Enlarge image

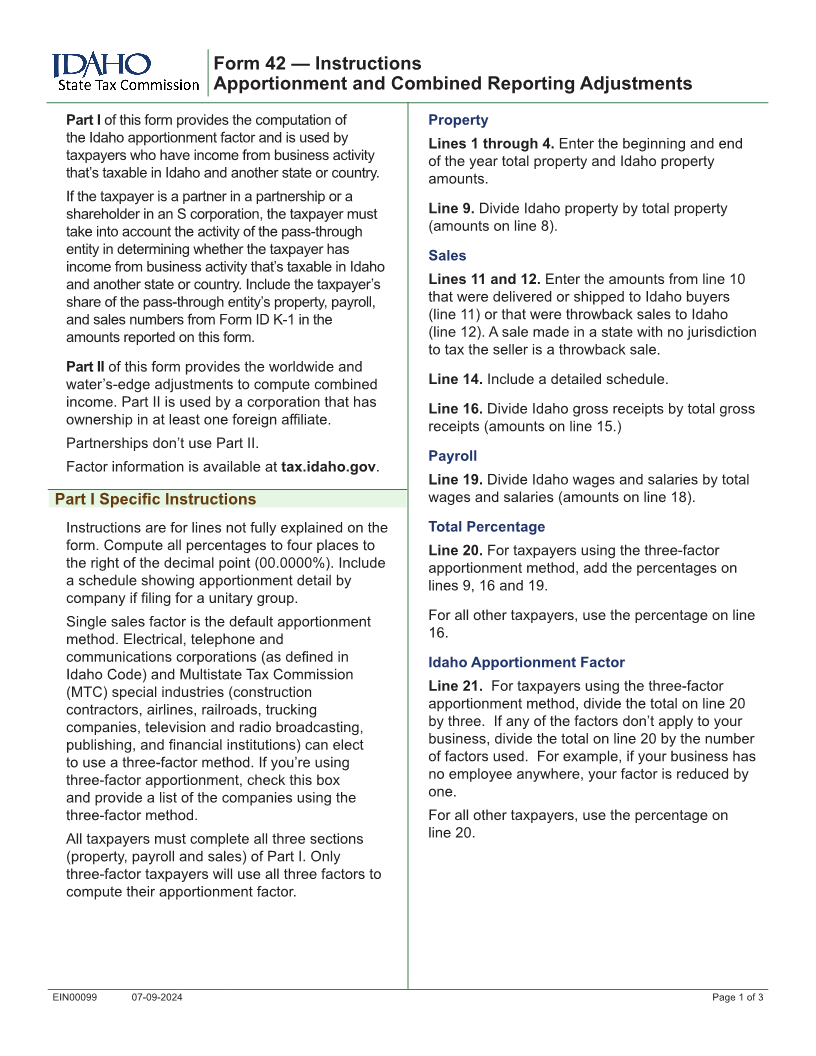

Form 42

Apportionment and Combined Reporting Adjustments 2024

Include with Idaho Income Tax Return as Page 3

Name as shown on return Federal Employer Identification Number (EIN)

Part I. Apportionment Formula Check if using three factor apportionment ▪

Property (Owned Property at Original Cost)

Total Idaho Percentage

Beginning of Year

1. Inventories ...................................................................... 1 ▪ ▪

2. Real and tangible personal property .............................. 2 ▪ ▪

Ending of Year

3. Inventories ...................................................................... 3 ▪ ▪

4. Real and tangible personal property .............................. 4 ▪ ▪

5. Total of lines 1 through 4 ................................................ 5

6. Average. Line 5 divided by 2 .......................................... 6

7. Rented property (capitalized at 8 times rents paid) ........ 7 ▪ ▪

8. Total property. Add lines 6 and 7 .................................... 8 ▪ ▪

9. Idaho property percentage. Compute percentage to four decimal places ........................................... 9 %

Sales (Gross Receipts)

10. Gross sales, less returns and allowances ...................... 10 ▪

11. Sales delivered or shipped to Idaho purchasers ............ 11 ▪

12. Idaho “throwback” sales ................................................. 12 ▪

13. Sales of services ............................................................ 13 ▪ ▪

14. Other business gross receipts ........................................ 14 ▪ ▪

15. Total gross receipts. Add lines 10 through 14 ................. 15 ▪ ▪

16. Idaho sales percentage. Compute percentage to four decimal places .............................................. 16 %

17. Reserved ........................................................................................................................................... 17

Payroll

18. Total wages and salaries ................................................. 18 ▪ ▪

19. Idaho payroll percentage. Compute percentage to four decimal places ............................................ 19 %

20. Total Percentage. See instructions ................................................................................................... 20 %

21. Idaho Apportionment Factor. See instructions ............................................................................... 21 %

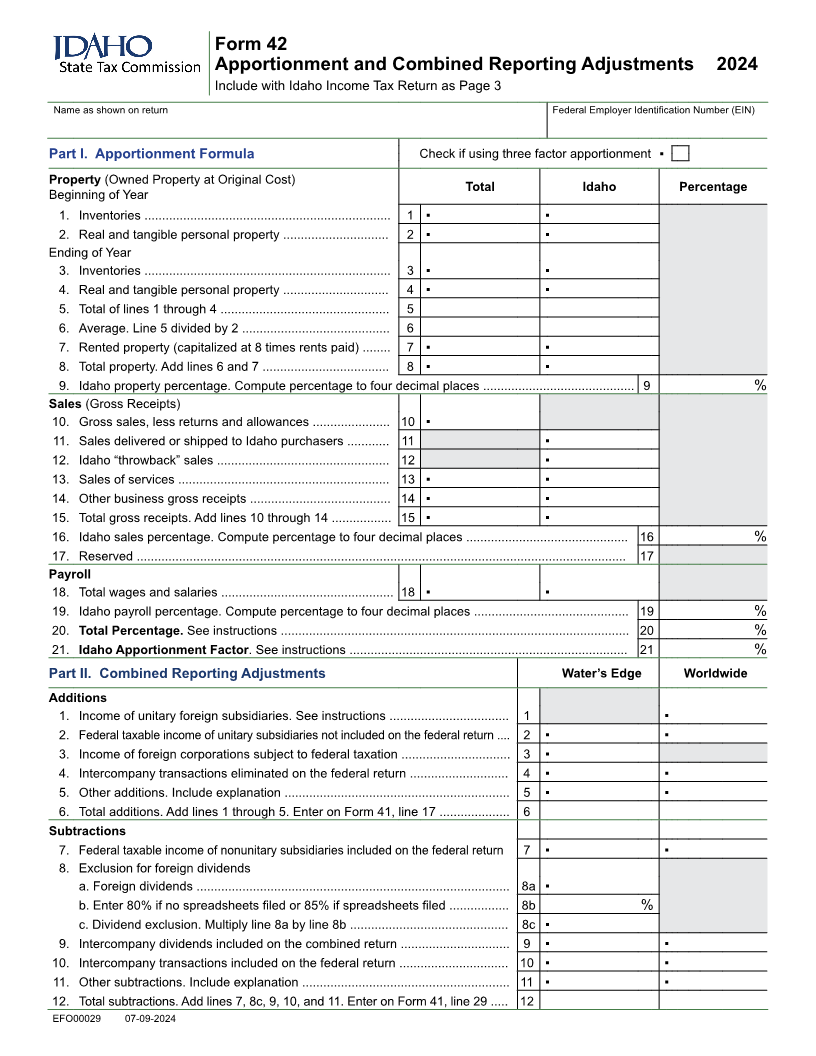

Part II. Combined Reporting Adjustments Water’s Edge Worldwide

Additions

1. Income of unitary foreign subsidiaries. See instructions .................................. 1 ▪

2. Federal taxable income of unitary subsidiaries not included on the federal return .... 2 ▪ ▪

3. Income of foreign corporations subject to federal taxation ............................... 3 ▪

4. Intercompany transactions eliminated on the federal return ............................ 4 ▪ ▪

5. Other additions. Include explanation ................................................................ 5 ▪ ▪

6. Total additions. Add lines 1 through 5. Enter on Form 41, line 17 .................... 6

Subtractions

7. Federal taxable income of nonunitary subsidiaries included on the federal return 7 ▪ ▪

8. Exclusion for foreign dividends

a. Foreign dividends ......................................................................................... 8a ▪

b. Enter 80% if no spreadsheets filed or 85% if spreadsheets filed ................. 8b %

c. Dividend exclusion. Multiply line 8a by line 8b ............................................. 8c ▪

9. Intercompany dividends included on the combined return ............................... 9 ▪ ▪

10. Intercompany transactions included on the federal return ............................... 10 ▪ ▪

11. Other subtractions. Include explanation ........................................................... 11 ▪ ▪

12. Total subtractions. Add lines 7, 8c, 9, 10, and 11. Enter on Form 41, line 29 ..... 12

EFO00029 07-09-2024