Enlarge image

Print Form Reset Form

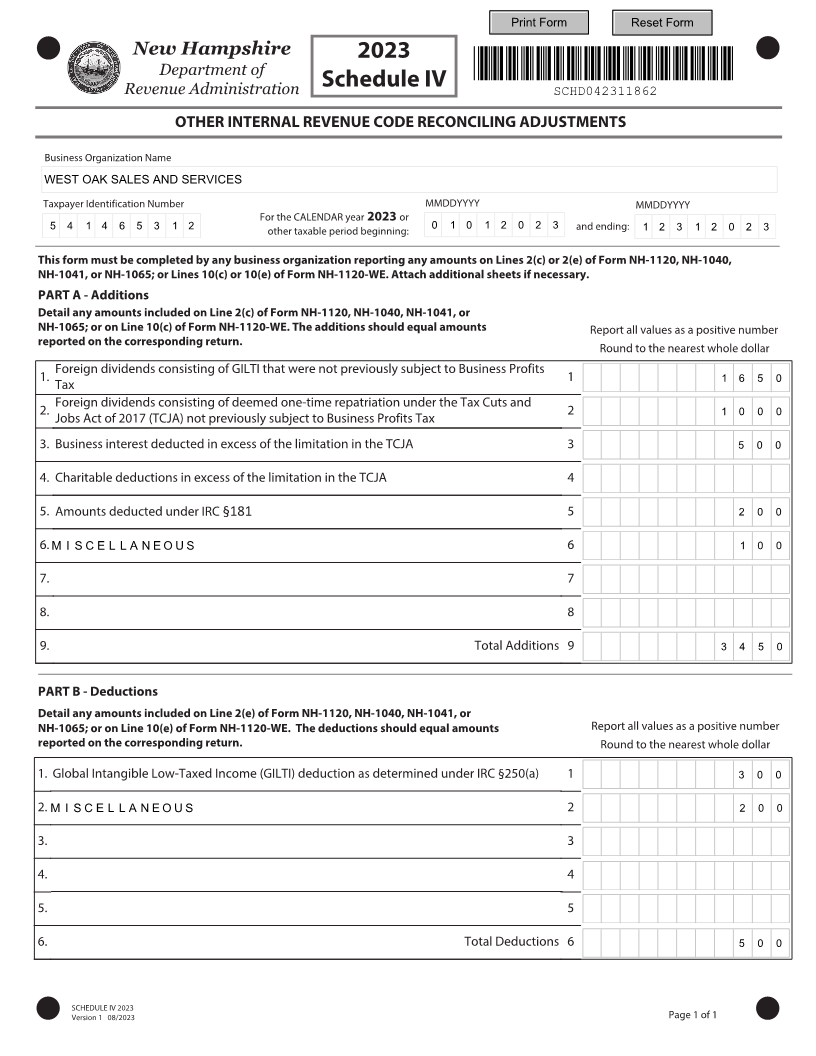

New Hampshire 202 3

Department of *SCHD042311862*

Schedule IV

Revenue Administration SCHD042311862

OTHER INTERNAL REVENUE CODE RECONCILING ADJUSTMENTS

Business Organization Name

WEST OAK SALES AND SERVICES

Taxpayer Identification Number MMDDYYYY MMDDYYYY

For the CALENDAR year 202 3 or

5 4 1 4 6 5 3 1 2 other taxable period beginning: 0 1 0 1 2 0 2 3 and ending: 1 2 3 1 2 0 2 3

This form must be completed by any business organization reporting any amounts on Lines 2(c) or 2(e) of Form NH-1120, NH-1040,

NH-1041, or NH-1065;or Lines 10(c) or 10(e) of Form NH-1120-WE .Attach additional sheets if necessary.

PART A - Additions

Detail any amounts included on Line 2(c) of Form NH-1120, NH-1040, NH-1041, or

NH-1065; or on Line 10(c) of Form NH-1120-WE. The additions should equal amounts Report all values as a positive number

reported on the corresponding return.

Round to the nearest whole dollar

Foreign dividends consisting of GILTI that were not previously subject to Business Profits

1. 1 1 6 5 0

Tax

Foreign dividends consisting of deemed one-time repatriation under the Tax Cuts and

2. 2 1 0 0 0

Jobs Act of 2017 (TCJA) not previously subject to Business Profits Tax

3. Business interest deducted in excess of the limitation in the TCJA 3 5 0 0

4. Charitable deductions in excess of the limitation in the TCJA 4

5. Amounts deducted under IRC §181 5 2 0 0

6. M I S C E L L A N E O U S 6 1 0 0

7. 7

8. 8

9. Total Additions 9 3 4 5 0

PART B - Deductions

Detail any amounts included on Line 2(e) of Form NH-1120, NH-1040, NH-1041, or

NH-1065; or on Line 10(e) of Form NH-1120-WE. The deductions should equal amounts Report all values as a positive number

reported on the corresponding return. Round to the nearest whole dollar

1. Global Intangible Low-Taxed Income (GILTI) deduction as determined under IRC § 250(a) 1 3 0 0

2. M I S C E L L A N E O U S 2 2 0 0

3. 3

4. 4

5. 5

6. Total Deductions 6 5 0 0

SCHEDULE IV 202 3

Version 1 08/2023 Page 1 of 1