Enlarge image

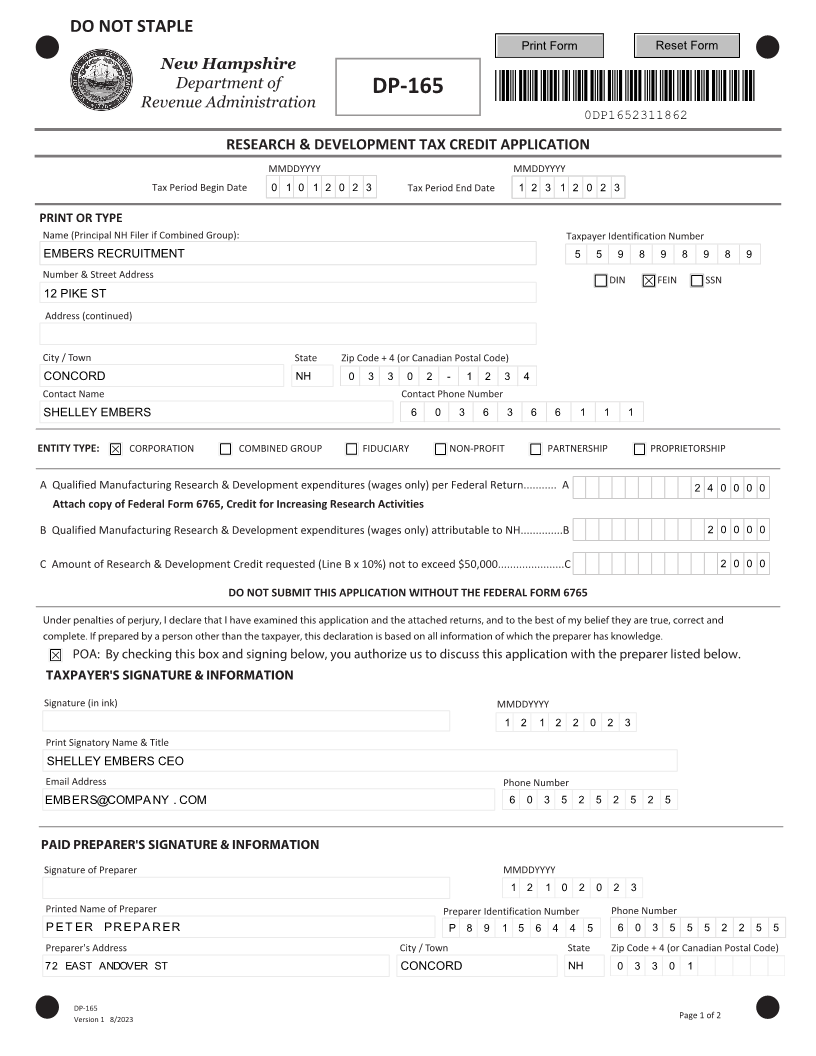

DO NOT STAPLE

Print Form Reset Form

New Hampshire

Department of

DP-165 *0DP1652311862*

Revenue Administration

0DP1652311862

RESEARCH & DEVELOPMENT TAX CREDIT APPLICATION

MMDDYYYY MMDDYYYY

Tax Period Begin Date 0 1 0 1 2 0 2 3 Tax Period End Date 1 2 3 1 2 0 2 3

PRINT OR TYPE

Name (Principal NH Filer if Combined Group): Taxpayer Identification Number

EMBERS RECRUITMENT 5 5 9 8 9 8 9 8 9

Number & Street Address DIN FEIN SSN

12 PIKE ST

Address (continued)

City / Town State Zip Code + 4 (or Canadian Postal Code)

CONCORD NH 0 3 3 0 2 - 1 2 3 4

Contact Name Contact Phone Number

SHELLEY EMBERS 6 0 3 6 3 6 6 1 1 1

ENTITY TYPE: CORPORATION COMBINED GROUP FIDUCIARY NON-PROFIT PARTNERSHIP PROPRIETORSHIP

A Qualified Manufacturing Research & Development expenditures (wages only) per Federal Return........... A 2 4 0 0 0 0

Attach copy of Federal Form 6765, Credit for Increasing Research Activities

B Qualified Manufacturing Research & Development expenditures (wages only) attributable to NH..............B 2 0 0 0 0

C Amount of Research & Development Credit requested (Line B x 10%) not to exceed $50,000......................C 2 0 0 0

DO NOT SUBMIT THIS APPLICATION WITHOUT THE FEDERAL FORM 6765

Under penalties of perjury, I declare that I have examined this application and the attached returns, and to the best of my belief they are true, correct and

complete. If prepared by a person other than the taxpayer, this declaration is based on all information of which the preparer has knowledge.

POA: By checking this box and signing below, you authorize us to discuss this application with the preparer listed below.

TAXPAYER'S SIGNATURE & INFORMATION

Signature (in ink) MMDDYYYY

1 2 1 2 2 0 2 3

Print Signatory Name & Title

SHELLEY EMBERS CEO

Email Address Phone Number

EMBERS@COMPANY . COM 6 0 3 5 2 5 2 5 2 5

PAID PREPARER'S SIGNATURE & INFORMATION

Signature of Preparer MMDDYYYY

1 2 1 0 2 0 2 3

Printed Name of Preparer Preparer Identification Number Phone Number

PET ER PREPA RER P 8 9 1 5 6 4 4 5 6 0 3 5 5 5 2 2 5 5

Preparer's Address City / Town State Zip Code + 4 (or Canadian Postal Code)

72 EAST ANDOVER ST CONCORD NH 0 3 3 0 1

DP-165

Version 1 8 /2023 Page 1 of 2