Enlarge image

2024 Idaho Substitute Forms

Specifications

October 2024

tax.idaho.gov

Enlarge image |

2024 Idaho Substitute Forms

Specifications

October 2024

tax.idaho.gov

|

Enlarge image |

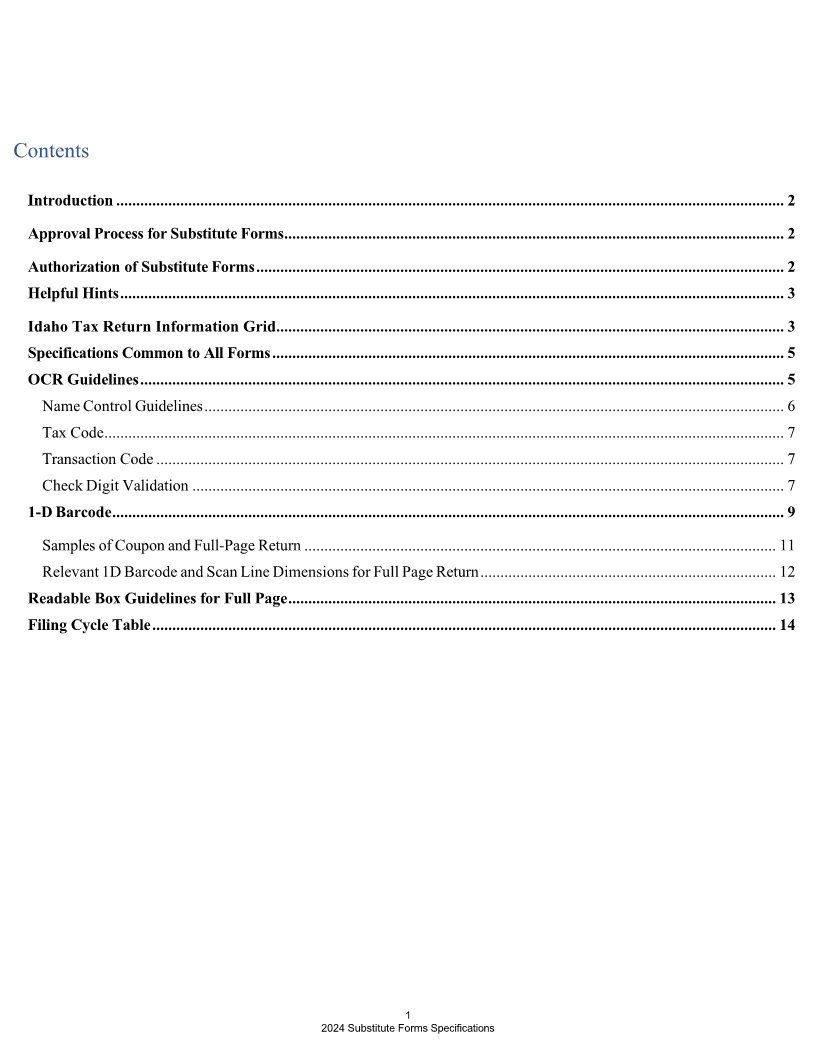

Contents

Introduction ....................................................................................................................................................................... 2

Approval Process for Substitute Forms ............................................................................................................................. 2

Authorization of Substitute Forms .................................................................................................................................... 2

Helpful Hints ...................................................................................................................................................................... 3

Idaho Tax Return Information Grid ............................................................................................................................... 3

Specifications Common to All Forms ................................................................................................................................ 5

OCR Guidelines ................................................................................................................................................................. 5

Name Control Guidelines ................................................................................................................................................. 6

Tax Code .......................................................................................................................................................................... 7

Transaction Code ............................................................................................................................................................. 7

Check Digit Validation .................................................................................................................................................... 7

1‐D Barcode ........................................................................................................................................................................ 9

Samples of Coupon and Full‐Page Return ...................................................................................................................... 11

Relevant 1D Barcode and Scan Line Dimensions for Full Page Return .......................................................................... 12

Readable Box Guidelines for Full Page .......................................................................................................................... 13

Filing Cycle Table ............................................................................................................................................................ 14

1

2024 Substitute Forms Specifications

|

Enlarge image |

Introduction

The Idaho State Tax Commission (ISTC) accepts substitute or reproduced tax forms. These forms must meet

the requirements of ISTC’s original forms. ISTC has established these guidelines and standards for software

partners or any other individual or business that plans to market, distribute, or file substitute or reproduced tax

forms.

Approval Process for Substitute Forms

A company that develops any substitute form must obtain approval from ISTC before releasing or

distributing the substitute form to its customers or clients. Any changes to the form by the developer after the

original approval must be resubmitted for additional approval.

Initial and all subsequent Substitute Document test submissions must include the complete set of submissions that

have not yet been authorized. We would like a full submission but contact us first if you need to request a partial

submission.

The review process begins with a visual verification of all scan lines, data fields, and barcode validation, to

identify layout errors. The final step is completed by processing substitute documents in imaging equipment

for optical character recognition (OCR) and system validation.

Developers receive notification of results within an average of 10 business days. After review, the returns are

emailed with an approval or notice of required changes.

All income tax forms that need approval must be submitted by December 1, 2024, and authorized by January

31, 2025. Permits receive approval as required.

When emailing multiple forms for approval, please separate the submissions between Individual Income Tax

Forms and Business Income Tax Forms. In addition, please indicate in the subject line of the email if the

attached forms are an initial submission or a resubmission.

Submission of One Data-Filled Income Tax Scenarios Per Form Type:

Submit one sample copy of each form for approval; this sample copy must contain variable data in all possible

locations and positions on each form.

Submission of Two Data-Filled Voucher Scenarios Per Form Type:

When creating voucher substitute documents for submission, use the data in the Voucher Forms Test Pack to

populate the data on the form and to create the corresponding scan line for each form. Test packets are located

on the State Exchange System (SES) in tax year 2024.

Authorization of Substitute Forms

The Tax Commission will verify accuracy of line references, data dots, lines, check boxes, and any

reference to percentages. The Tax Commission will check the revision dates, header of the returns, form

name, year, and barcodes for accuracy.

Authorization of substitute document will be contingent on:

• Scan lines matching the test-plan scenarios.

• Forms that meet the specifications listed in this document.

2

2024 Substitute Forms Specifications

|

Enlarge image |

Substitute forms will not be accepted by fax. Submit all substitute income tax forms in PDF format to:

substituteforms@tax.idaho.gov

Helpful Hints

• Substitute forms must contain all current data elements included on the state-provided form.

• Substitute forms must be proofread prior to submission to the state.

• Do not print EINs, SSNs, or copyright information on the top or bottom of the forms.

• Substitute forms must include your NACTP vendor ID number and the form version date. Place the

NACTP vendor ID above the year of the tax form.

• For a comprehensive review of NACTP standards, please visit (http://www.nactp.org/).

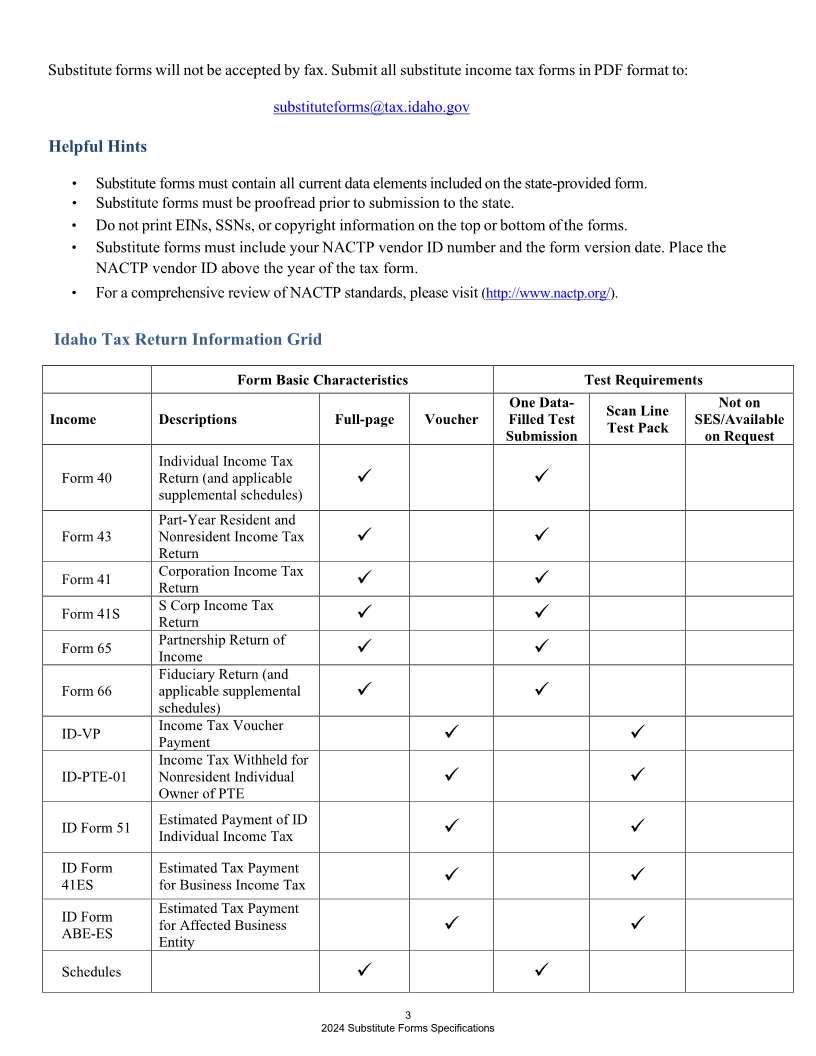

Idaho Tax Return Information Grid

Form Basic Characteristics Test Requirements

One Data- Not on

Scan Line

Income Descriptions Full-page Voucher Filled Test SES/Available

Test Pack

Submission on Request

Individual Income Tax

Form 40 Return (and applicable

supplemental schedules)

Part-Year Resident and

Form 43 Nonresident Income Tax

Return

Corporation Income Tax

Form 41

Return

S Corp Income Tax

Form 41S

Return

Partnership Return of

Form 65

Income

Fiduciary Return (and

Form 66 applicable supplemental

schedules)

Income Tax Voucher

ID-VP

Payment

Income Tax Withheld for

ID-PTE-01 Nonresident Individual

Owner of PTE

Estimated Payment of ID

ID Form 51

Individual Income Tax

ID Form Estimated Tax Payment

41ES for Business Income Tax

Estimated Tax Payment

ID Form

for Affected Business

ABE-ES

Entity

Schedules

3

2024 Substitute Forms Specifications

|

Enlarge image |

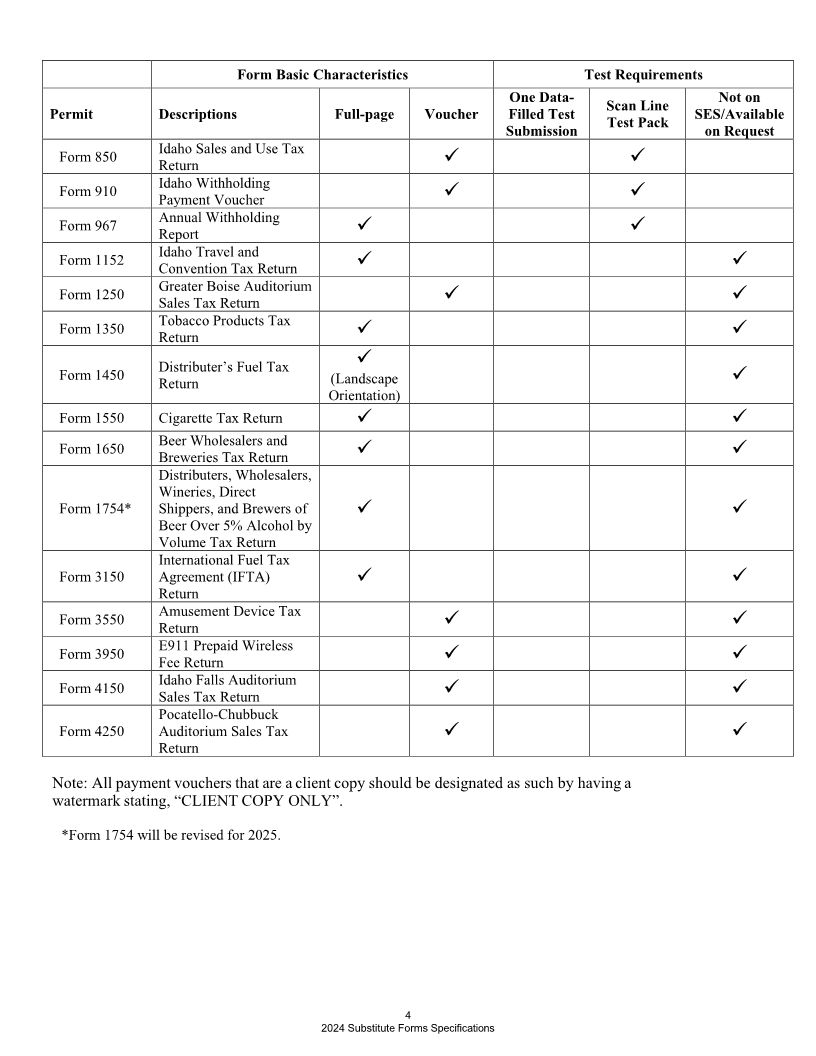

Form Basic Characteristics Test Requirements

One Data- Not on

Scan Line

Permit Descriptions Full-page Voucher Filled Test SES/Available

Test Pack

Submission on Request

Idaho Sales and Use Tax

Form 850

Return

Idaho Withholding

Form 910

Payment Voucher

Annual Withholding

Form 967

Report

Idaho Travel and

Form 1152

Convention Tax Return

Greater Boise Auditorium

Form 1250

Sales Tax Return

Tobacco Products Tax

Form 1350

Return

Distributer’s Fuel Tax

Form 1450 (Landscape

Return

Orientation)

Form 1550 Cigarette Tax Return

Beer Wholesalers and

Form 1650

Breweries Tax Return

Distributers, Wholesalers,

Wineries, Direct

Form 1754* Shippers, and Brewers of

Beer Over 5% Alcohol by

Volume Tax Return

International Fuel Tax

Form 3150 Agreement (IFTA)

Return

Amusement Device Tax

Form 3550

Return

E911 Prepaid Wireless

Form 3950

Fee Return

Idaho Falls Auditorium

Form 4150

Sales Tax Return

Pocatello-Chubbuck

Form 4250 Auditorium Sales Tax

Return

Note: All payment vouchers that are a client copy should be designated as such by having a

watermark stating, “CLIENT COPY ONLY”.

*Form 1754 will be revised for 2025.

4

2024 Substitute Forms Specifications

|

Enlarge image |

Specifications Common to All Forms

Margins

Margins on substitute returns should be the same as on the official Tax Commission return.

Shading

Some official Tax Commission returns contain shading. Please include shading where shown on the Tax

Commission generated returns.

Form Fonts

All substitute returns should be printed in a font that closely resembles the font used on the original return. In the

case of scan line reproductions, these must follow the exact font and sizing specifications listed below.

Data Dots and Line Numbers

Data dots and line numbers are essential codes to the Tax Commission’s returns processing system.

All substitute tax returns must include these symbols and line numbers.

Scannable Returns

Tax Commission full-page tax returns are optically read on high-speed scanners. All optically scanned full-page

returns have a large box for tax due/refund amounts. All characters and numbers must be centered within

each box.

OCR Guidelines

OCR Scan line

All vouchers contain an OCR scan line on the lower right of the return. Permit full-page returns contain a scan

line on the lower left.

The OCR scan line must be OCR-A 12-Pitch (12 characters per inch – fixed print). The Idaho

State Tax Commission uses OCR Extended font. It must also contain the following information in

the following order:

Seg. 1 Seg. 2 Seg. 3 Seg. 4 Seg. 5 Seg. 6 Seg. 7 Seg. 8

Scan Line Segments: 123456789 000000000 NNNN 01 1223 A 95 0

Segment Description Individual Business Permit Digits Format

income tax income tax

1 Taxpayer SSN EIN or ID EIN or SSN 9 EIN: 123456789

Identification License SSN: 123456789

nd

2 2 Taxpayer Spouse SSN Repeat EIN or ID ID Permit or 9 EIN: 123456789

Identification (TIN) or 9 zeros Permit or 9 zeros SSN: 123456789

9 zeros Zeros: 000000000

Permit #: 000001234

3 Name Control See Name See Name See Name 4 NNNN

Control Control Control

Guidelines Guidelines Guidelines

4 Tax Code 01 05 Access link for 2 ##

Tax Code list

5

2024 Substitute Forms Specifications

|

Enlarge image |

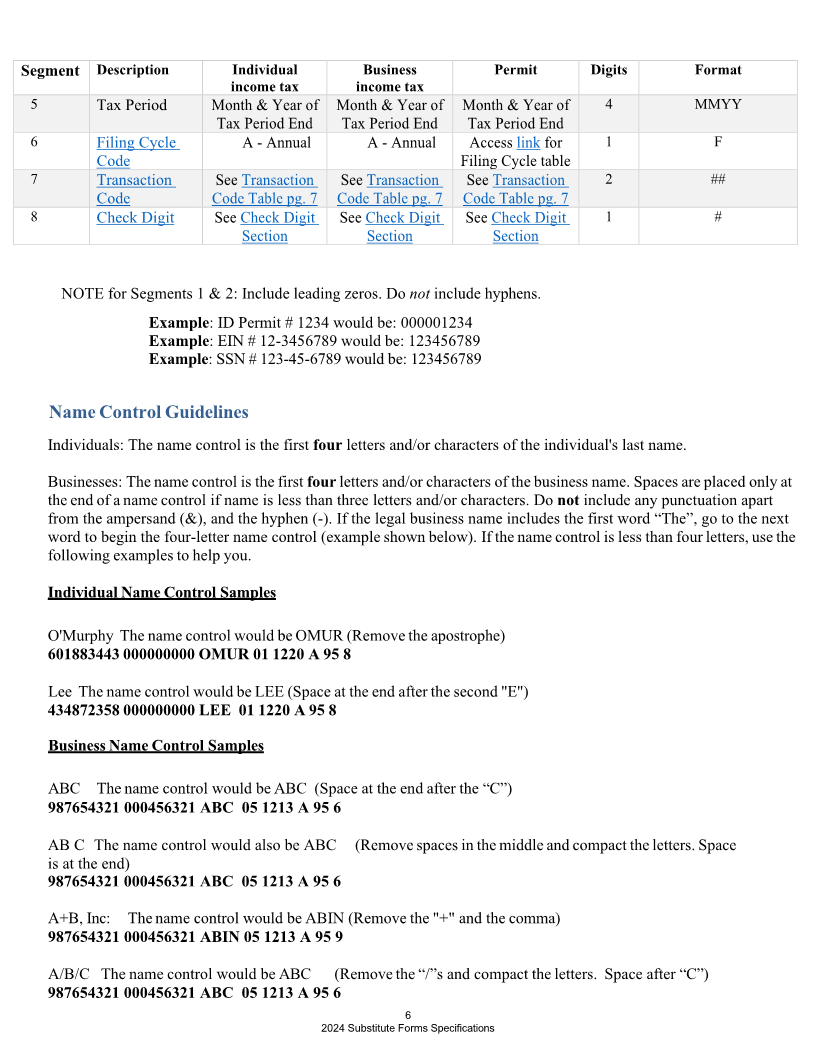

Segment Description Individual Business Permit Digits Format

income tax income tax

5 Tax Period Month & Year of Month & Year of Month & Year of 4 MMYY

Tax Period End Tax Period End Tax Period End

6 Filing Cycle A - Annual A - Annual Access link for 1 F

Code Filing Cycle table

7 Transaction See Transaction See Transaction See Transaction 2 ##

Code Code Table pg. 7 Code Table pg. 7 Code Table pg. 7

8 Check Digit See Check Digit See Check Digit See Check Digit 1 #

Section Section Section

NOTE for Segments 1 & 2: Include leading zeros. Do not include hyphens.

Example: ID Permit # 1234 would be: 000001234

Example: EIN # 12-3456789 would be: 123456789

Example: SSN # 123-45-6789 would be: 123456789

Name Control Guidelines

Individuals: The name control is the first four letters and/or characters of the individual's last name.

Businesses: The name control is the first four letters and/or characters of the business name. Spaces are placed only at

the end of a name control if name is less than three letters and/or characters. Do not include any punctuation apart

from the ampersand (&), and the hyphen (-). If the legal business name includes the first word “The”, go to the next

word to begin the four-letter name control (example shown below). If the name control is less than four letters, use the

following examples to help you.

Individual Name Control Samples

O'Murphy The name control would be OMUR (Remove the apostrophe)

601883443 000000000 OMUR 01 1220 A 95 8

Lee The name control would be LEE (Space at the end after the second "E")

434872358 000000000 LEE 01 1220 A 95 8

Business Name Control Samples

ABC The name control would be ABC (Space at the end after the “C”)

987654321 000456321 ABC 05 1213 A 95 6

AB C The name control would also be ABC (Remove spaces in the middle and compact the letters. Space

is at the end)

987654321 000456321 ABC 05 1213 A 95 6

A+B, Inc: The name control would be ABIN (Remove the "+" and the comma)

987654321 000456321 ABIN 05 1213 A 95 9

A/B/C The name control would be ABC (Remove the “/”s and compact the letters. Space after “C”)

987654321 000456321 ABC 05 1213 A 95 6

6

2024 Substitute Forms Specifications

|

Enlarge image |

A/B/C Company The name control would be ABCC (Remove the “/”s and compact the letters)

987654321 000456321 ABCC 05 1213 A 95 0

John Doe Inc. (Business): The name control would be JOHN

987654321 000456321 JOHN 05 1213 A 95 1

The ABC Company: The name control would be ABCC (Disregard “The” as part of the name control)

987654321 000456321 ABCC 05 1213 A 95 0

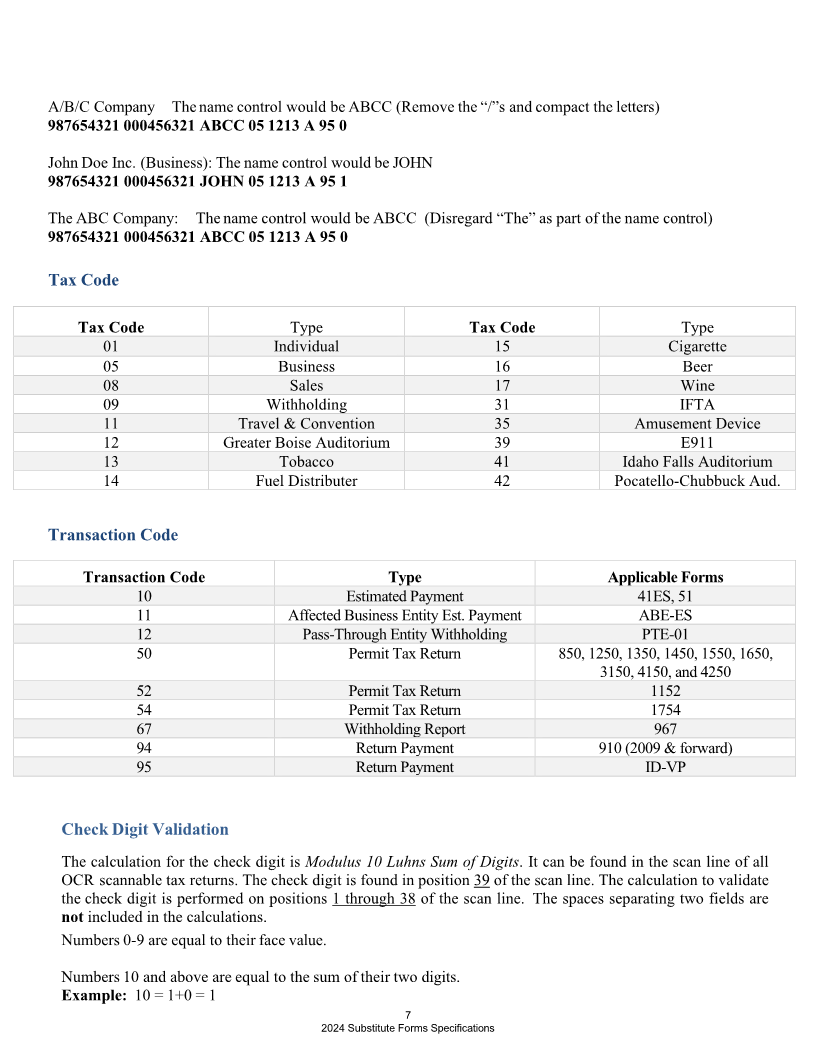

Tax Code

Tax Code Type Tax Code Type

01 Individual 15 Cigarette

05 Business 16 Beer

08 Sales 17 Wine

09 Withholding 31 IFTA

11 Travel & Convention 35 Amusement Device

12 Greater Boise Auditorium 39 E911

13 Tobacco 41 Idaho Falls Auditorium

14 Fuel Distributer 42 Pocatello-Chubbuck Aud.

Transaction Code

Transaction Code Type Applicable Forms

10 Estimated Payment 41ES, 51

11 Affected Business Entity Est. Payment ABE-ES

12 Pass-Through Entity Withholding PTE-01

50 Permit Tax Return 850, 1250, 1350, 1450, 1550, 1650,

3150, 4150, and 4250

52 Permit Tax Return 1152

54 Permit Tax Return 1754

67 Withholding Report 967

94 Return Payment 910 (2009 & forward)

95 Return Payment ID-VP

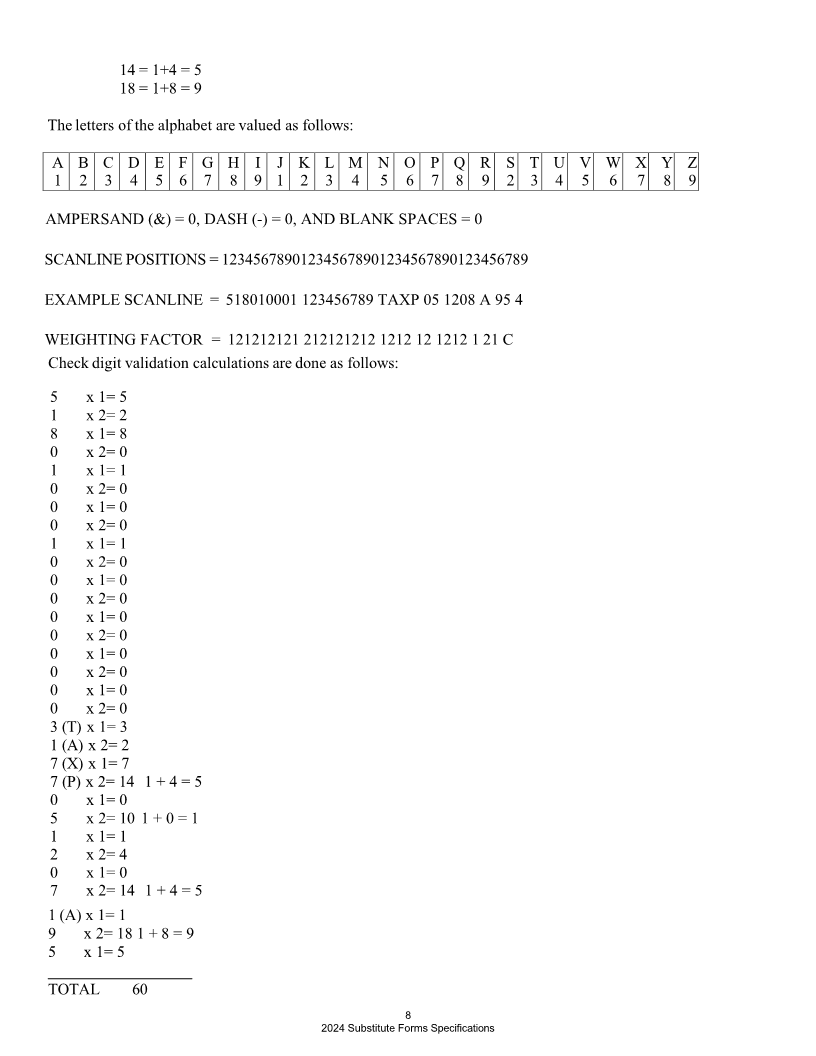

Check Digit Validation

The calculation for the check digit is Modulus 10 Luhns Sum of Digits. It can be found in the scan line of all

OCR scannable tax returns. The check digit is found in position 39 of the scan line. The calculation to validate

the check digit is performed on positions 1 through 38 of the scan line. The spaces separating two fields are

not included in the calculations.

Numbers 0-9 are equal to their face value.

Numbers 10 and above are equal to the sum of their two digits.

Example: 10 = 1+0 = 1

7

2024 Substitute Forms Specifications

|

Enlarge image |

14 = 1+4 = 5

18 = 1+8 = 9

The letters of the alphabet are valued as follows:

A B C D E F G H I J K L M N O P Q R S T U V W X Y Z

1 2 3 4 5 6 7 8 9 1 2 3 4 5 6 7 8 9 2 3 4 5 6 7 8 9

AMPERSAND (&) = 0, DASH ( ) = 0,-AND BLANK SPACES = 0

SCANLINE POSITIONS = 123456789012345678901234567890123456789

EXAMPLE SCANLINE = 518010001 123456789 TAXP 05 1208 A 95 4

WEIGHTING FACTOR = 121212121 212121212 1212 12 1212 1 21 C

Check digit validation calculations are done as follows:

5 x 1= 5

1 x 2= 2

8 x 1= 8

0 x 2= 0

1 x 1= 1

0 x 2= 0

0 x 1= 0

0 x 2= 0

1 x 1= 1

0 x 2= 0

0 x 1= 0

0 x 2= 0

0 x 1= 0

0 x 2= 0

0 x 1= 0

0 x 2= 0

0 x 1= 0

0 x 2= 0

3 (T) x 1= 3

1 (A) x 2= 2

7 (X) x 1= 7

7 (P) x 2= 14 1 + 4 = 5

0 x 1= 0

5 x 2= 10 1 + 0 = 1

1 x 1= 1

2 x 2= 4

0 x 1= 0

7 x 2= 14 1 + 4 = 5

1 (A) x 1= 1

9 x 2= 18 1 + 8 = 9

5 x 1= 5

TOTAL 60

8

2024 Substitute Forms Specifications

|

Enlarge image |

1. Sum of the digits. The sum in this example equals 60.

2. Divide the sum by 10. 60/10 = 6 with a remainder of 0.

3. Subtract the remainder from 10. 10 - 0 = 10.

4. The check digit equals 0.

Note:

The "C" used in the example of weighting factor on the previous page designates the location of the check digit.

It has no other purpose.

Note:

If the remainder is equal to zero, the check digit is 0.

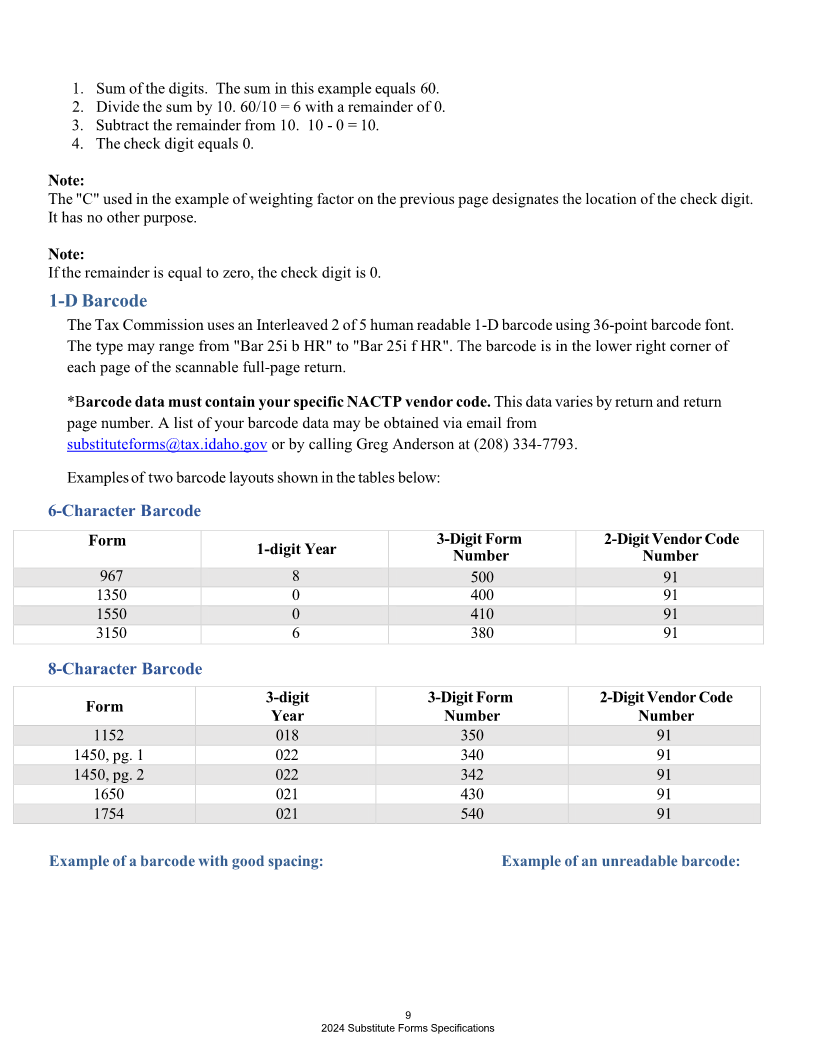

1‐D Barcode

The Tax Commission uses an Interleaved 2 of 5 human readable 1-D barcode using 36-point barcode font.

The type may range from "Bar 25i b HR" to "Bar 25i f HR". The barcode is in the lower right corner of

each page of the scannable full-page return.

*Barcode data must contain your specific NACTP vendor code. This data varies by return and return

page number. A list of your barcode data may be obtained via email from

substituteforms@tax.idaho.gov or by calling Greg Anderson at (208) 334-7793.

Examples of two barcode layouts shown in the tables below:

6-Character Barcode

Form 3-Digit Form 2-Digit Vendor Code

1-digit Year Number Number

967 8 500 91

1350 0 400 91

1550 0 410 91

3150 6 380 91

8-Character Barcode

3-digit 3-Digit Form 2-Digit Vendor Code

Form

Year Number Number

1152 018 350 91

1450, pg. 1 022 340 91

1450, pg. 2 022 342 91

1650 021 430 91

1754 021 540 91

Example of a barcode with good spacing: Example of an unreadable barcode:

9

2024 Substitute Forms Specifications

|

Enlarge image | 10 2024 Substitute Forms Specifications |

Enlarge image |

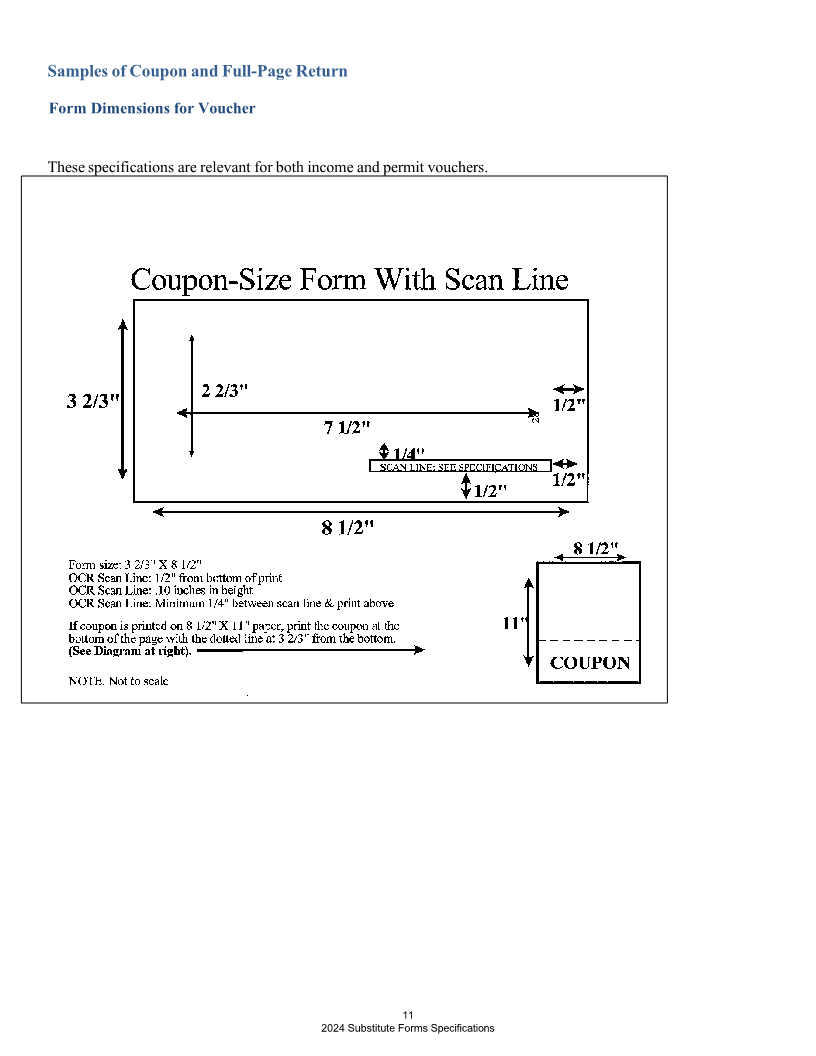

Samples of Coupon and Full‐Page Return

Form Dimensions for Voucher

These specifications are relevant for both income and permit vouchers.

11

2024 Substitute Forms Specifications

|

Enlarge image |

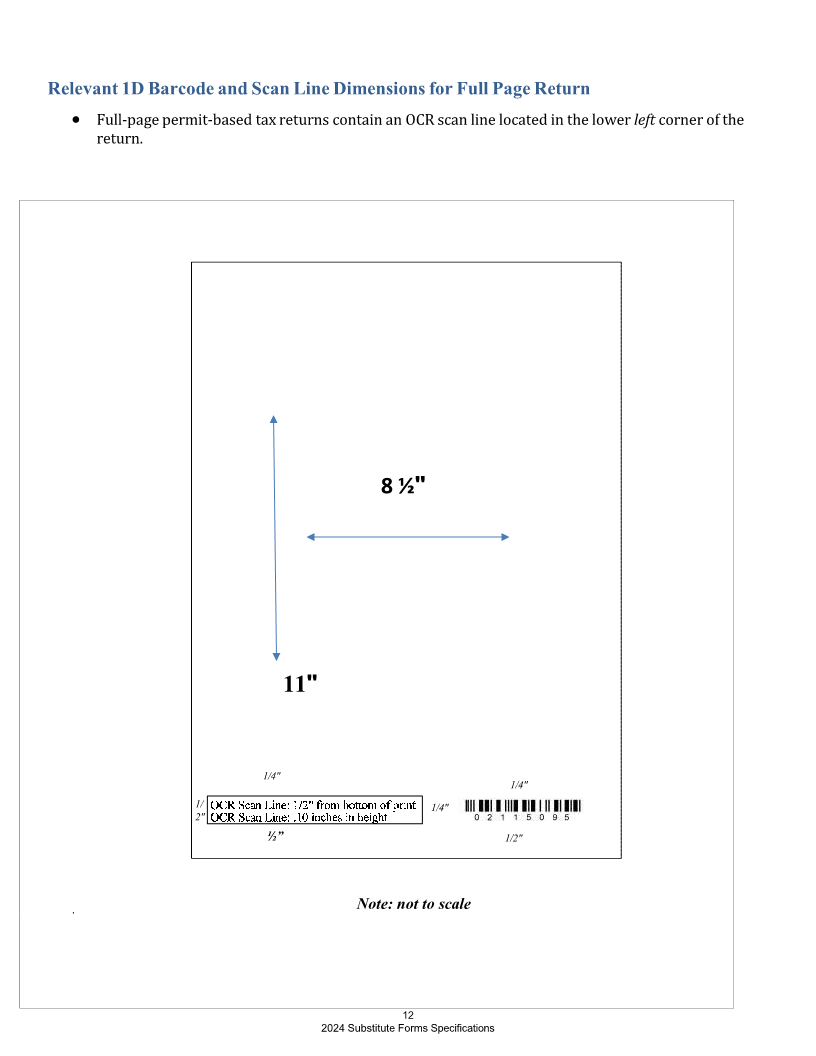

Relevant 1D Barcode and Scan Line Dimensions for Full Page Return

• left

Full-page permit-based tax returns contain an OCR scan line located in the lower corner of the

return.

8 ½"

11"

1/4"

1/4"

1/ 1/4"

2"

½” 1/2"

Note: not to scale

12

2024 Substitute Forms Specifications

|

Enlarge image |

Readable Box Guidelines for Full Page

Examples of ‘box’ data:

• Amended return

• State Use Only – Use Name Control Guidelines for this box

• SSN or EIN

• Tax Due

• Refund

• Tax Period (box at the end of the tax period ending date) - Enter the tax period ending

date in the MMYY format. For example, “06/30/25” would be 0625.

NOTE: Developers must fill these in with the appropriate data on a completed return.

The placement of boxes on substitute scannable returns must be placed and measured exactly as

shown on the original return. In order to achieve a successful read in these fields, here are some guidelines when

creating these boxes:

Numbers in the boxes and the amended indicator must be centered. Do not left or right justify. The fields

containing data should be larger than the other fields. Smaller fields are more difficult to scan and read. For

example, the Amended Return box below is too small to be scanned. In the scenario below, the Amended Return

box should be at least twice the size shown.

Generally, the OCR data should fit comfortably within the lines of the box. Below is an example of a box that’s

too small in relation to the font size:

When typing information into OCR fields, avoid inserting data near the borders of the field. The following data

is typed too close to the bottom border:

Another common error is using a negative sign or parentheses to represent a refund within the OCR Refund

Field. A positive number is what is expected, and the extra characters are misread by our scanner. For

example, the opening parenthesis in the following example is read as a numerical value of “1”.

13

2024 Substitute Forms Specifications

|

Enlarge image |

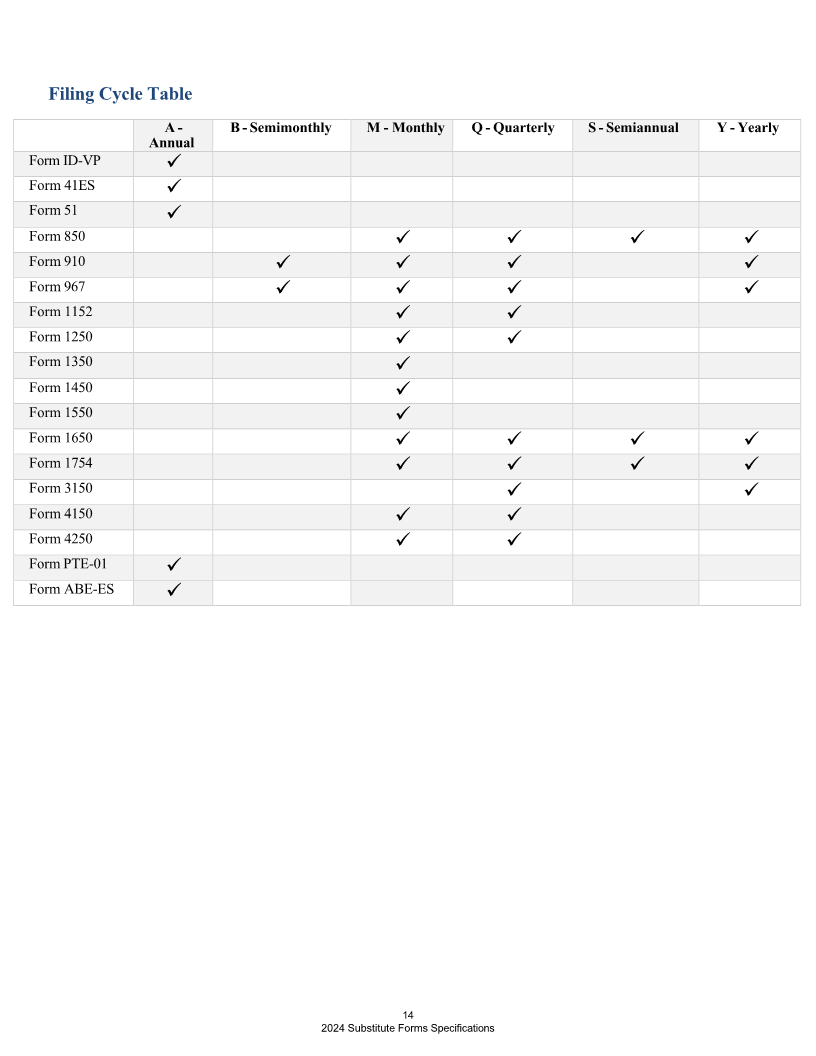

Filing Cycle Table

A - B - Semimonthly M - Monthly Q - Quarterly S - Semiannual Y - Yearly

Annual

Form ID-VP

Form 41ES

Form 51

Form 850

Form 910

Form 967

Form 1152

Form 1250

Form 1350

Form 1450

Form 1550

Form 1650

Form 1754

Form 3150

Form 4150

Form 4250

Form PTE-01

Form ABE-ES

14

2024 Substitute Forms Specifications

|