Enlarge image

Print Form Reset Form

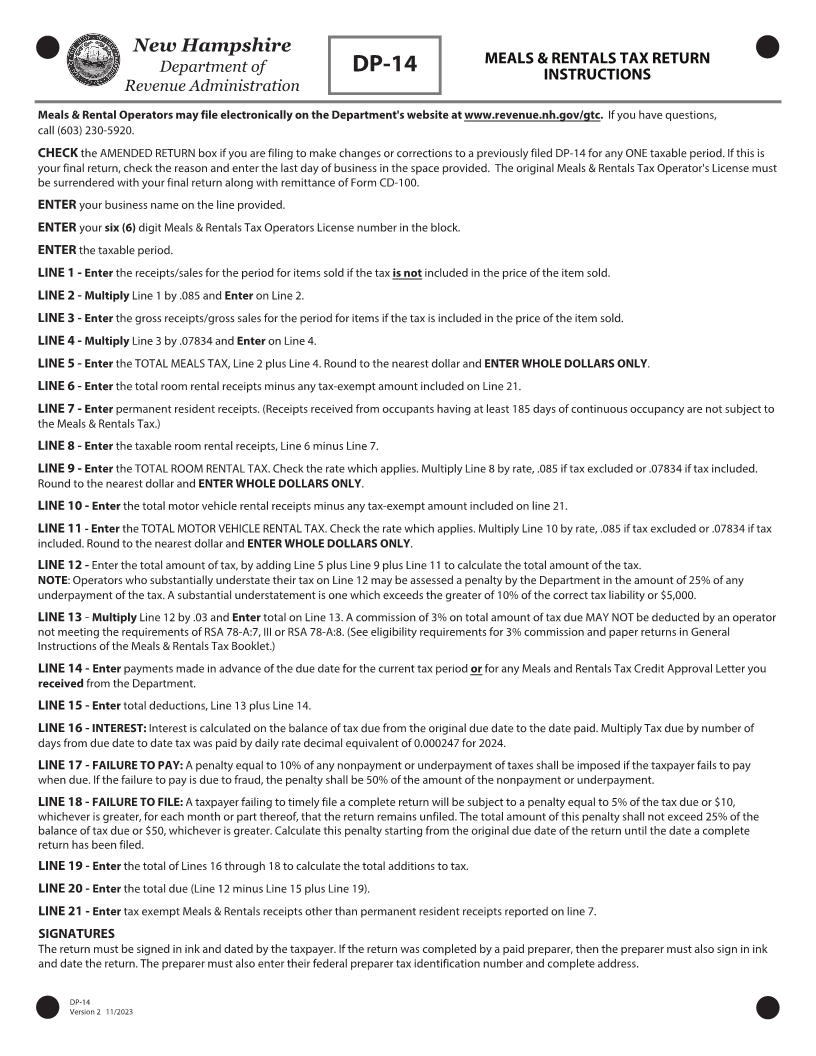

New Hampshire

Department of DP-14 *00DP142311862*

Revenue Administration 00DP142311862

MEALS & RENTALS TAX RETURN Amended Return

Business Name IF THIS IS YOUR FINAL RETURN, FILE FORM CD-100 AND GIVE REASON:

BAILEY PROVISIONS 1 - Business Discontinued Last Day of Business

License Number Tax Period (MMYYYY) 2 - Change in Organization MMDDYYYY

Due on the 15th day of the month

1 2 3 4 5 6 following the close of the tax period. 1 2 2 0 2 3 3 - Business Sold 1 2 1 5 2 0 2 3

1. Tax excluded receipts 1 2 5 5 6 1 Round to the nearest

whole dollar

2. Meals Tax at 8.5% (Multiply Line 1 by .085) 2 2 1 7 3

3. Tax included receipts 3 5 0 0

and Beverages 4. Meals Tax at 7.834% (Multiply Line 3 by .07834) 4 3 9

Receipts From Meals 5. Total Meals Tax (Line 2 plus Line 4) 2 2 1 2

6. Room rental receipts 6 2 0 2 0 2

7. Permanent resident receipts 7 1 0 2 0

8. Taxable room rental receipts (Line 6 minus Line 7) 8 1 9 1 8 2

9. Total room rental tax

(multiply Line 8 by .085 or .07834) Check rate used: .085 .07834 1 6 3 0

10. Motor vehicle rental receipts 10 5 0 0

Receipts From Rentals 11. Total motor vehicle rental tax

(multiply Line 10 by .085 or .07834) Check rate used: .085 .07834 4 3

12. Total tax (Line 5 plus Line 9 plus Line 11) 3 8 8 5

13. Commission (Line 12 multiplied by .03) (See 3% commission eligibility

requirements in General Instructions) 13 6 8

14. Original return payment/credits/estimated payments 14 1 2

Total deductions (Line 13 plus Line 14) 8 0

16. Interest (see instructions) 16 1 3

17. Penalty for failure to pay (see instructions) 17 2 0

18. Penalty for failure to file (see instructions) 18 1 3

Deductions and Additions Total additions (sum of Lines 16, 17, & 18) 4 6

20. Total Due (Line 12 minus Line 15, plus Line 19)

Make checks payable to State of New Hampshire 3 8 5 1

21. Tax exempt meals and rental receipts 2 1 0 1

Under penalties of perjury, I declare that I have examined this return and to the best of my belief it is true, correct and complete. (If prepared by a person other than

the operator, this declaration is based on all information of which the preparer has knowledge.)

Signature (in ink) (Failure to sign may result in assessment of penalties) MMDDYYYY Phone Number

1 0 3 1 2 0 2 3 6 0 3 1 2 3 5 4 5 4

Signature (in ink) Preparer Other Than Operator MMDDYYYY Preparer Address, City, State, Zip

0 3 1 5 1 9 5 1 17 MACDONALD ST

Print Preparer's Name Preparer's Tax ID Number NASHUA NH 01234

4 5 4 4 6 1 4 5 6

DP-14 MAIL TO: NH DRA, TAXPAYER SERVICES, PO BOX 637, CONCORD, NH 03302-0637

Version 2 11 /2023

Enclose, but do not staple or tape your payment with the return