Enlarge image

Print Form Reset Form

New Hampshire 202

Department of 3 *DP120P2311862*

Revenue Administration DP-120-P DP120P2311862

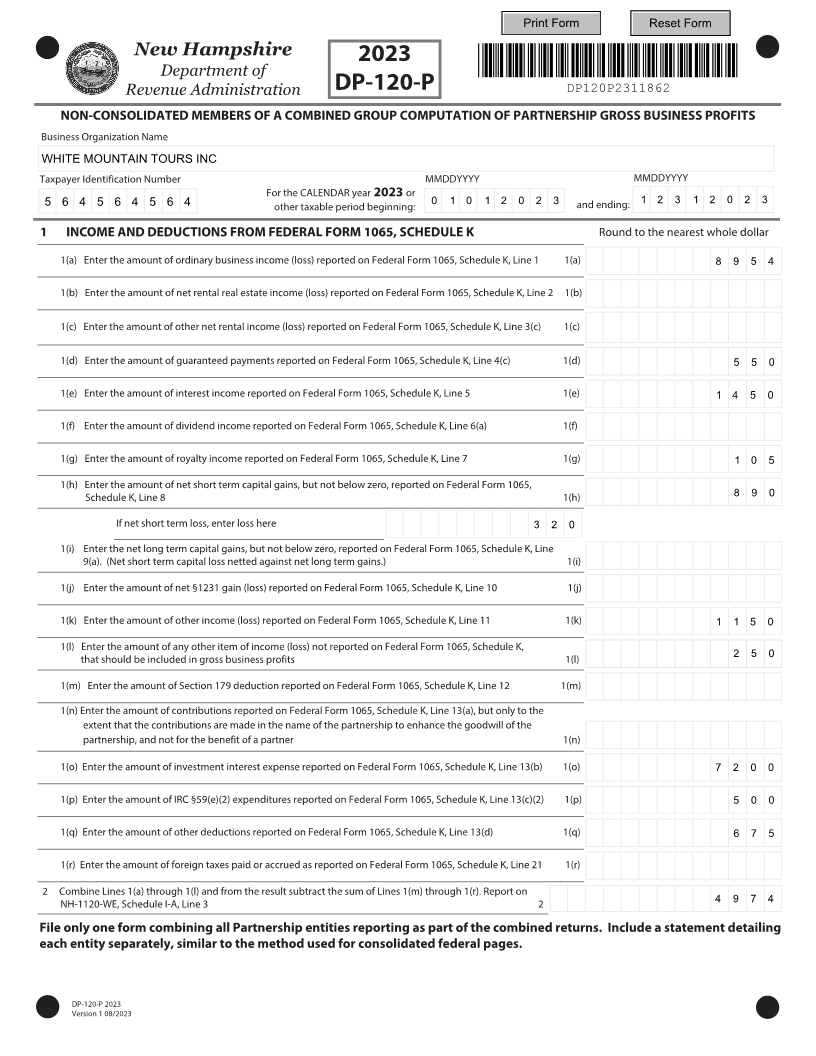

NON-CONSOLIDATED MEMBERS OF A COMBINED GROUP COMPUTATION OF PARTNERSHIP GROSS BUSINESS PROFITS

Business Organization Name

WHITE MOUNTAIN TOURS INC

Taxpayer Identification Number MMDDYYYY MMDDYYYY

For the CALENDAR year 202 3 or

5 6 4 5 6 4 5 6 4 other taxable period beginning: 0 1 0 1 2 0 2 3 and ending: 1 2 3 1 2 0 2 3

1 INCOME AND DEDUCTIONS FROM FEDERAL FORM 1065, SCHEDULE K Round to the nearest whole dollar

1(a) Enter the amount of ordinary business income (loss) reported on Federal Form 1065, Schedule K, Line 1 1(a) 8 9 5 4

1(b) Enter the amount of net rental real estate income (loss) reported on Federal Form 1065, Schedule K, Line 2 1(b)

1(c) Enter the amount of other net rental income (loss) reported on Federal Form 1065, Schedule K, Line 3(c) 1(c)

1(d) Enter the amount of guaranteed payments reported on Federal Form 1065, Schedule K, Line 4(c) 1(d) 5 5 0

1(e) Enter the amount of interest income reported on Federal Form 1065, Schedule K, Line 5 1(e) 1 4 5 0

1(f) Enter the amount of dividend income reported on Federal Form 1065, Schedule K, Line 6(a) 1(f)

1(g) Enter the amount of royalty income reported on Federal Form 1065, Schedule K, Line 7 1(g) 1 0 5

1(h) Enter the amount of net short term capital gains, but not below zero, reported on Federal Form 1065,

Schedule K, Line 8 1(h) 8 9 0

If net short term loss, enter loss here 3 2 0

1(i) Enter the net long term capital gains, but not below zero, reported on Federal Form 1065, Schedule K, Line

9(a). (Net short term capital loss netted against net long term gains.) 1(i)

1(j) Enter the amount of net §1231 gain (loss) reported on Federal Form 1065, Schedule K, Line 10 1(j)

1(k) Enter the amount of other income (loss) reported on Federal Form 1065, Schedule K, Line 11 1(k) 1 1 5 0

1(l) Enter the amount of any other item of income (loss) not reported on Federal Form 1065, Schedule K,

that should be included in gross business profits 1(l) 2 5 0

1(m) Enter the amount of Section 179 deduction reported on Federal Form 1065, Schedule K, Line 12 1(m)

1(n) Enter the amount of contributions reported on Federal Form 1065, Schedule K, Line 13(a), but only to the

extent that the contributions are made in the name of the partnership to enhance the goodwill of the

partnership, and not for the benefit of a partner 1(n)

1(o) Enter the amount of investment interest expense reported on Federal Form 1065, Schedule K, Line 13(b) 1(o) 7 2 0 0

1(p) Enter the amount of IRC §59(e)(2) expenditures reported on Federal Form 1065, Schedule K, Line 13(c)(2) 1(p) 5 0 0

1(q) Enter the amount of other deductions reported on Federal Form 1065, Schedule K, Line 13(d) 1(q) 6 7 5

1(r) Enter the amount of foreign taxes paid or accrued as reported on Federal Form 1065, Schedule K, Line 21 1(r)

2 Combine Lines 1(a) through 1(l) and from the result subtract the sum of Lines 1(m) through 1(r). Report on

NH-1120-WE, Schedule I-A, Line 3 2 4 9 7 4

File only one form combining all Partnership entities reporting as part of the combined returns. Include a statement detailing

each entity separately, similar to the method used for consolidated federal pages.

VersionDP-120-P1 08/202202 3 3