Enlarge image

New Hampshire Print Form Reset Form

Payment

Department of

Voucher *0NHPYT2311862*

Revenue Administration

0NHPYT2311862

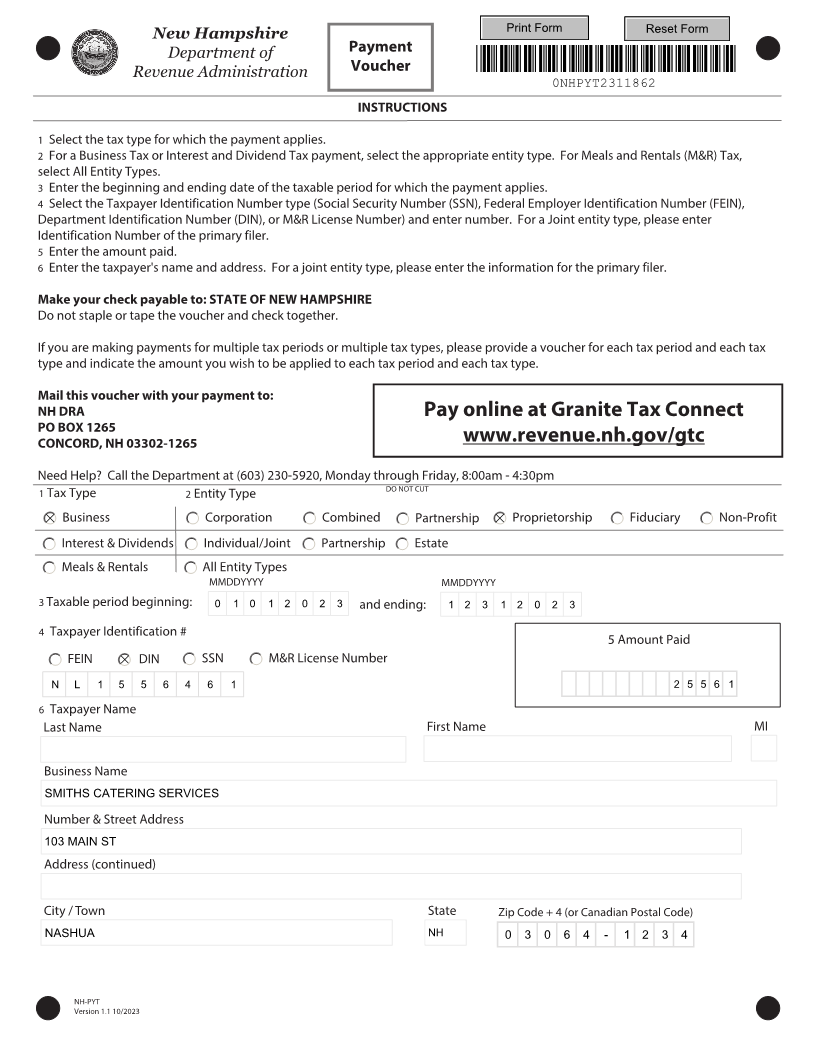

INSTRUCTIONS

1 Select the tax type for which the payment applies.

2 For a Business Tax or Interest and Dividend Tax payment, select the appropriate entity type. For Meals and Rentals (M&R) Tax,

select All Entity Types.

3 Enter the beginning and ending date of the taxable period for which the payment applies.

4 Select the Taxpayer Identification Number type (Social Security Number (SSN), Federal Employer Identification Number (FEIN),

Department Identification Number (DIN), or M&R License Number) and enter number. For a Joint entity type, please enter

Identification Number of the primary filer.

5 Enter the amount paid.

6 Enter the taxpayer's name and address. For a joint entity type, please enter the information for the primary filer.

Make your check payable to: STATE OF NEW HAMPSHIRE

Do not staple or tape the voucher and check together.

If you are making payments for multiple tax periods or multiple tax types, please provide a voucher for each tax period and each tax

type and indicate the amount you wish to be applied to each tax period and each tax type.

Mail this voucher with your payment to:

NH DRA Pay online at Granite Tax Connect

PO BOX 1265

CONCORD, NH 03302-1265 www.revenue.nh.gov/gtc

Need Help? Call the Department at (603) 230-5920, Monday through Friday, 8:00am - 4:30pm

DO NOT CUT

1 Tax Type 2 Entity Type

Business Corporation Combined Partnership Proprietorship Fiduciary Non-Profit

Interest & Dividends Individual/Joint Partnership Estate

Meals & Rentals All Entity Types

MMDDYYYY MMDDYYYY

3 Taxable period beginning: 0 1 0 1 2 0 2 3 and ending: 1 2 3 1 2 0 2 3

4 Taxpayer Identification #

5 Amount Paid

FEIN DIN SSN M&R License Number

N L 1 5 5 6 4 6 1 2 5 5 6 1

6 Taxpayer Name

Last Name First Name MI

Business Name

SMITHS CATERING SERVICES

Number & Street Address

103 MAIN ST

Address (continued)

City / Town State Zip Code + 4 (or Canadian Postal Code)

NASHUA NH 0 3 0 6 4 - 1 2 3 4

NH-PYT

Version 1. 1 10/2023