Enlarge image

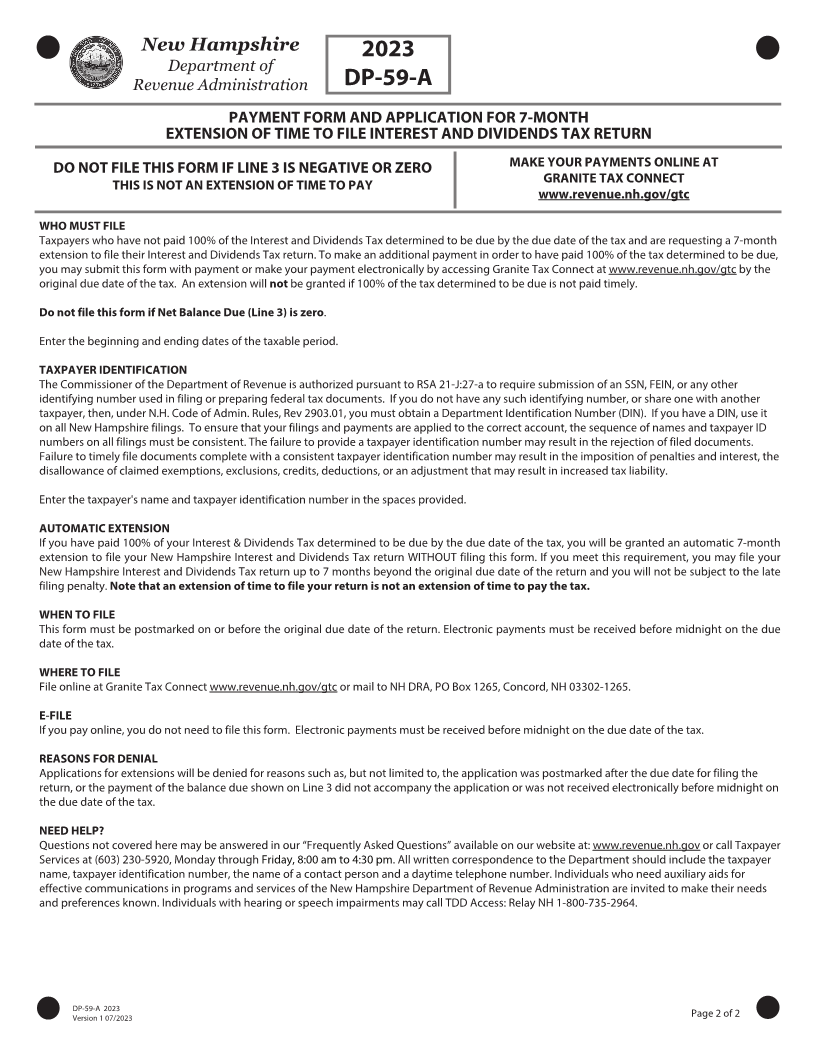

Print Form Reset Form

New Hampshire 202

Department of 3 *0DP59A2311862*

Revenue Administration DP-59-A 0DP59A2311862

PAYMENT FORM AND APPLICATION FOR 7-MONTH

EXTENSION OF TIME TO FILE INTEREST AND DIVIDENDS TAX RETURN

DO NOT FILE THIS FORM IF LINE 3 IS NEGATIVE OR ZERO MAKE YOUR PAYMENTS ONLINE AT

THIS IS NOT AN EXTENSION OF TIME TO PAY GRANITE TAX CONNECT

www.revenue.nh.gov/gtc

For the CALENDAR year 202 3 or other taxable period beginning: ENTITY TYPE - Check One

MMDDYYYY MMDDYYYY

and ending: 1 - Individual/Joint 3 - Partnership/LLC 4 - Estate

0 1 0 1 2 0 2 3 1 2 3 1 2 0 2 3

Last Name

First Name MI Social Security Number Taxpayer Identification Number

1 5 6 4 4 5 6 1 5

Spouse's Last Name If issued a DIN, use DIN in the

appropriate taxpayer

identification box.

First Name MI Social Security Number DO NOT enter SSN or FEIN

Name of Partnership, Estate, or LLC

SHOREWAYS KITCHEN INC

Number & Street Address

57 COMMERCE WAY

Address (continued)

UNIT 6

City / Town State Zip Code + 4 (or Canadian Postal Code)

PORTSMOUTH NH 0 3 8 0 1 - 1 7 5 8

100% PAYMENT IS DUE ON OR BEFORE THE DUE DATE OF THE TAX Round to the nearest whole dollar

File online at Granite Tax Connect 1 Enter 100% of the Interest and Dividends Tax determined to be due (net of

www.revenue.nh.gov/gtc RSA 77-G Education Tax Credit) 7 6 2 3 5

2(a) Enter credit carried over from prior

Make check payable to: year and total estimated tax payments

State of New Hampshire

Mail to: NH DRA 2(b) Enter payment previously made,

PO BOX 1265 if applicable 5 2 0 0 0

CONCORD NH 03302-1265

2 Total advance payments and credits

Enclose, but do not staple or tape your (Line 2(a) plus Line 2(b)) 5 2 0 0 0

payment to this extension. 3 NET BALANCE DUE:

If negative or zero DO NOT file this (Line 1 minus Line 2) Pay This Amount 2 4 2 3 5

application.

VersionDP-59-A 1202 07/2023 3 Page 1 of 2