- 7 -

Enlarge image

|

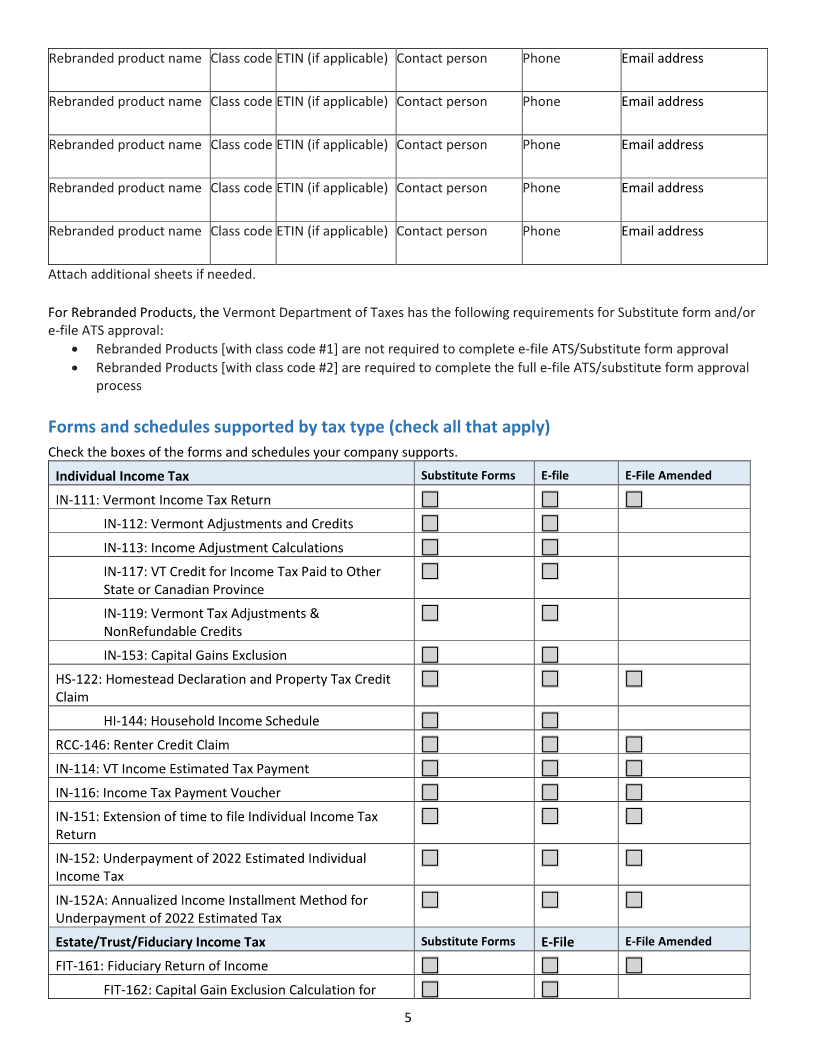

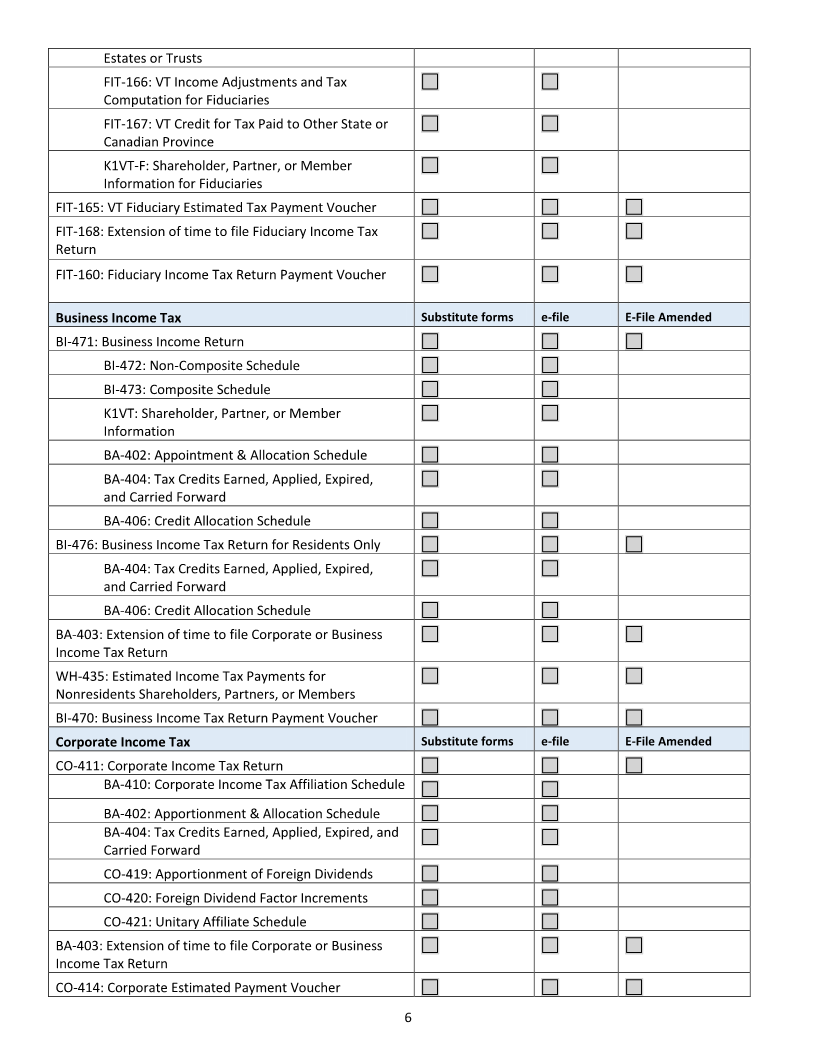

CO-422: Corporate Income Tax Return Payment Voucher

Substitute forms e-file E-File Amended

MRT-441: Meals and Rooms Tax Return

REF-620: Application for Refund of VT Sales & Use or

Meals & Rooms Tax

SUT-451: Sales and Use Tax Return

WHT-430: Withholding Tax Payment

WHT-434: Annual Withholding Reconciliation

WHT-436: Quarterly Withholding Reconciliation

Electronic amended returns

Vermont Department of Taxes requests you support electronic amended returns for those available through MeF.

Agency requirements

This section identifies agency requirements and expectations of new and existing Software Providers and the software

product.

Issue notification and resolution requirements

This section represents the Vermont Department of Taxes issue notification and issue resolution standards. If your

company identifies an issue, incident, or threat of significance you should:

• Conduct an initial analysis and immediately take steps to block or contain the issue.

• Share detailed information about the impacts to the returns or taxpayers immediately as permitted by

applicable laws, regulations, or policies. The information includes, but is not limited to:

o Description of the incident.

o Date and time of the incident.

o Date and time the incident was discovered.

o How the incident was discovered.

o Data involved, including specific data elements.

o Actual or estimated number of taxpayer records involved.

o A sample of the submission IDs of those involved with the incident.

o Examples of information communicated to customers or other external audiences about the issue.

o Plan for correcting the issue and, if appropriate, notifying those impacted.

• Work with the Vermont Department of Taxes to identify, correct, and prevent the issue.

• If applicable, work with the Vermont Department of Taxes to develop and distribute communication material

and instructions for customers. Please contact tax.vendorsupport@vermont.gov for a quick response.

Data breaches, security incidents, or other improper disclosures of taxpayer data that by law require reporting to the

Office of the Vermont Attorney General must also be reported to the Vermont Department of Taxes. Software

Providers executing this agreement are subject to the data breach notification laws and regulations of the State of

Vermont including, but not limited to, 9 V.S.A. § 2435

Notify the agency if any forms and/or payments you support are not ready when your software is available for use.

7

|