Enlarge image

Print Form Reset Form

New Hampshire 202

Department of 3 *DP22102311862*

DP-2210/2220

Revenue Administration DP22102311862

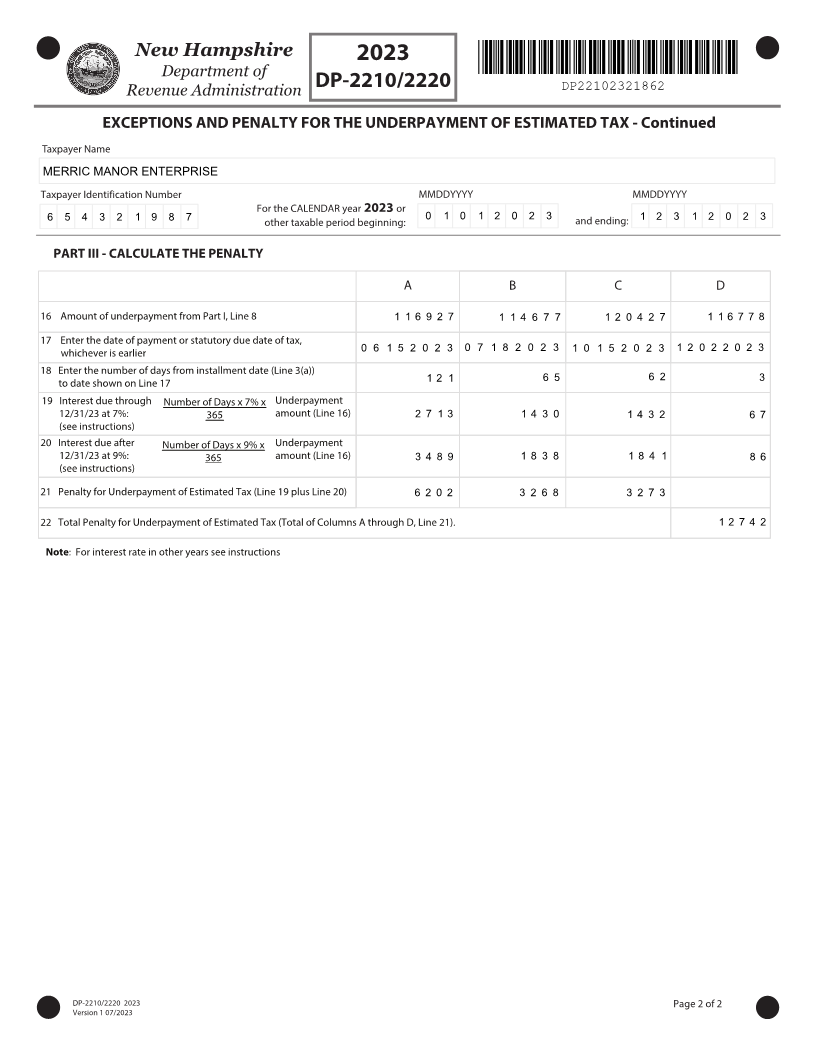

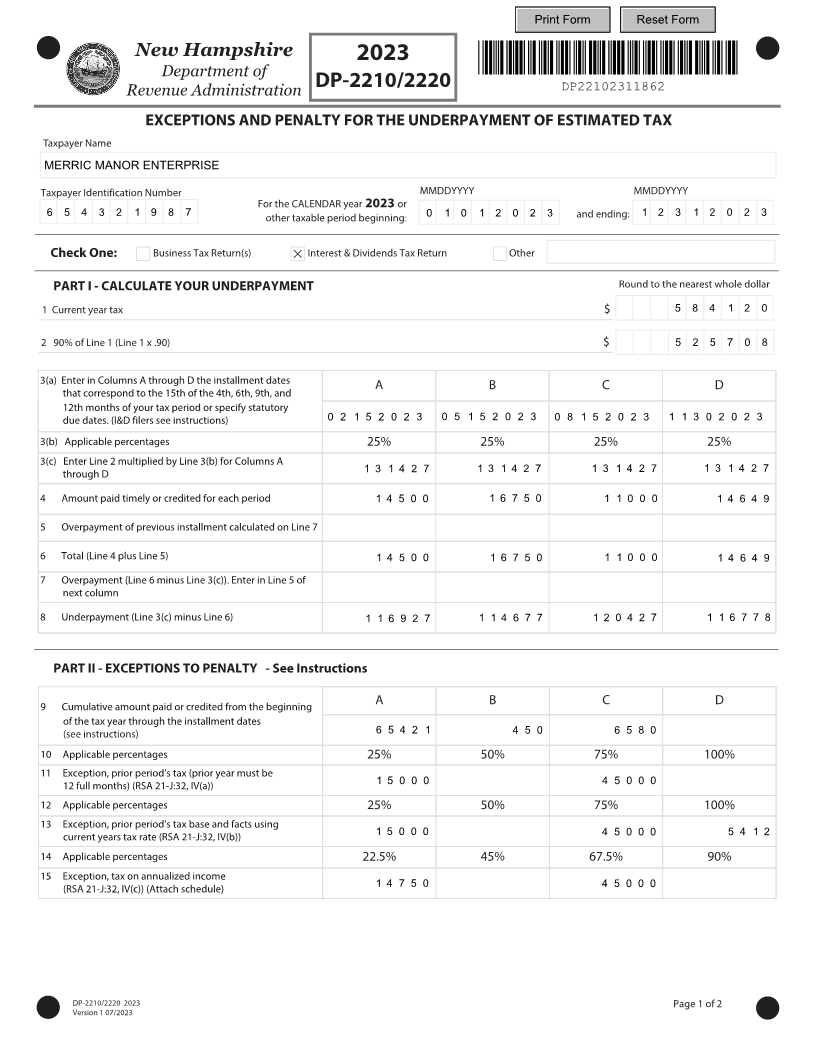

EXCEPTIONS AND PENALTY FOR THE UNDERPAYMENT OF ESTIMATED TAX

Taxpayer Name

MERRIC MANOR ENTERPRISE

Taxpayer Identification Number MMDDYYYY MMDDYYYY

For the CALENDAR year 202 or

6 5 4 3 2 1 9 8 7 3 0 1 0 1 2 0 2 3 and ending: 1 2 3 1 2 0 2 3

other taxable period beginning:

Check One: Business Tax Return(s) Interest & Dividends Tax Return Other

PART I - CALCULATE YOUR UNDERPAYMENT Round to the nearest whole dollar

1 Current year tax $ 5 8 4 1 2 0

2 90% of Line 1 (Line 1 x .90) $ 5 2 5 7 0 8

3(a) Enter in Columns A through D the installment dates A B C D

that correspond to the 15th of the 4th, 6th, 9th, and

12th months of your tax period or specify statutory

due dates. (I&D filers see instructions) 0 2 1 5 2 0 2 3 0 5 1 5 2 0 2 3 0 8 1 5 2 0 2 3 1 1 3 0 2 0 2 3

3(b) Applicable percentages 25% 25% 25% 25%

3(c) Enter Line 2 multiplied by Line 3(b) for Columns A

through D 1 3 1 4 2 7 1 3 1 4 2 7 1 3 1 4 2 7 1 3 1 4 2 7

4 Amount paid timely or credited for each period 1 4 5 0 0 1 6 7 5 0 1 1 0 0 0 1 4 6 4 9

5 Overpayment of previous installment calculated on Line 7

6 Total (Line 4 plus Line 5) 1 4 5 0 0 1 6 7 5 0 1 1 0 0 0 1 4 6 4 9

7 Overpayment (Line 6 minus Line 3(c)). Enter in Line 5 of

next column

8 Underpayment (Line 3(c) minus Line 6) 1 1 6 9 2 7 1 1 4 6 7 7 1 2 0 4 2 7 1 1 6 7 7 8

PART II - EXCEPTIONS TO PENALTY - See Instructions

9 Cumulative amount paid or credited from the beginning A B C D

of the tax year through the installment dates

(see instructions) 6 5 4 2 1 4 5 0 6 5 8 0

10 Applicable percentages 25% 50% 75% 100%

11 Exception, prior period’s tax (prior year must be

12 full months) (RSA 21-J:32, IV(a)) 1 5 0 0 0 4 5 0 0 0

12 Applicable percentages 25% 50% 75% 100%

13 Exception, prior period’s tax base and facts using

current years tax rate (RSA 21-J:32, IV(b)) 1 5 0 0 0 4 5 0 0 0 5 4 1 2

14 Applicable percentages 22.5% 45% 67.5% 90%

15 Exception, tax on annualized income

(RSA 21-J:32, IV(c)) (Attach schedule) 1 4 7 5 0 4 5 0 0 0

Page 1 of 2

VersionDP-2210/2220 1 07 /202202 3 3