Enlarge image

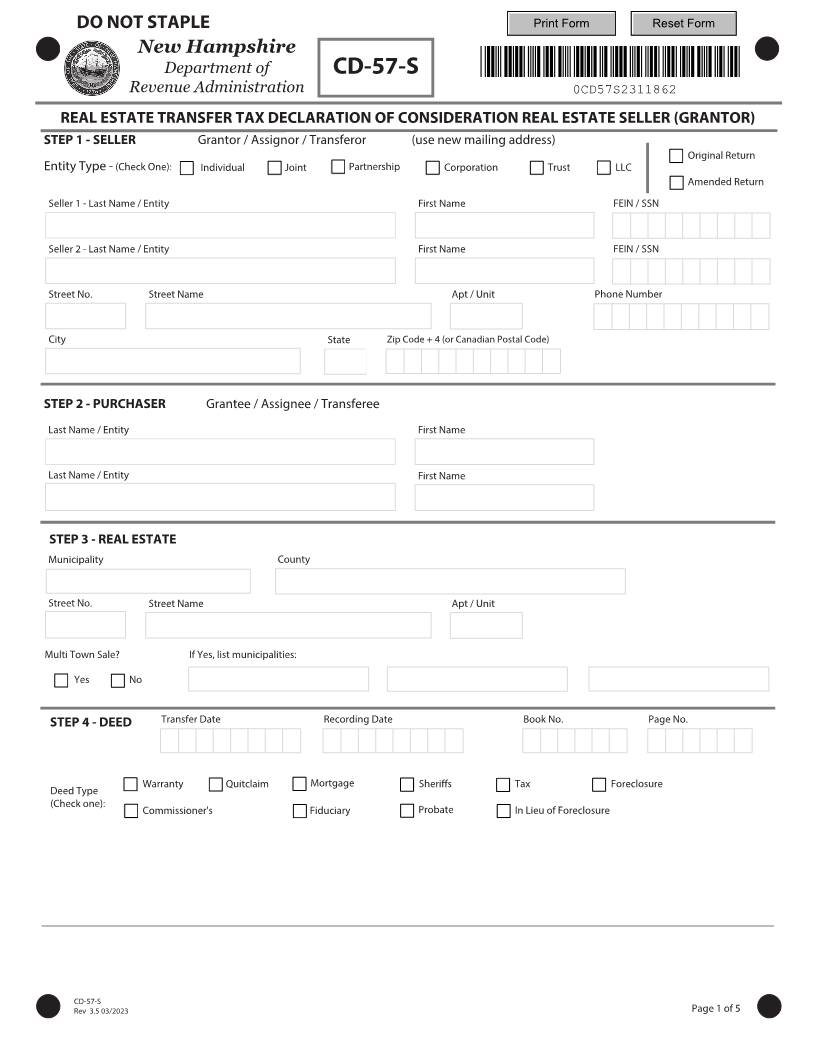

DO NOT STAPLE Print Form Reset Form

New Hampshire

Department of CD-57-S *0CD57S2311862*

Revenue Administration 0CD57S2311862

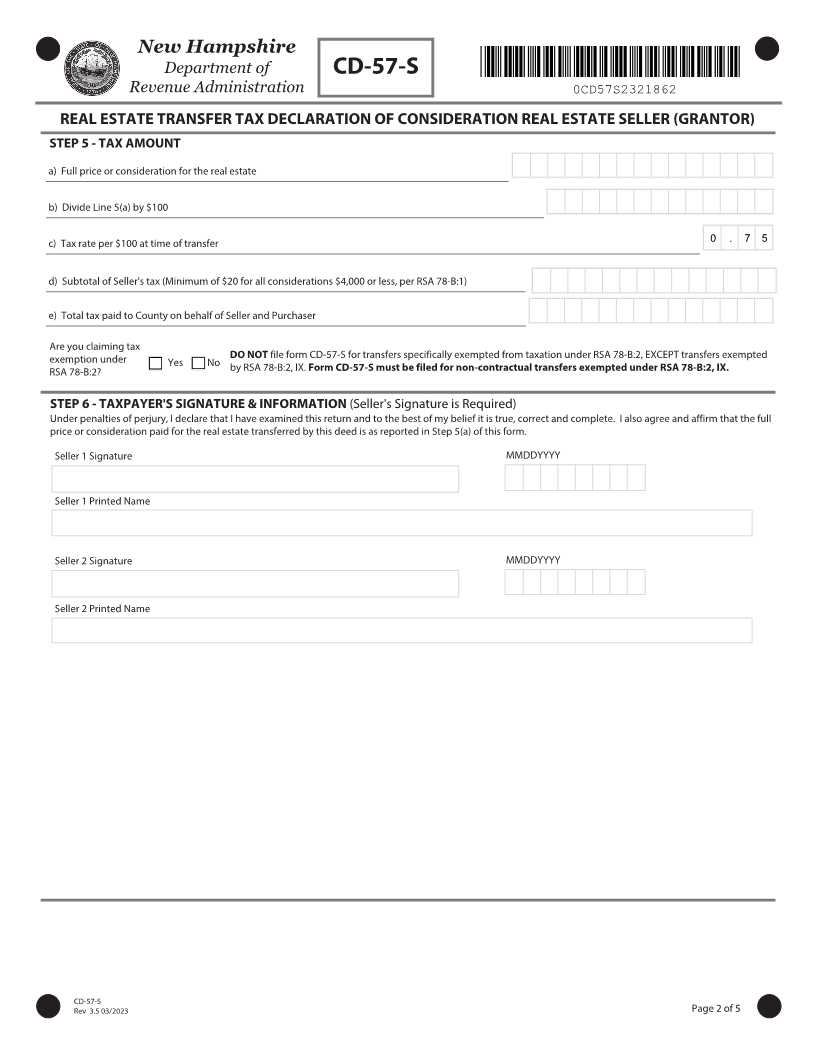

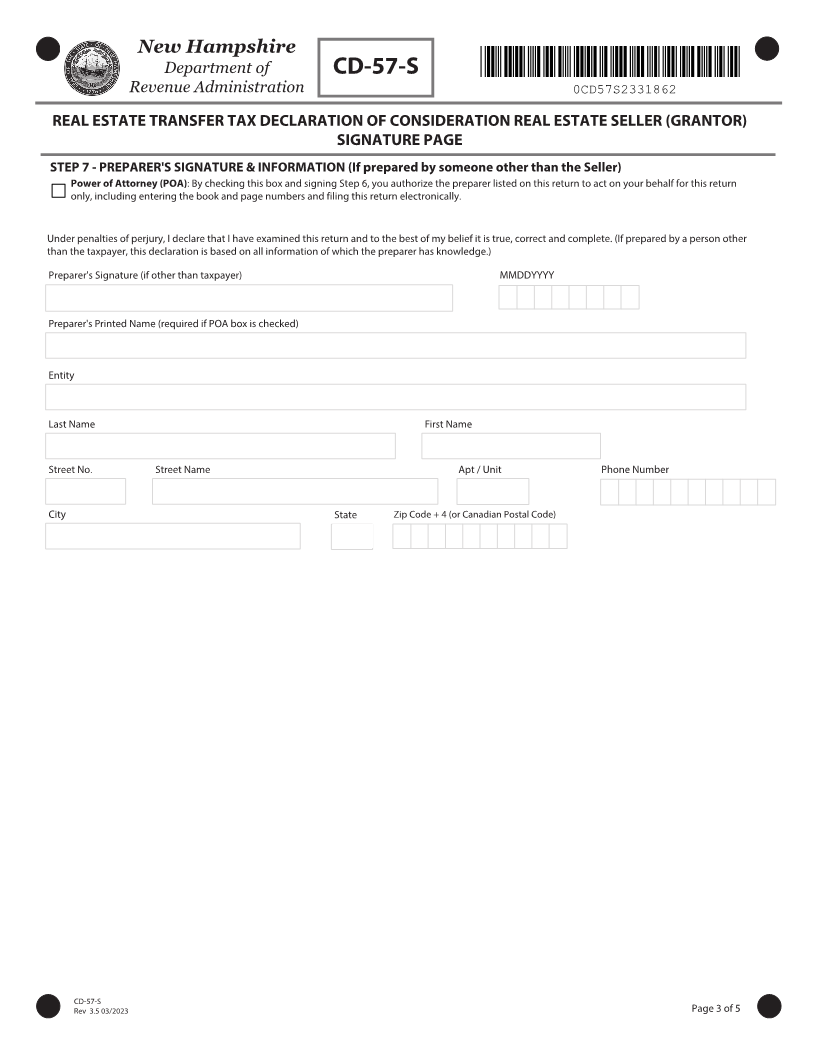

REAL ESTATE TRANSFER TAX DECLARATION OF CONSIDERATION REAL ESTATE SELLER (GRANTOR)

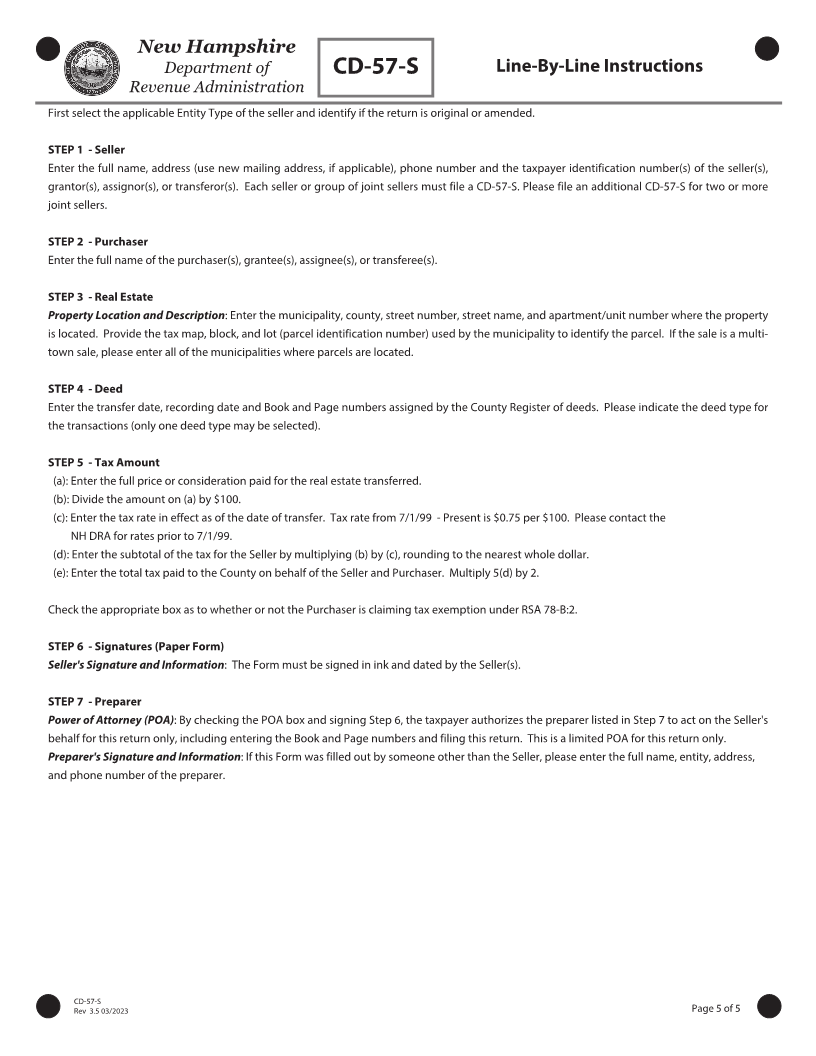

STEP 1 - SELLER Grantor / Assignor / Transferor (use new mailing address)

Original Return

Entity Type - (Check One): Individual Joint Partnership Corporation Trust LLC

Amended Return

Seller 1 - Last Name / Entity First Name FEIN / SSN

Seller 2 - Last Name / Entity First Name FEIN / SSN

Street No. Street Name Apt / Unit Phone Number

City State Zip Code + 4 (or Canadian Postal Code)

STEP 2 - PURCHASER Grantee / Assignee / Transferee

Last Name / Entity First Name

Last Name / Entity First Name

STEP 3 - REAL ESTATE

Municipality County

Street No. Street Name Apt / Unit

Multi Town Sale? If Yes, list municipalities:

Yes No

STEP 4 - DEED Transfer Date Recording Date Book No. Page No.

Warranty Quitclaim Mortgage Sheriffs Tax Foreclosure

Deed Type

(Check one): Probate In Lieu of Foreclosure

Commissioner's Fiduciary

CD-57-S

Rev 3.5 03/2023 Page 1 of 5