Enlarge image

Print Form Reset Form

New Hampshire

202

Department of 3 *0DP1322311862*

Revenue Administration DP-132 0DP1322311862

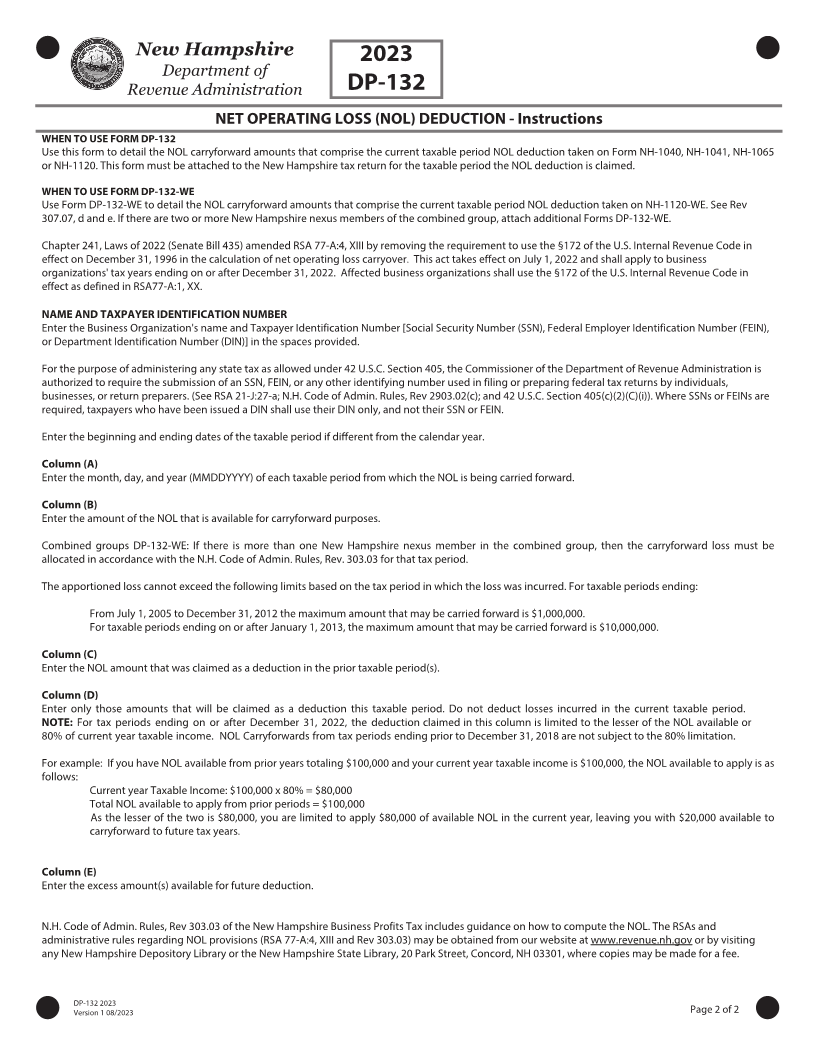

NET OPERATING LOSS (NOL) DEDUCTION

Business Organization Name

BLUE WAVE INC

Taxpayer Identification Number MMDDYYYY MMDDYYYY

For the CALENDAR year 2023 or

9 3 7 6 0 0 5 5 3 other taxable period beginning: 0 1 0 1 2 0 2 3 and ending: 1 2 3 1 2 0 2 3

Column A Column B Column C Column D Column E

Ending date of taxable New Hampshire NOL Amount of NOL carry forward Amount of NOL to be used Amount of NOL to

period in which available for carryforward which has been used in taxable as a deduction in this carryforward to future

NOL occurred from DP-131-A periods prior to this taxable taxable period taxable period

period (See Instructions)

1 1 2 3 1 2 0 1 4 5 5 2 0 0 5 5 2 0 0

2 1 2 3 1 2 0 1 5 3 1 3 6 0 7 0 0 3 2 1 3 0 3 3 9

3 1 2 3 1 2 0 1 6 7 5 8 0 7 5 8 0

4 1 2 3 1 2 0 1 7 1 8 5 4 0 0 1 8 3 5 6 4 1 8 3 6

5 1 2 3 1 2 0 1 8 5 5 0 0 7 2 0 4 7 8 0

6 1 2 3 1 2 0 1 9 1 5 4 5 0 1 5 4 5 0

7 1 2 3 1 2 0 2 0 1 6 9 5 0 4 0 0 3 2 0 0 1 3 3 5 0

8 1 2 3 1 2 0 2 1 1 2 5 0 0 1 2 5 0 0

9 1 2 3 1 2 0 2 2 3 8 5 0 3 0 0 0 5 0 8 0 0

10 1 2 3 1 2 0 2 3 6 5 8 5 6 5 8 5

11 3 4 0 3 7 5 4 8 2 0 2 4 9 9 1 5 8 5 6 4 0

Line 11 - Total Columns B, C, D, & E (Sum Lines 1 - 10 in each respective column).

The amount of NOL carryforward deducted this taxable period is Column D, Line 11(see instructions).

This is the amount to be reported on the applicable Business Profits Tax return.

NOTE: Column B less Column C should equal the sum of Column D plus Column E.

VersionDP-132 202 1 083/2023 Page 1 of 2