Enlarge image

Print Form Reset Form

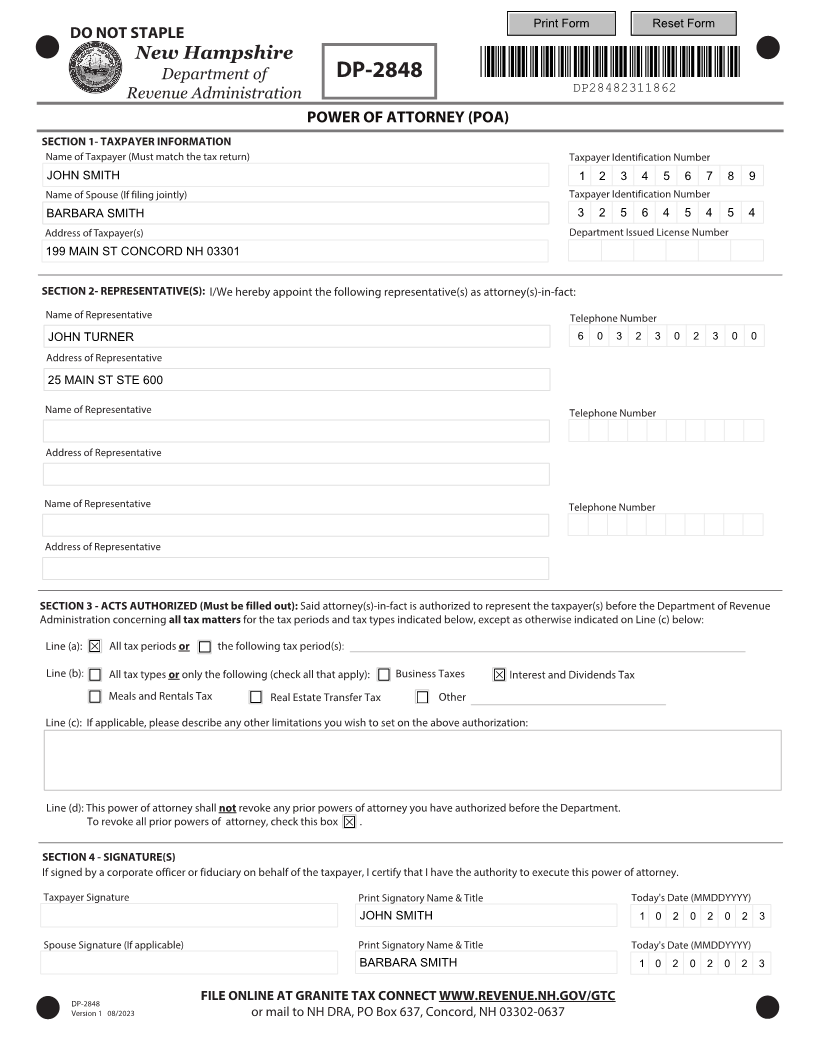

DO NOT STAPLE

New Hampshire

Department of DP-2848 *DP28482311862*

Revenue Administration DP28482311862

POWER OF ATTORNEY (POA)

SECTION 1- TAXPAYER INFORMATION

Name of Taxpayer (Must match the tax return) Taxpayer Identification Number

JOHN SMITH 1 2 3 4 5 6 7 8 9

Name of Spouse (If filing jointly) Taxpayer Identification Number

BARBARA SMITH 3 2 5 6 4 5 4 5 4

Address of Taxpayer(s) Department Issued License Number

199 MAIN ST CONCORD NH 03301

SECTION 2- REPRESENTATIVE(S): I/We hereby appoint the following representative(s) as attorney(s)-in-fact:

Name of Representative Telephone Number

JOHN TURNER 6 0 3 2 3 0 2 3 0 0

Address of Representative

25 MAIN ST STE 600

Name of Representative Telephone Number

Address of Representative

Name of Representative Telephone Number

Address of Representative

SECTION 3 - ACTS AUTHORIZED (Must be filled out): Said attorney(s)-in-fact is authorized to represent the taxpayer(s) before the Department of Revenue

Administration concerning all tax matters for the tax periods and tax types indicated below, except as otherwise indicated on Line (c) below:

Line (a): All tax periods or the following tax period(s):

Line (b): All tax types oronly the following (check all that apply): Business Taxes Interest and Dividends Tax

Meals and Rentals Tax Real Estate Transfer Tax Other

Line (c): If applicable, please describe any other limitations you wish to set on the above authorization:

Line (d): This power of attorney shall not revoke any prior powers of attorney you have authorized before the Department.

To revoke all prior powers of attorney, check this box .

SECTION 4 - SIGNATURE(S)

If signed by a corporate officer or fiduciary on behalf of the taxpayer, I certify that I have the authority to execute this power of attorney.

Taxpayer Signature Print Signatory Name & Title Today's Date (MMDDYYYY)

JOHN SMITH 1 0 2 0 2 0 2 3

Spouse Signature (If applicable) Print Signatory Name & Title Today's Date (MMDDYYYY)

BARBARA SMITH 1 0 2 0 2 0 2 3

FILE ONLINE AT GRANITE TAX CONNECT WWW.REVENUE.NH.GOV/GTC

DP-2848

Version 1 8 0 /2023 or mail to NH DRA, PO Box 637, Concord, NH 03302-0637