Enlarge image

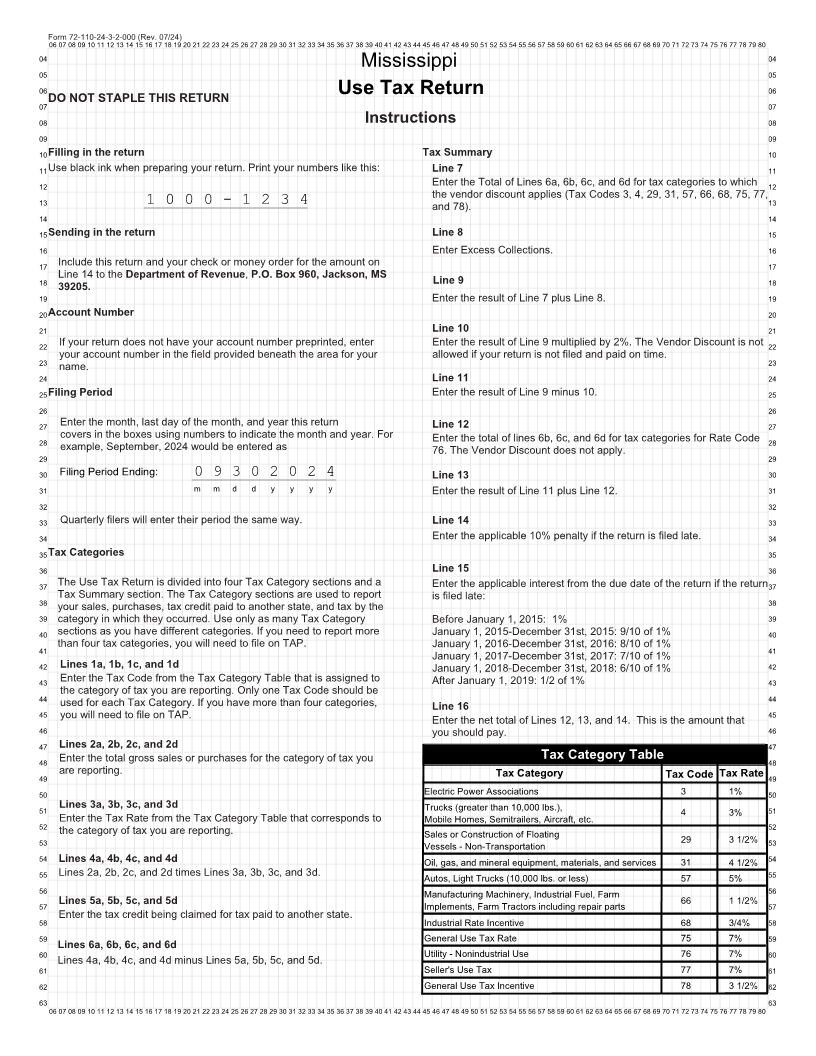

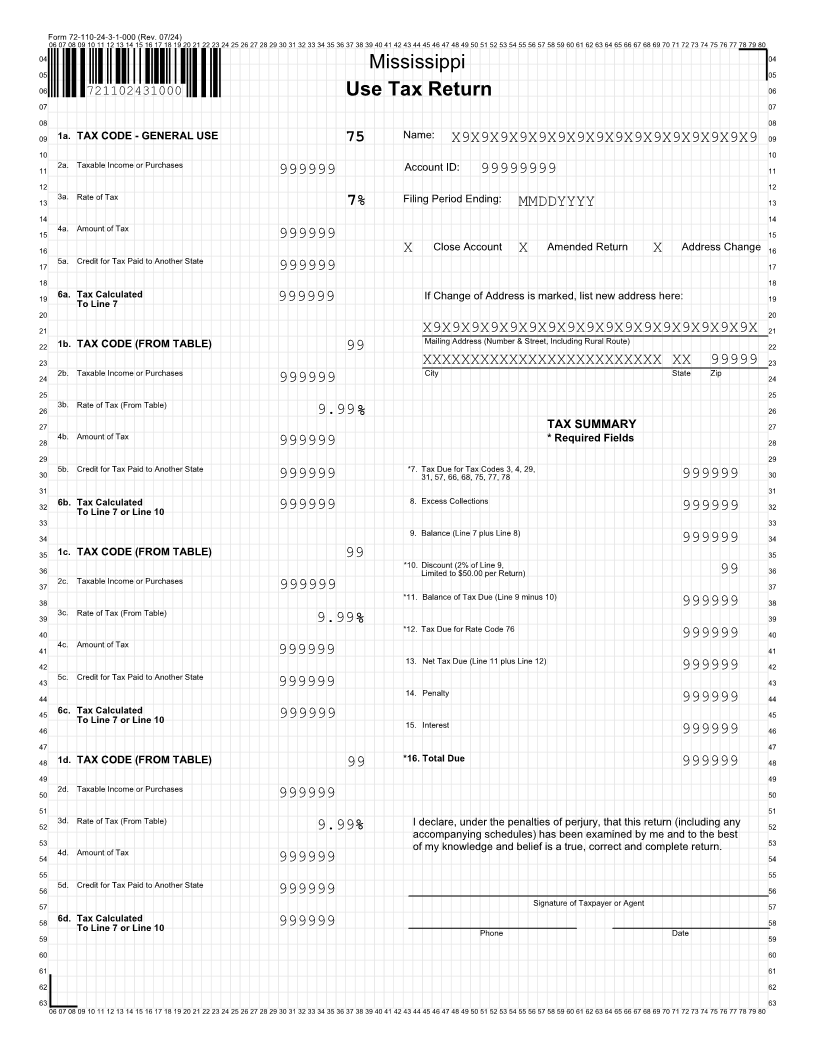

Form 72-110-24-3-1-000 (Rev. 07/24)

06 07 08 09 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 80

04 04

Mississippi

05 05

06 721102431000 Use Tax Return 06

07 07

08 08

09 1a. TAX CODE - GENERAL USE 75 Name: X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9 09

10 10

11 2a. Taxable Income or Purchases 999999 Account ID: 99999999 11

12 12

13 3a. Rate of Tax 7% Filing Period Ending: MMDDYYYY 13

14 14

15 4a. Amount of Tax 15

999999

16 X Close Account X Amended Return X Address Change 16

17 5a. Credit for Tax Paid to Another State 17

999999

18 18

19 6a. Tax Calculated 999999 If Change of Address is marked, list new address here: 19

To Line 7

20 20

21 X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X 21

22 1b. TAX CODE (FROM TABLE) 99 Mailing Address (Number & Street, Including Rural Route) 22

23 XXXXXXXXXXXXXXXXXXXXXXXXX XX 99999 23

24 2b. Taxable Income or Purchases City State Zip 24

999999

25 25

26 3b. Rate of Tax (From Table) 26

9.99 %

27 TAX SUMMARY 27

28 4b. Amount of Tax * Required Fields 28

999999

29 29

30 5b. Credit for Tax Paid to Another State *7. Tax Due for Tax Codes 3, 4, 29, 30

999999 31, 57, 66, 68, 75, 77, 78 999999

31 31

32 6b. Tax Calculated 999999 8. Excess Collections 999999 32

To Line 7 or Line 10

33 33

34 9. Balance (Line 7 plus Line 8) 34

999999

35 1c. TAX CODE (FROM TABLE) 99 35

36 *10. Discount (2% of Line 9, 36

Limited to $50.00 per Return) 99

37 2c. Taxable Income or Purchases 37

999999

38 *11. Balance of Tax Due (Line 9 minus 10) 38

999999

39 3c. Rate of Tax (From Table) 39

40 9.99 % *12. Tax Due for Rate Code 76 40

999999

41 4c. Amount of Tax 41

999999

42 13. Net Tax Due (Line 11 plus Line 12) 42

999999

43 5c. Credit for Tax Paid to Another State 43

999999

44 14. Penalty 44

999999

45 6c. Tax Calculated 45

46 To Line 7 or Line 10 999999 15. Interest 46

999999

47 47

48 1d. TAX CODE (FROM TABLE) 99 *16. Total Due 999999 48

49 49

50 2d. Taxable Income or Purchases 50

999999

51 51

52 3d. Rate of Tax (From Table) I declare, under the penalties of perjury, that this return (including any 52

9.99% accompanying schedules) has been examined by me and to the best

53 4d. Amount of Tax of my knowledge and belief is a true, correct and complete return. 53

54 999999 54

55 55

56 5d. Credit for Tax Paid to Another State 56

999999

57 Signature of Taxpayer or Agent 57

58 6d. Tax Calculated 58

59 To Line 7 or Line 10 999999 Phone Date 59

60 60

61 61

62 62

63 63

06 07 08 09 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 80