Enlarge image

New Hampshire

202 4

Department of Print This Page Reset Pages

Revenue Administration DP-255-ES

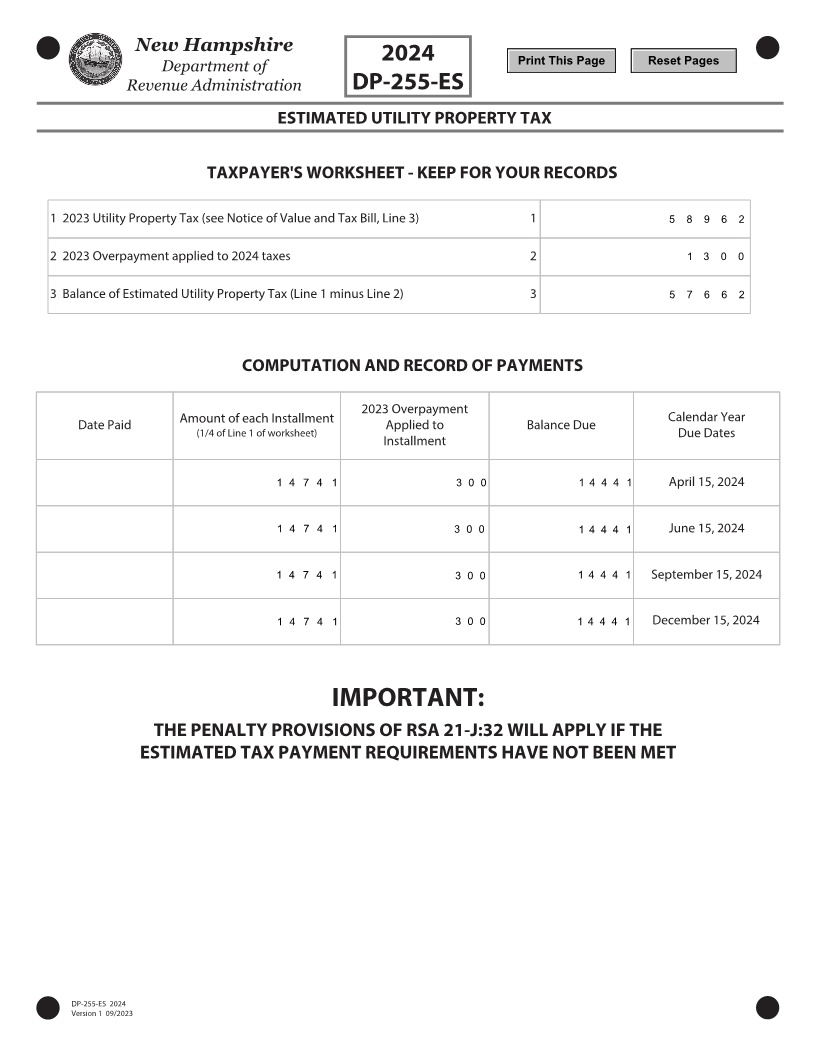

ESTIMATED UTILITY PROPERTY TAX

TAXPAYER'S WORKSHEET - KEEP FOR YOUR RECORDS

1 202 3Utility Property Tax (see Notice of Value and Tax Bill, Line 3) 1 5 8 9 6 2

2 202 3Overpayment applied to 202 4taxes 2 1 3 0 0

3 Balance of Estimated Utility Property Tax (Line 1 minus Line 2) 3 5 7 6 6 2

COMPUTATION AND RECORD OF PAYMENTS

202 3Overpayment

Amount of each Installment Calendar Year

Date Paid Applied to Balance Due

(1/4 of Line 1 of worksheet) Due Dates

Installment

1 4 7 4 1 3 0 0 1 4 4 4 1 April 15, 2024

1 4 7 4 1 3 0 0 1 4 4 4 1 June 15, 2024

1 4 7 4 1 3 0 0 1 4 4 4 1 September 15, 2024

1 4 7 4 1 3 0 0 1 4 4 4 1 December 15, 2024

IMPORTANT:

THE PENALTY PROVISIONS OF RSA 21-J:32 WILL APPLY IF THE

ESTIMATED TAX PAYMENT REQUIREMENTS HAVE NOT BEEN MET

DP-255-ES 202 4

Version 1 90 /2023