Enlarge image

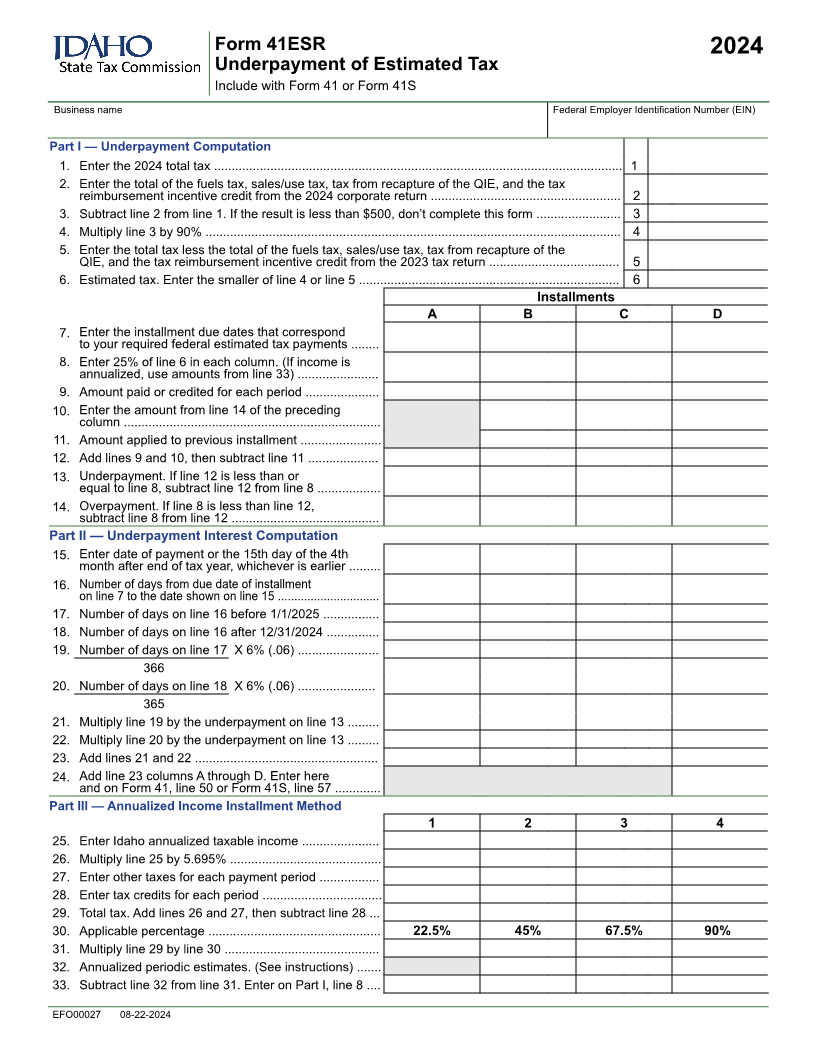

Form 41ESR 2024

Underpayment of Estimated Tax

Include with Form 41 or Form 41S

Business name Federal Employer Identification Number (EIN)

Part I — Underpayment Computation

1. Enter the 2024 total tax .................................................................................................................... 1

2. Enter the total of the fuels tax, sales/use tax, tax from recapture of the QIE, and the tax

reimbursement incentive credit from the 2024 corporate return ...................................................... 2

3. Subtract line 2 from line 1. If the result is less than $500, don’t complete this form ........................ 3

4. Multiply line 3 by 90% ...................................................................................................................... 4

5. Enter the total tax less the total of the fuels tax, sales/use tax, tax from recapture of the

QIE, and the tax reimbursement incentive credit from the 2023 tax return ..................................... 5

6. Estimated tax. Enter the smaller of line 4 or line 5 .......................................................................... 6

Installments

A B C D

7. Enter the installment due dates that correspond

to your required federal estimated tax payments ........

8. Enter 25% of line 6 in each column. (If income is

annualized, use amounts from line 33) .......................

9. Amount paid or credited for each period .....................

10. Enter the amount from line 14 of the preceding

column .........................................................................

11. Amount applied to previous installment .......................

12. Add lines 9 and 10, then subtract line 11 ....................

13. Underpayment. If line 12 is less than or

equal to line 8, subtract line 12 from line 8 ..................

14. Overpayment. If line 8 is less than line 12,

subtract line 8 from line 12 ..........................................

Part II — Underpayment Interest Computation

15. Enter date of payment or the 15th day of the 4th

month after end of tax year, whichever is earlier .........

16. Number of days from due date of installment

on line 7 to the date shown on line 15 ...............................

17. Number of days on line 16 before 1/1/2025 ................

18. Number of days on line 16 after 12/31/2024 ...............

19. Number of days on line 17 X 6% (.06) .......................

366

20. Number of days on line 18 X 6% (.06) ......................

365

21. Multiply line 19 by the underpayment on line 13 .........

22. Multiply line 20 by the underpayment on line 13 .........

23. Add lines 21 and 22 ....................................................

24. Add line 23 columns A through D. Enter here

and on Form 41, line 50 or Form 41S, line 57 .............

Part III — Annualized Income Installment Method

1 2 3 4

25. Enter Idaho annualized taxable income ......................

26. Multiply line 25 by 5.695% ...........................................

27. Enter other taxes for each payment period .................

28. Enter tax credits for each period ..................................

29. Total tax. Add lines 26 and 27, then subtract line 28 ...

30. Applicable percentage ................................................. 22.5% 45% 67.5% 90%

31. Multiply line 29 by line 30 ............................................

32. Annualized periodic estimates. (See instructions) .......

33. Subtract line 32 from line 31. Enter on Part I, line 8 ....

EFO00027 08-22-2024