Enlarge image

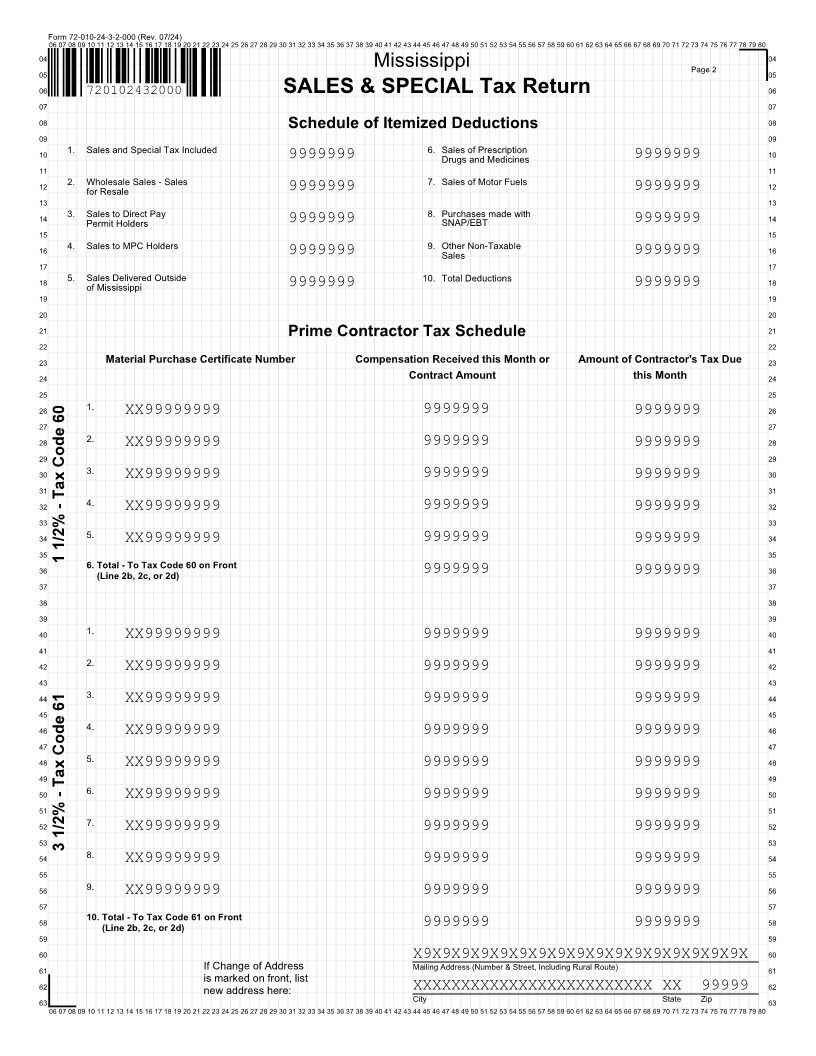

Form 72-010-24-3-1-000 (Rev. 07/24)

06 07 08 09 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 80

04 04

05 Mississippi 05

06 720102431000 SALES & SPECIAL Tax Return 06

07 07

08 08

09 1a. TAX CODE - GENERAL SALES 74 Name: 09

X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9

10 10

11 2a. Gross Income or Sales 9999999 Account ID: 99999999 11

12 12

(From Schedule on Back)

13 3a. Deductions 9999999 Filing Period Ending: MMDDYYYY 13

14 14

15 4a. Taxable Gross Income 15

999999

16 X Close Account X Amended Return X Address Change 16

17 5a. Rate of Tax 7% (See Back) 17

18 TAX SUMMARY 18

19 6a. Tax Calculated * Required Fields 19

To Line 7 999999

20 20

21 *7. Tax Due for Tax Codes 12, 13, 14, 21

15, 28, 30, 56, 59, 65, 70, 73, 74, 83 999999

22 22

23 1b. TAX CODE (FROM TABLE) 99 8. Excess Collections 999999 23

24 24

25 2b. Gross Income or Sales 9999999 *9. Balance (Line 7 plus Line 8) 999999 25

26 26

27 3b. Deductions 10. Discount (2% of Line 9, 27

(From Schedule on Back) 9999999 Limited to $50.00 per Return) 99

28 28

29 4b. Taxable Gross Income 999999 *11. Balance of Tax Due (Line 9 999999 29

minus Line 10)

30 30

31 5b. Rate of Tax (From Table) 9.99% *12. Tax Due for Tax Codes 60, 61, 64, 71, 72, 80 999999 31

32 32

33 6b. Tax Calculated *13. Total Tax Due (Line 11 plus 999999 33

To Line 7, Line 12 or Line 16 999999 Line 12)

34 34

35 14. Tax Credit for Tax Paid on Items 35

Purchased for Resale 999999

36 36

37 1c. TAX CODE (FROM TABLE) *15. Total Sales Tax Due 37

99 (Line 13 minus Line 14) 999999

38 38

39 2c. Gross Income or Sales *16. Special Tax Due 21, 25, 87, 88, 89, 90, 39

9999999 91, 92, 93, 94, 95, 96, 97, 98, 99 999999

40 40

41 3c. Deductions 17. Discount (2% of Line 16, 41

(From Schedule on Back) 9999999 Limited to $50.00 per Return) 99

42 42

43 4c. Taxable Gross Income *18. Balance of Special Tax Due 43

999999 (Line 16 minus Line 17) 999999

44 44

45 5c. Rate of Tax (From Table) 9.99% *19. Total Sales Tax & Special Tax Due (Line 15 plus Line 18) 999999 45

46 46

47 6c. Tax Calculated 20. Penalty 47

To Line 7, Line 12 or Line 16 999999 999999

48 48

49 21. Interest 49

999999

50 50

51 1d. TAX CODE (FROM TABLE) 99 *22. Total Due (Line 19 plus 999999 51

Line 20 plus Line 21)

52 52

53 2d. Gross Income or Sales 9999999 53

54 54

55 3d. Deductions 55

(From Schedule on Back) 9999999

56 This form is only for use starting with the July 2024 period. 56

57 4d. Taxable Gross Income 999999 I declare, under the penalties of perjury, that this return (including any 57

accompanying schedules) has been examined by me and to the best of my

58 knowledge and belief is a true, correct and complete return. 58

59 5d. Rate of Tax (From Table) 59

9.99%

60 60

61 6d. Tax Calculated 999999 Signature of Taxpayer or Agent 61

To Line 7, Line 12 or Line 16

62 62

63 Phone Date 63

06 07 08 09 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 80