Enlarge image

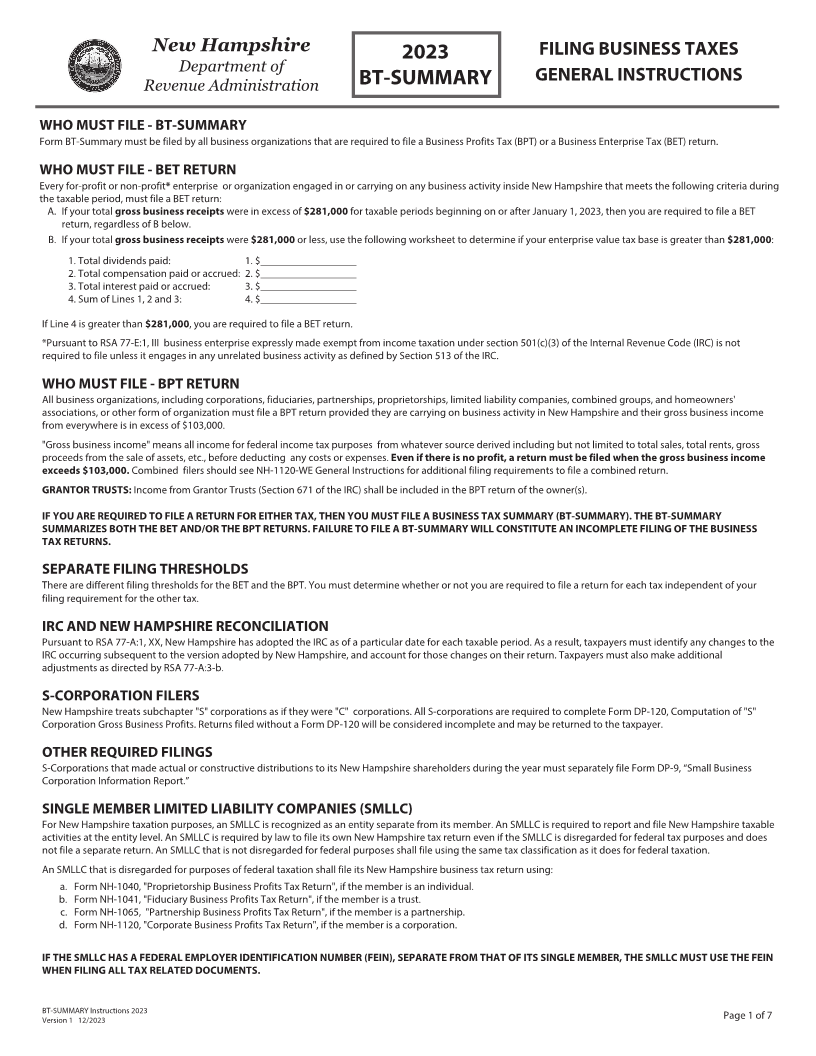

New Hampshire 2023 FILING BUSINESS TAXES

Department of

BT-SUMMARY GENERAL INSTRUCTIONS

Revenue Administration

WHO MUST FILE -BT-SUMMARY

Form BT-Summary must be filed by all business organizations that are required to file a Business Profits Tax (BPT) or a Business Enterprise Tax (BET) return.

WHO MUST FILE -BET RETURN

Every for-profit or non-profit *enterprise or organization engaged in or carrying on any business activity inside New Hampshire that meets the following criteria during

the taxable period, must file a BET return:

A. If your total gross business receipts were in excess of $281,000 for taxable periods beginning on or after January 1, 2023, then you are required to file a BET

return, regardless of B below.

B. If your total gross business receipts were $281,000 or less, use the following worksheet to determine if your enterprise value tax base is greater than $281,000:

1. Total dividends paid: 1. $__________________

2. Total compensation paid or accrued: 2. $__________________

3. Total interest paid or accrued: 3. $__________________

4. Sum of Lines 1, 2 and 3: 4. $__________________

If Line 4 is greater than $281,000, you are required to file a BET return.

*Pursuant to RSA 77-E:1, III business enterprise expressly made exempt from income taxation under section 501(c)(3) of the Internal Revenue Code (IRC) is not

required to file unless it engages in any unrelated business activity as defined by Section 513 of the IRC.

WHO MUST FILE - BPT RETURN

All business organizations, including corporations, fiduciaries, partnerships, proprietorships, limited liability companies, combined groups, and homeowners'

associations, or other form of organization must file a BPT return provided they are carrying on business activity in New Hampshire and their gross business income

from everywhere is in excess of $103,000.

"Gross business income" means all income for federal income tax purposes from whatever source derived including but not limited to total sales, total rents, gross

proceeds from the sale of assets, etc., before deducting any costs or expenses. Even if there is no profit, a return must be filed when the gross business income

exceeds $103,000. Combined filers should see NH-1120-WE General Instructions for additional filing requirements to file a combined return.

GRANTOR TRUSTS: Income from Grantor Trusts (Section 671 of the IRC) shall be included in the BPT return of the owner(s).

IF YOU ARE REQUIRED TO FILE A RETURN FOR EITHER TAX, THEN YOU MUST FILE A BUSINESS TAX SUMMARY (BT-SUMMARY). THE BT-SUMMARY

SUMMARIZES BOTH THE BET AND/OR THE BPT RETURNS. FAILURE TO FILE A BT-SUMMARY WILL CONSTITUTE AN INCOMPLETE FILING OF THE BUSINESS

TAX RETURNS.

SEPARATE FILING THRESHOLDS

There are different filing thresholds for the BET and the BPT. You must determine whether or not you are required to file a return for each tax independent of your

filing requirement for the other tax.

IRC AND NEW HAMPSHIRE RECONCILIATION

Pursuant to RSA 77-A:1, XX, New Hampshire has adopted the IRC as of a particular date for each taxable period. As a result, taxpayers must identify any changes to the

IRC occurring subsequent to the version adopted by New Hampshire, and account for those changes on their return. Taxpayers must also make additional

adjustments as directed by RSA 77-A:3-b.

S-CORPORATION FILERS

New Hampshire treats subchapter "S" corporations as if they were "C" corporations. All S-corporations are required to complete Form DP-120, Computation of "S"

Corporation Gross Business Profits. Returns filed without a Form DP-120 will be considered incomplete and may be returned to the taxpayer.

OTHER REQUIRED FILINGS

S-Corporations that made actual or constructive distributions to its New Hampshire shareholders during the year must separately file Form DP-9, “Small Business

Corporation Information Report.”

SINGLE MEMBER LIMITED LIABILITY COMPANIES (SMLLC)

For New Hampshire taxation purposes, an SMLLC is recognized as an entity separate from its member. An SMLLC is required to report and file New Hampshire taxable

activities at the entity level. An SMLLC is required by law to file its own New Hampshire tax return even if the SMLLC is disregarded for federal tax purposes and does

not file a separate return. An SMLLC that is not disregarded for federal purposes shall file using the same tax classification as it does for federal taxation.

An SMLLC that is disregarded for purposes of federal taxation shall file its New Hampshire business tax return using:

a. Form NH-1040, "Proprietorship Business Profits Tax Return", if the member is an individual.

b. Form NH-1041, "Fiduciary Business Profits Tax Return", if the member is a trust.

c. Form NH-1065, "Partnership Business Profits Tax Return", if the member is a partnership.

d. Form NH-1120, "Corporate Business Profits Tax Return", if the member is a corporation.

IF THE SMLLC HAS A FEDERAL EMPLOYER IDENTIFICATION NUMBER (FEIN), SEPARATE FROM THAT OF ITS SINGLE MEMBER, THE SMLLC MUST USE THE FEIN

WHEN FILING ALL TAX RELATED DOCUMENTS.

BT-SUMMARY Instructions 202 3 Page 1 of 7

Version 1 12 /2023