Enlarge image

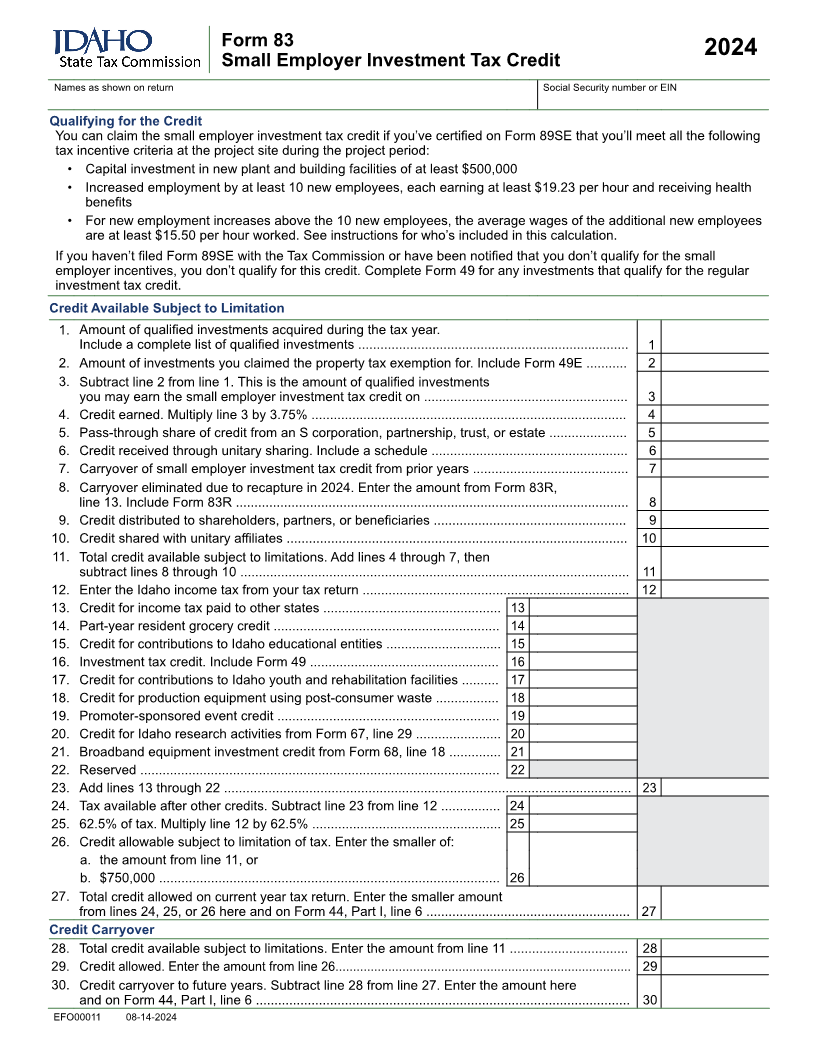

Form 83

2024

Small Employer Investment Tax Credit

Names as shown on return Social Security number or EIN

Qualifying for the Credit

You can claim the small employer investment tax credit if you’ve certified on Form 89SE that you’ll meet all the following

tax incentive criteria at the project site during the project period:

• Capital investment in new plant and building facilities of at least $500,000

• Increased employment by at least 10 new employees, each earning at least $19.23 per hour and receiving health

benefits

• For new employment increases above the 10 new employees, the average wages of the additional new employees

are at least $15.50 per hour worked. See instructions for who’s included in this calculation.

If you haven’t filed Form 89SE with the Tax Commission or have been notified that you don’t qualify for the small

employer incentives, you don’t qualify for this credit. Complete Form 49 for any investments that qualify for the regular

investment tax credit.

Credit Available Subject to Limitation

1. Amount of qualified investments acquired during the tax year.

Include a complete list of qualified investments ......................................................................... 1

2. Amount of investments you claimed the property tax exemption for. Include Form 49E ........... 2

3. Subtract line 2 from line 1. This is the amount of qualified investments

you may earn the small employer investment tax credit on ....................................................... 3

4. Credit earned. Multiply line 3 by 3.75% ..................................................................................... 4

5. Pass-through share of credit from an S corporation, partnership, trust, or estate ..................... 5

6. Credit received through unitary sharing. Include a schedule ..................................................... 6

7. Carryover of small employer investment tax credit from prior years .......................................... 7

8. Carryover eliminated due to recapture in 2024. Enter the amount from Form 83R,

line 13. Include Form 83R .......................................................................................................... 8

9. Credit distributed to shareholders, partners, or beneficiaries .................................................... 9

10. Credit shared with unitary affiliates ............................................................................................ 10

11. Total credit available subject to limitations. Add lines 4 through 7, then

subtract lines 8 through 10 ......................................................................................................... 11

12. Enter the Idaho income tax from your tax return ........................................................................ 12

13. Credit for income tax paid to other states ................................................ 13

14. Part-year resident grocery credit ............................................................. 14

15. Credit for contributions to Idaho educational entities ............................... 15

16. Investment tax credit. Include Form 49 ................................................... 16

17. Credit for contributions to Idaho youth and rehabilitation facilities .......... 17

18. Credit for production equipment using post-consumer waste ................. 18

19. Promoter-sponsored event credit ............................................................ 19

20. Credit for Idaho research activities from Form 67, line 29 ....................... 20

21. Broadband equipment investment credit from Form 68, line 18 .............. 21

22. Reserved .................................................................................................22

23. Add lines 13 through 22 .............................................................................................................. 23

24. Tax available after other credits. Subtract line 23 from line 12 ................ 24

25. 62.5% of tax. Multiply line 12 by 62.5% ................................................... 25

26. Credit allowable subject to limitation of tax. Enter the smaller of:

a. the amount from line 11, or

b. $750,000 ............................................................................................ 26

27. Total credit allowed on current year tax return. Enter the smaller amount

from lines 24, 25, or 26 here and on Form 44, Part I, line 6 ....................................................... 27

Credit Carryover

28. Total credit available subject to limitations. Enter the amount from line 11 ................................ 28

29. Credit allowed. Enter the amount from line 26.................................................................................... 29

30. Credit carryover to future years. Subtract line 28 from line 27. Enter the amount here

and on Form 44, Part I, line 6 ..................................................................................................... 30

EFO00011 08-14-2024