Enlarge image

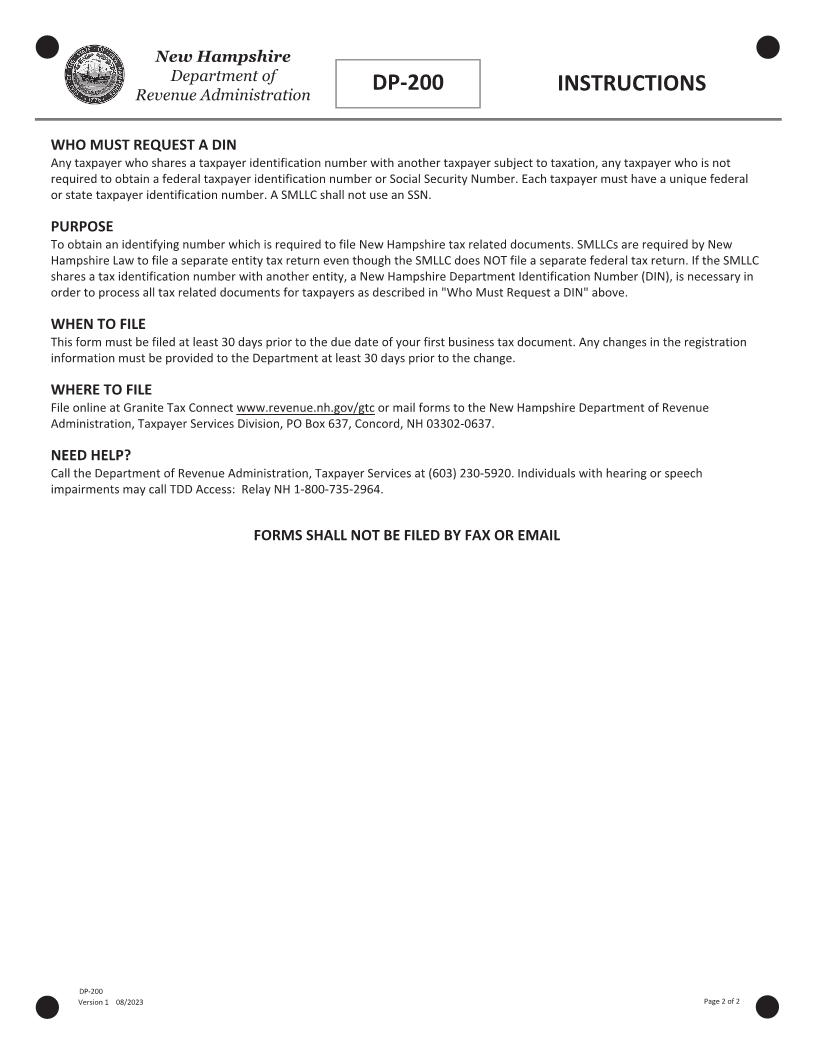

Print Form Reset Form

New Hampshire

Department of

DP-200 *0DP2002311862*

Revenue Administration

0DP2002311862

REQUEST FOR DEPARTMENT IDENTIFICATION NUMBER (DIN)

BUSINESS ENTITY INFORMATION

Business Name

7 SEAS INC

Number & Street Address DO NOT FILE THIS FORM FOR AN SMLLC

7 BUTTON RD THAT ALREADY HAS ITS OWN FEIN

City / Town State Zip Code + 4 (or Canadian Postal Code)

HOOKSETT NH 0 3 1 0 6 - 1 2 5 4

You must use your Department Identification Number (DIN) on all of the documents filed with the DRA instead of the Federal Employer Identification Number (FEIN) or

Social Security Number (SSN).

MEMBER OR TAXPAYER INFORMATION

Member or Taxpayer Name Taxpayer Identification Number

SAMANTHA EVANS 2 3 4 2 3 4 2 3 4

Number & Street Address FEIN SSN

6 COMMERCIAL ST APT 5

City / Town State Zip Code + 4 (or Canadian Postal Code)

CONCORD NH 0 3 3 0 1

ENTITY TYPE: CORPORATION COMBINED GROUP FIDUCIARY PARTNERSHIP PROPRIETORSHIP

For federal income tax purposes, the income of the SMLLC will be reported on the tax return of the member as listed above.

For federal income tax purposes, the income of the SMLLC will NOT be reported on the tax return of the member as listed above.

THE INCOME WILL BE REPORTED ON THE TAX RETURN FOR:

Member or Taxpayer Name Taxpayer Identification Number

Number & Street Address

FEIN SSN

City / Town State Zip Code + 4 (or Canadian Postal Code)

SIGNATURE & INFORMATION

Under penalties of perjury, I declare that I have examined this document and to the best of my belief it is true, correct and complete.

Signature (in ink) of Applicant MMDDYYYY

1 1 2 1 2 0 2 3

Print Signatory Name & Title

SAMANTHA EVANS

FILE ONLINE AT GRANI TE TAX CONNECT WWW.REVENUE.NH.GOV/GTC OR

MAIL TO: NH DRA, PO BOX 637, CONCORD NH 03302-0637

DP-200

Version 1 08/2023 Page 1 of 2