Enlarge image

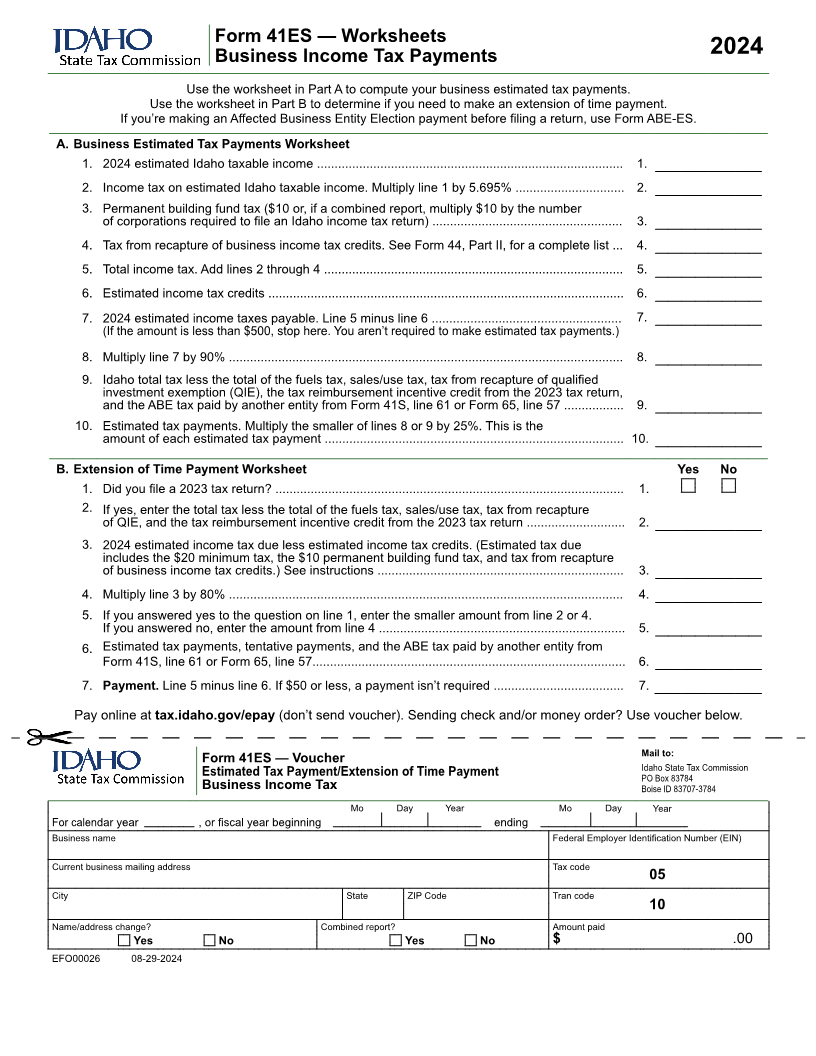

Form 41ES — Worksheets

Business Income Tax Payments 2024

Use the worksheet in Part A to compute your business estimated tax payments.

Use the worksheet in Part B to determine if you need to make an extension of time payment.

If you’re making an Affected Business Entity Election payment before filing a return, use Form ABE-ES.

A. Business Estimated Tax Payments Worksheet

1. 2024 estimated Idaho taxable income ....................................................................................... 1.

2. Income tax on estimated Idaho taxable income. Multiply line 1 by 5.695% ............................... 2.

3. Permanent building fund tax ($10 or, if a combined report, multiply $10 by the number

of corporations required to file an Idaho income tax return) ...................................................... 3.

4. Tax from recapture of business income tax credits. See Form 44, Part II, for a complete list ... 4.

5. Total income tax. Add lines 2 through 4 ..................................................................................... 5.

6. Estimated income tax credits ..................................................................................................... 6.

7. 2024 estimated income taxes payable. Line 5 minus line 6 ...................................................... 7.

(If the amount is less than $500, stop here. You aren’t required to make estimated tax payments.)

8. Multiply line 7 by 90% ................................................................................................................ 8.

9. Idaho total tax less the total of the fuels tax, sales/use tax, tax from recapture of qualified

investment exemption (QIE), the tax reimbursement incentive credit from the 2023 tax return,

and the ABE tax paid by another entity from Form 41S, line 61 or Form 65, line 57 ................. 9.

10. Estimated tax payments. Multiply the smaller of lines 8 or 9 by 25%. This is the

amount of each estimated tax payment ..................................................................................... 10.

B. Extension of Time Payment Worksheet Yes No

1. Did you file a 2023 tax return? ................................................................................................... 1.

2. If yes, enter the total tax less the total of the fuels tax, sales/use tax, tax from recapture

of QIE, and the tax reimbursement incentive credit from the 2023 tax return ............................ 2.

3. 2024 estimated income tax due less estimated income tax credits. (Estimated tax due

includes the $20 minimum tax, the $10 permanent building fund tax, and tax from recapture

of business income tax credits.) See instructions ...................................................................... 3.

4. Multiply line 3 by 80% ................................................................................................................ 4.

5. If you answered yes to the question on line 1, enter the smaller amount from line 2 or 4.

If you answered no, enter the amount from line 4 ...................................................................... 5.

6. Estimated tax payments, tentative payments, and the ABE tax paid by another entity from

Form 41S, line 61 or Form 65, line 57......................................................................................... 6.

7. Payment. Line 5 minus line 6. If $50 or less, a payment isn’t required ..................................... 7.

Pay online at tax.idaho.gov/epay (don’t send voucher). Sending check and/or money order? Use voucher below.

Mail to:

Form 41ES — Voucher Idaho State Tax Commission

Estimated Tax Payment/Extension of Time Payment PO Box 83784

Business Income Tax Boise ID 83707-3784

Mo Day Year Mo Day Year

For calendar year , or fiscal year beginning ending

Business name Federal Employer Identification Number (EIN)

Current business mailing address Tax code

05

City State ZIP Code Tran code

10

Name/address change? Combined report? Amount paid

Yes No Yes No $ .00

EFO00026 08-29-2024