Enlarge image

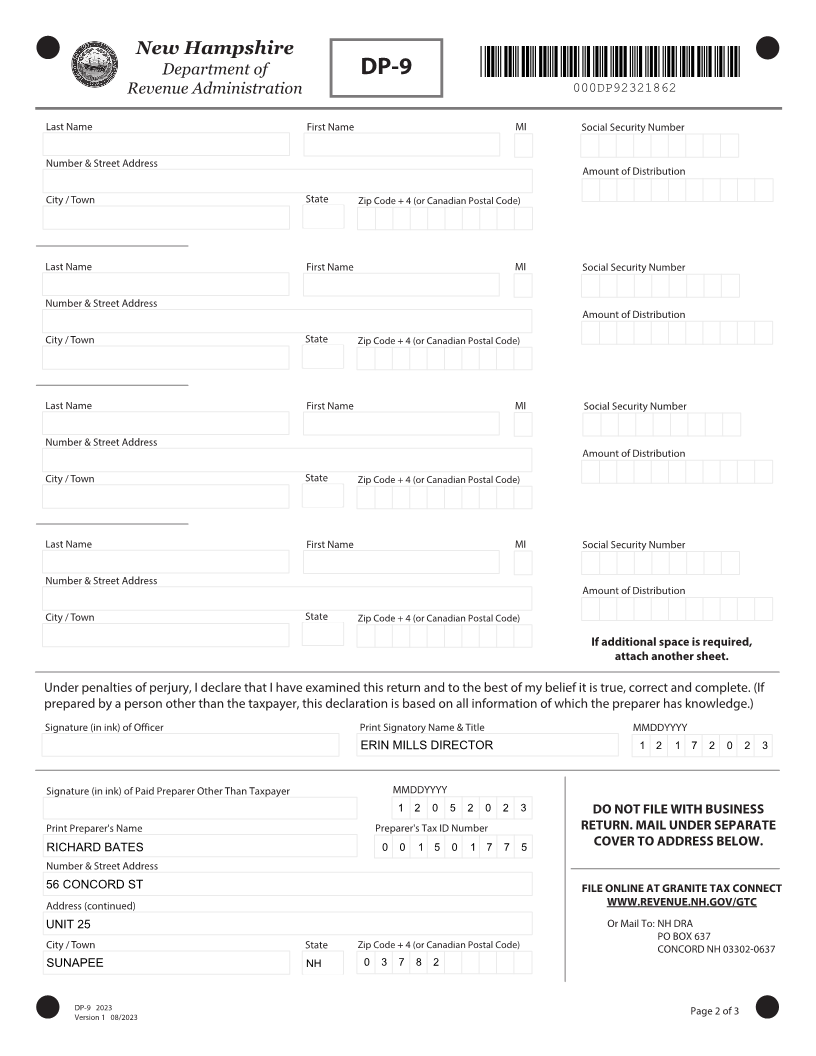

DO NOT ATTACH TO RETURN

Print Form Reset Form

New Hampshire

Department of DP-9 *000DP92311862*

Revenue Administration 000DP92311862

SMALL BUSINESS CORPORATION ("S" CORP) INFORMATION REPORT

Name of "S" Corporation Federal Employer ID Number Calendar Year

AW BIRCH PLANT CORP 5 4 1 2 5 4 4 4 4 2 0 2 0

Number & Street Address City / Town

185 LAWRENCE ST CONCORD

Address (continued) State Zip Code + 4 (or Canadian Postal Code)

FLOOR 2 NH 0 3 3 0 1 - 0 6 3 4

Total of all actual distributions made to New Hampshire residents for the period end ............................................... $ 5 8 6 0 0 0

Shareholder Name and Address (New Hampshire Residents ONLY)

Last Name First Name MI Social Security Number

RICH MILDRED P 0 0 1 1 1 2 2 2 7

Number & Street Address

Amount of Distribution

90 BUCKS PLACE

2 5 0 0 0

City / Town State Zip Code + 4 (or Canadian Postal Code)

WEARE NH 0 3 8 2 1

Last Name First Name MI Social Security Number

TILTON KACEY M 0 0 2 3 3 6 6 6 6

Number & Street Address

Amount of Distribution

76 MAIN ST

2 5 0 0 0

City / Town State Zip Code + 4 (or Canadian Postal Code)

WEARE NH 0 3 2 8 1

Last Name First Name MI Social Security Number

ROBERTS COURTNEY E 3 6 5 2 2 2 2 1 5

Number & Street Address

Amount of Distribution

56 TIMBER LANE

5 3 6 0 0 0

City / Town State Zip Code + 4 (or Canadian Postal Code)

CONCORD NH 0 3 3 0 1

Last Name First Name MI Social Security Number

Number & Street Address

Amount of Distribution

City / Town State Zip Code + 4 (or Canadian Postal Code)

DP- 9 202 3 Page 1 of 3

Version 1 8 0 /2023