Enlarge image

Print Form Reset Form

New Hampshire 202

Department of 3 *DP131A2311862*

DP-131-A

Revenue Administration DP131A2311862

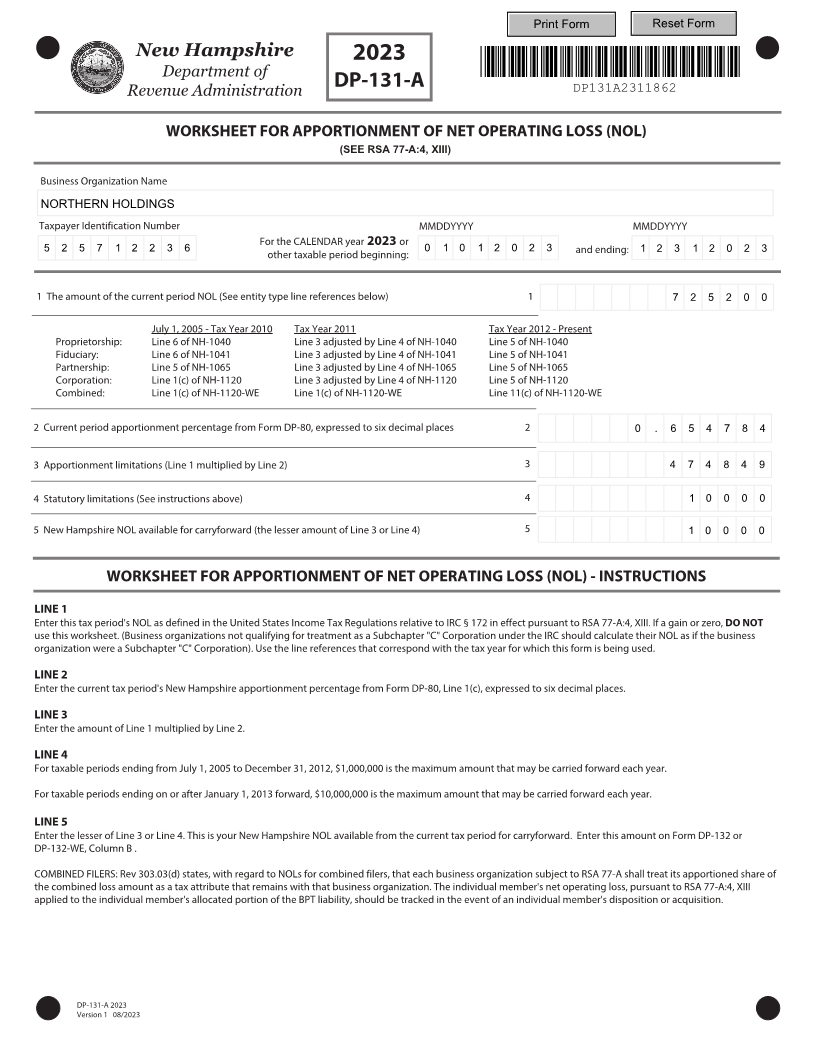

WORKSHEET FOR APPORTIONMENT OF NET OPERATING LOSS (NOL)

(SEE RSA 77-A:4, XIII)

Business Organization Name

NORTHERN HOLDINGS

Taxpayer Identification Number MMDDYYYY MMDDYYYY

For the CALENDAR year 2023 or

5 2 5 7 1 2 2 3 6 other taxable period beginning: 0 1 0 1 2 0 2 3 and ending: 1 2 3 1 2 0 2 3

1 The amount of the current period NOL (See entity type line references below) 1 7 2 5 2 0 0

July 1, 2005 - Tax Year 2010 Tax Year 2011 Tax Year 2012 - Present

Proprietorship: Line 6 of NH-1040 Line 3 adjusted by Line 4 of NH-1040 Line 5 of NH-1040

Fiduciary: Line 6 of NH-1041 Line 3 adjusted by Line 4 of NH-1041 Line 5 of NH-1041

Partnership: Line 5 of NH-1065 Line 3 adjusted by Line 4 of NH-1065 Line 5 of NH-1065

Corporation: Line 1(c) of NH-1120 Line 3 adjusted by Line 4 of NH-1120 Line 5 of NH-1120

Combined: Line 1(c) of NH-1120-WE Line 1(c) of NH-1120-WE Line 11(c) of NH-1120-WE

2 Current period apportionment percentage from Form DP-80, expressed to six decimal places 2 0 . 6 5 4 7 8 4

3 Apportionment limitations (Line 1 multiplied by Line 2) 3 4 7 4 8 4 9

4 Statutory limitations (See instructions above) 4 1 0 0 0 0

5 New Hampshire NOL available for carryforward (the lesser amount of Line 3 or Line 4) 5 1 0 0 0 0

WORKSHEET FOR APPORTIONMENT OF NET OPERATING LOSS (NOL) - INSTRUCTIONS

LINE 1

Enter this tax period's NOL as defined in the United States Income Tax Regulations relative to IRC § 172 in effect pursuant to RSA 77-A:4, XIII. If a gain or zero, DO NOT

use this worksheet. (Business organizations not qualifying for treatment as a Subchapter "C" Corporation under the IRC should calculate their NOL as if the business

organization were a Subchapter "C" Corporation). Use the line references that correspond with the tax year for which this form is being used.

LINE 2

Enter the current tax period's New Hampshire apportionment percentage from Form DP-80, Line 1(c), expressed to six decimal places.

LINE 3

Enter the amount of Line 1 multiplied by Line 2.

LINE 4

For taxable periods ending from July 1, 2005 to December 31, 2012, $1,000,000 is the maximum amount that may be carried forward each year.

For taxable periods ending on or after January 1, 2013 forward, $10,000,000 is the maximum amount that may be carried forward each year.

LINE 5

Enter the lesser of Line 3 or Line 4. This is your New Hampshire NOL available from the current tax period for carryforward. Enter this amount on Form DP-132 or

DP-132-WE, Column B .

COMBINED FILERS: Rev 303.03(d) states, with regard to NOLs for combined filers, that each business organization subject to RSA 77-A shall treat its apportioned share of

the combined loss amount as a tax attribute that remains with that business organization. The individual member's net operating loss, pursuant to RSA 77-A:4, XIII

applied to the individual member's allocated portion of the BPT liability, should be tracked in the event of an individual member's disposition or acquisition.

VersionDP-131-A1 8 202 0 /2023 3