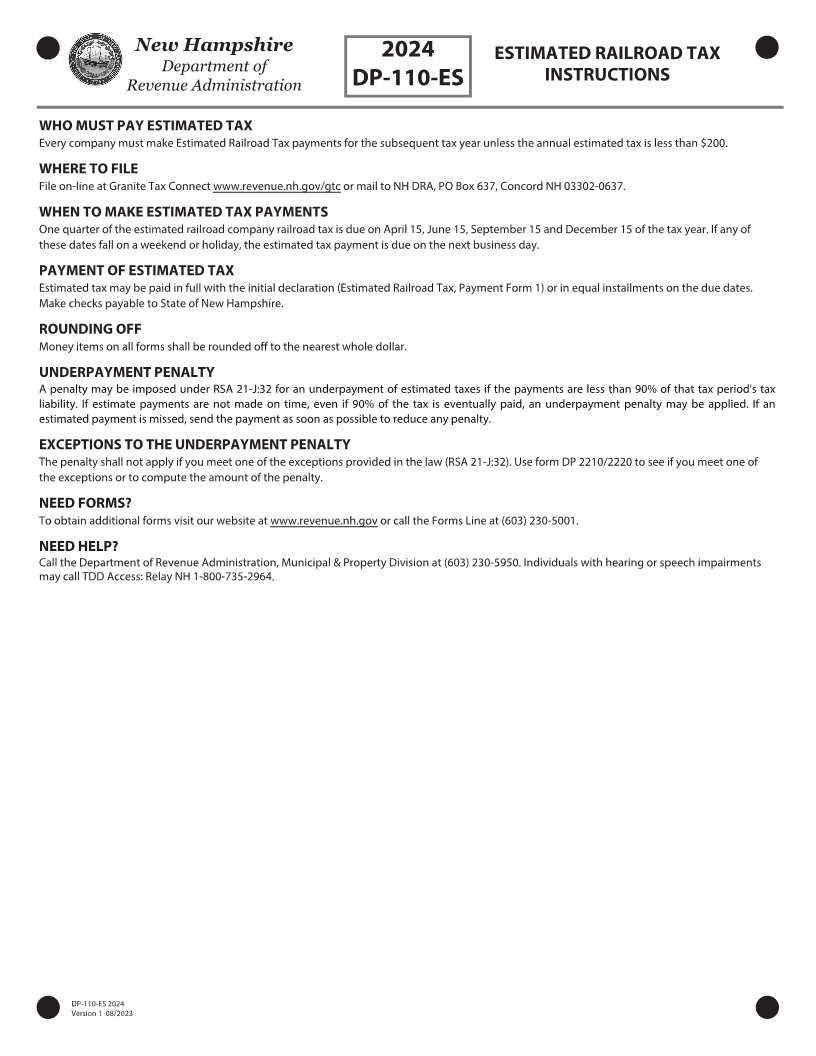

TAXPAYER'S WORKSHEET KEEP FOR YOUR RECORDS-

1 202 3Railroad Company Railroad Tax (see Notice of Value and Tax Bill, Line 5) 1 2 0 0 0 0 0

2 202 3Overpayment applied to 202 4taxes 2 5 6 4 4

3 Balance of Estimated Railroad Company Railroad Tax (Line 1 minus Line 2) 3 1 9 4 3 5 6

COMPUTATION AND RECORD OF PAYMENTS

202 3Overpayment

Amount of each Installment Calendar Year

Date Paid Applied to Balance Due

(1/4 of Line 1 of worksheet) Due Dates

Installment

1 2 0 4 2 0 2 3 5 0 0 0 0 3 0 0 4 9 7 0 0 April 15, 2024

1 2 0 5 2 0 2 3 5 0 0 0 0 3 0 0 4 9 7 0 0 June 15, 2024

1 2 1 4 2 0 2 3 5 0 0 0 0 3 0 0 4 9 7 0 0 September 15, 2024

1 2 3 0 2 0 2 3 5 0 0 0 0 3 0 0 4 9 7 0 0 December 15, 2024

IMPORTANT:

THE PENALTY PROVISIONS OF RSA 21-J:32 WILL APPLY IF THE

ESTIMATED TAX PAYMENT REQUIREMENTS HAVE NOT BEEN MET

DP-110-ES 202 4

Version 1 8 0 /2023