Enlarge image

New Hampshire

Department of TY2024 - LETTER OF INTENT (LOI) Print Form

TO PRODUCE SUBSTITUTE OR REPRODUCED FORMS

Revenue Administration

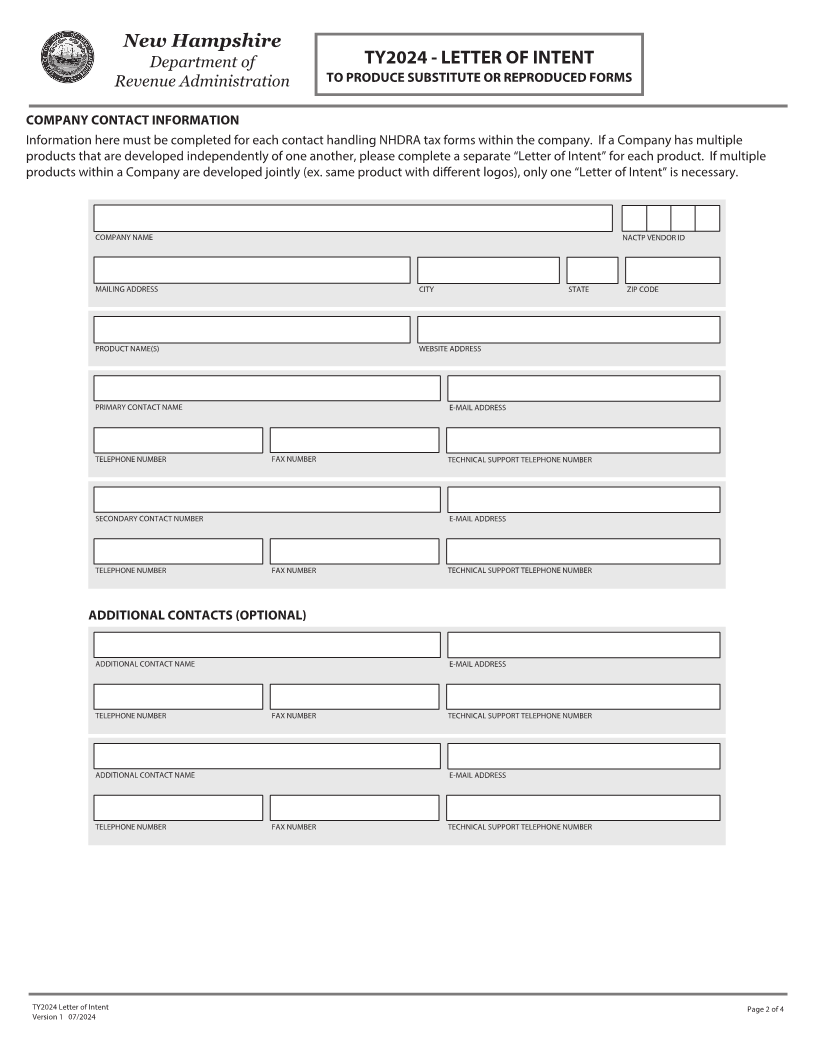

COMPANY NAME DBA NAME

agrees to abide by the New Hampshire Department of Revenue Administration (NHDRA) requirements for substituting or

reproducing TY202 4forms, as follows:

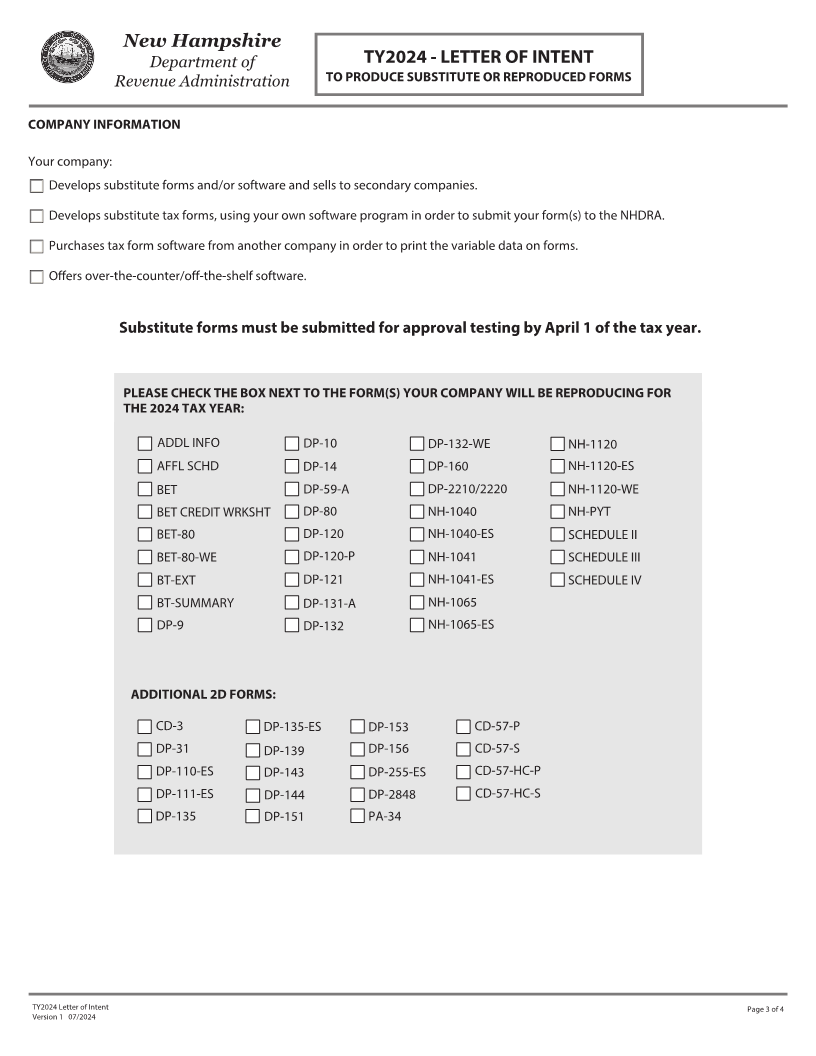

Companies or individuals who develop substitute tax forms or products shall follow the NHDRA's established guidelines

established in “General Instructions and Requirements for Reproducing New Hampshire Tax Forms – TY202 ,"4including but not

limited to, the following:

2D barcodes are mandated on all forms substituting or reproducing official forms that require 2D barcodes. In addition, all

1D barcodes must be reproduced as a "Code 39 Barcode."

Companies or individuals shall be able to print a banner on all affected “returns/voucher” forms, where incorrect variable data

has been entered in a format other than what was specified by the NHDRA. The banner must be in 18pt font, bold, and be

printed on the return/voucher to alert the user that incorrectly formatted data has been entered. The NHDRA recommends

using: “INCOMPLETE DATA: DO NOT FILE.” This banner is to allow the NHDRA to readily identify these forms.

Do not sell, release, license, or distribute tax packages to customers or clients prior to receiving approval for each tax form

included in the package. Un-approved and/or non-submitted forms are not to be included in the release of any software

package.

Notify customers/clients of the computer hardware requirements, including printers, printer fonts, font cartridges, specialty

fonts, etc., necessary to produce your company’s scannable/substitute tax forms that were approved by the NHDRA. Notify the

NHDRA and your customers/clients immediately if computation errors or other variable data errors are found.

Promptly correct errors in the company’s products and substitute tax forms. Provide the NHDRA with written proof(s) showing

the company has corrected all the errors and has notified customers/clients of the corrections.

Authorize the NHDRA to include the name of your company in various public information materials designed to inform the

public and practitioners about software developers who have agreed, complied or failed to comply with the specifications for

reproducing tax forms.

Failure to meet these requirements may result in your company being removed as an approved software vendor. All

returns submitted using your products will be rejected.

Check this box if this is an amended LOI.

Reason for amendment:

SIGNATURE TITLE DATE

Please submit the completed LOI, to E-FormsDevelopment@dra.nh.gov,no later than November 1 ,5202 . 4

Your substitute forms will not be tested until the LOI is received.

For any general questions about this LOI, please contact Britni Amrol at E-FormsDevelopment@dra.nh.gov.

TY2024 Letter of I ntent Page 1 of 4

Version 1 7 0 /2024