Enlarge image

Print Form Reset Form

New Hampshire

Department of PA-34 *00PA342311862*

Revenue Administration 00PA342311862

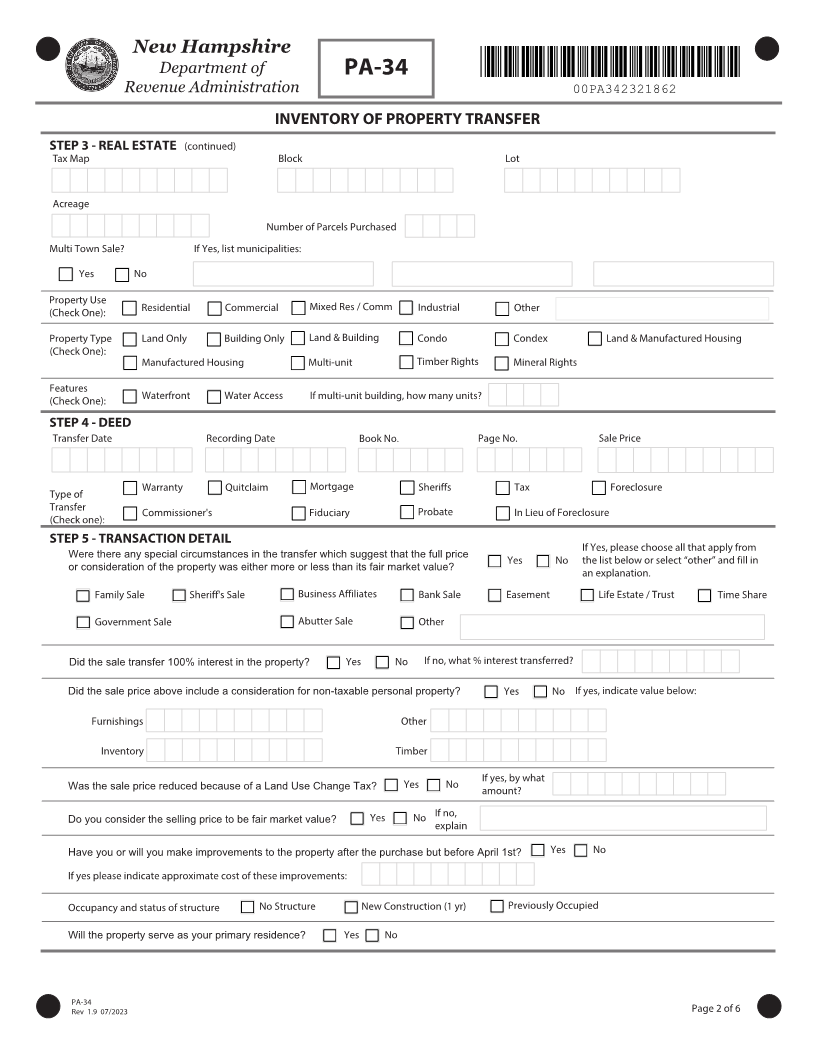

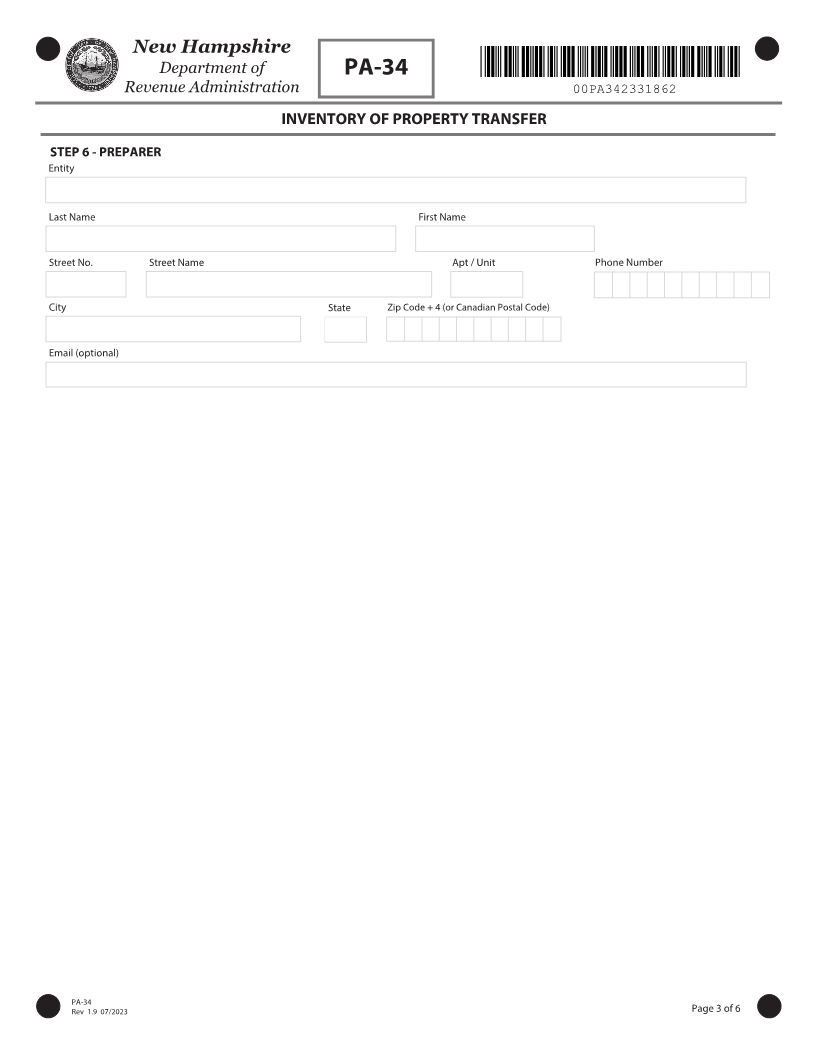

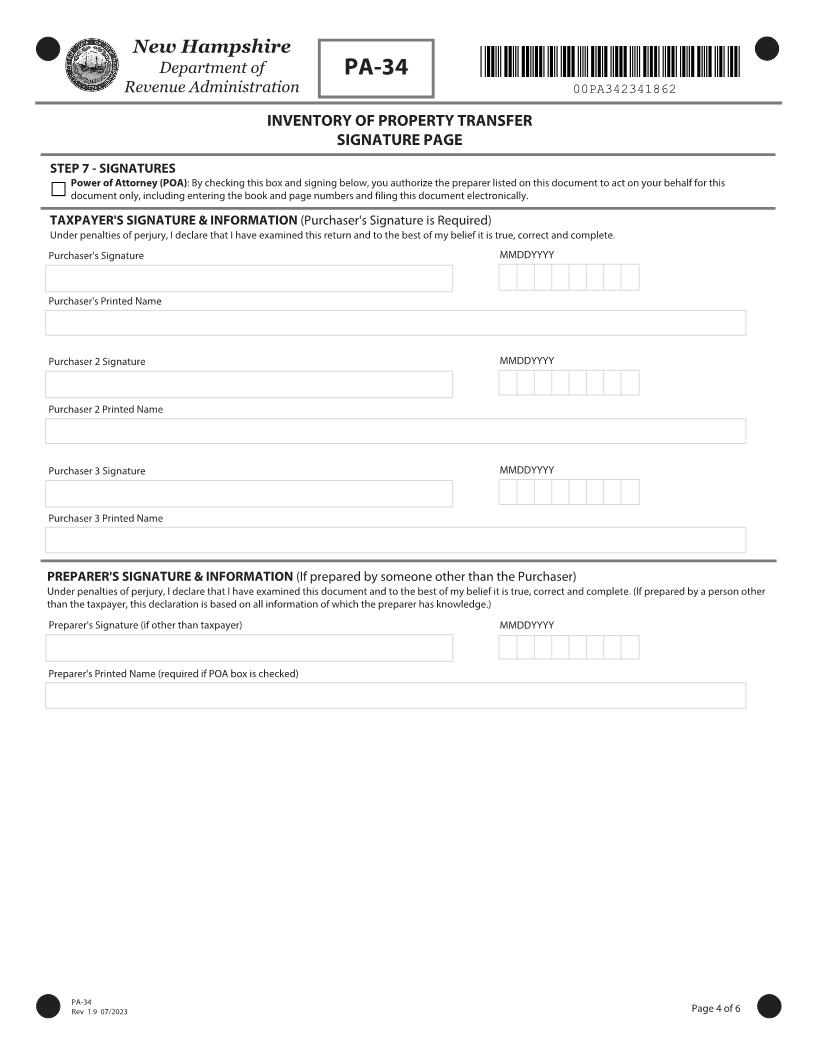

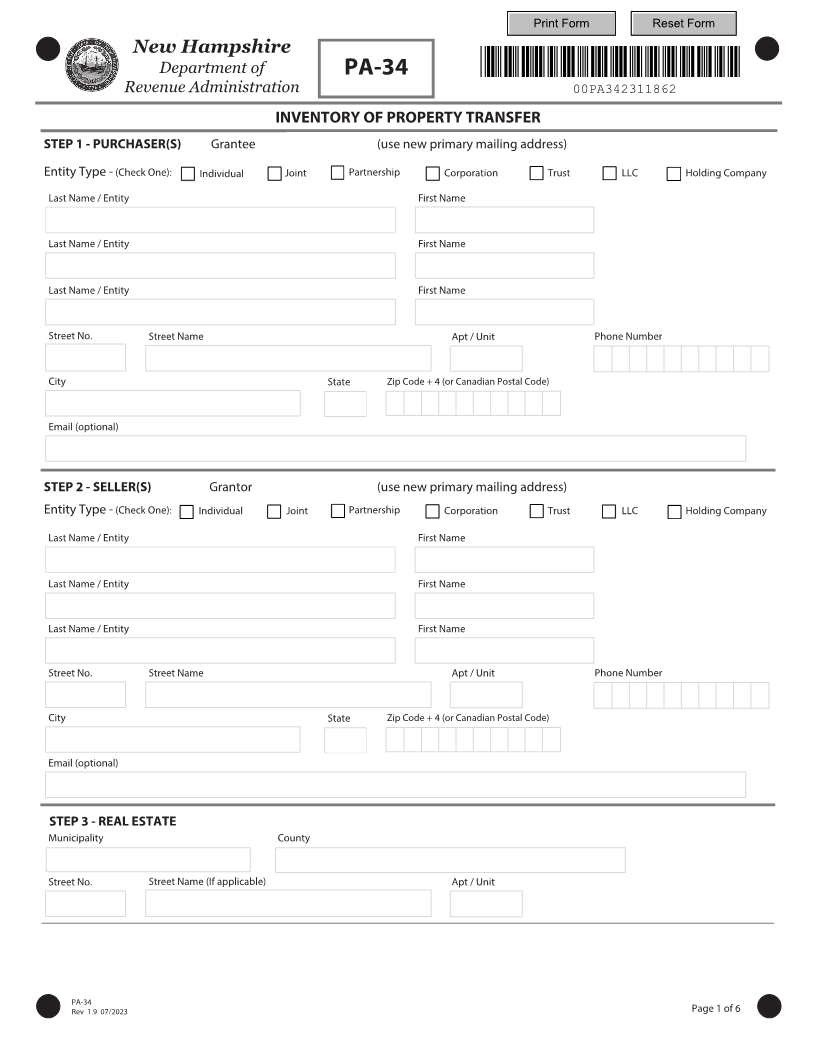

INVENTORY OF PROPERTY TRANSFER

STEP 1 - PURCHASER(S) Grantee (use new primary mailing address)

Entity Type - (Check One): Individual Joint Partnership Corporation Trust LLC Holding Company

Last Name / Entity First Name

Last Name / Entity First Name

Last Name / Entity First Name

Street No. Street Name Apt / Unit Phone Number

City State Zip Code + 4 (or Canadian Postal Code)

Email (optional)

STEP 2 - SELLER(S) Grantor (use new primary mailing address)

Entity Type - (Check One): Individual Joint Partnership Corporation Trust LLC Holding Company

Last Name / Entity First Name

Last Name / Entity First Name

Last Name / Entity First Name

Street No. Street Name Apt / Unit Phone Number

City State Zip Code + 4 (or Canadian Postal Code)

Email (optional)

STEP 3 - REAL ESTATE

Municipality County

Street No. Street Name (If applicable) Apt / Unit

PA-34

Rev 1 .9 7 0 /2023 Page 1 of 6