Enlarge image

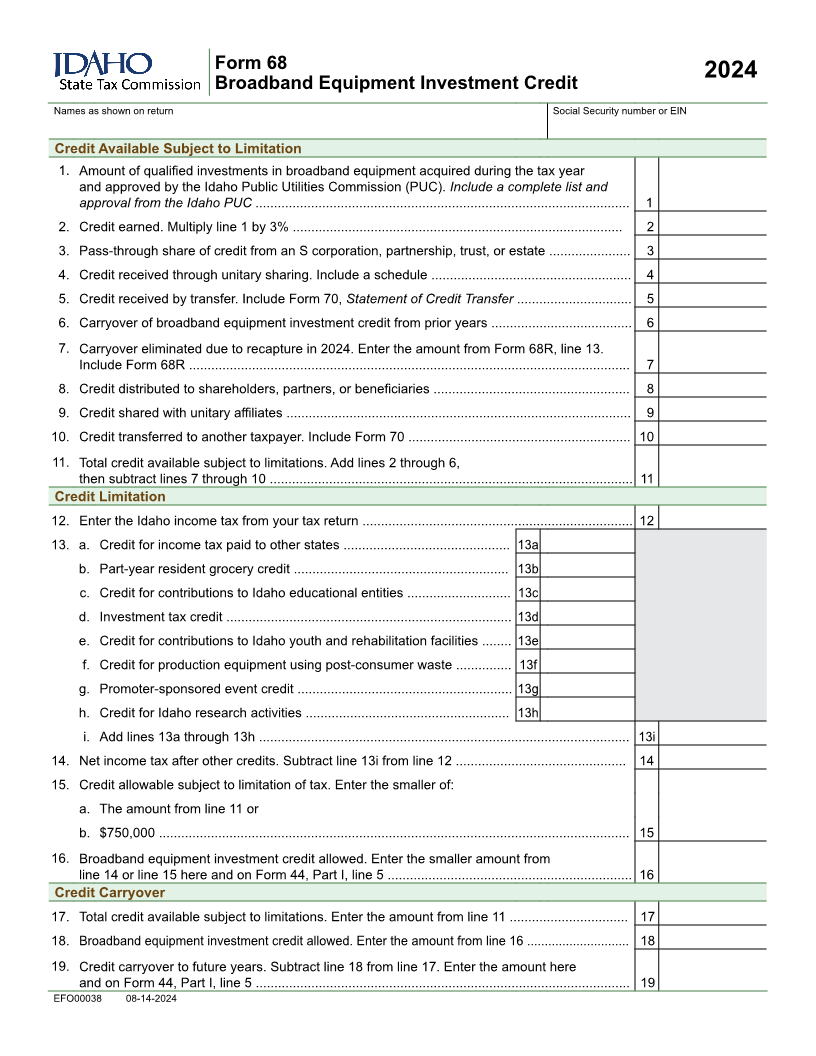

Form 68

2024

Broadband Equipment Investment Credit

Names as shown on return Social Security number or EIN

Credit Available Subject to Limitation

1. Amount of qualified investments in broadband equipment acquired during the tax year

and approved by the Idaho Public Utilities Commission (PUC). Include a complete list and

approval from the Idaho PUC ..................................................................................................... 1

2. Credit earned. Multiply line 1 by 3% ......................................................................................... 2

3. Pass-through share of credit from an S corporation, partnership, trust, or estate ...................... 3

4. Credit received through unitary sharing. Include a schedule ...................................................... 4

5. Credit received by transfer. Include Form 70, Statement of Credit Transfer ............................... 5

6. Carryover of broadband equipment investment credit from prior years ...................................... 6

7. Carryover eliminated due to recapture in 2024. Enter the amount from Form 68R, line 13.

Include Form 68R ....................................................................................................................... 7

8. Credit distributed to shareholders, partners, or beneficiaries ..................................................... 8

9. Credit shared with unitary affiliates ............................................................................................. 9

10. Credit transferred to another taxpayer. Include Form 70 ............................................................ 10

11. Total credit available subject to limitations. Add lines 2 through 6,

then subtract lines 7 through 10 .................................................................................................. 11

Credit Limitation

12. Enter the Idaho income tax from your tax return ......................................................................... 12

13. a. Credit for income tax paid to other states ............................................. 13a

b. Part-year resident grocery credit .......................................................... 13b

c. Credit for contributions to Idaho educational entities ............................ 13c

d. Investment tax credit .............................................................................13d

e. Credit for contributions to Idaho youth and rehabilitation facilities ........ 13e

f. Credit for production equipment using post-consumer waste ............... 13f

g. Promoter-sponsored event credit .......................................................... 13g

h. Credit for Idaho research activities ....................................................... 13h

i. Add lines 13a through 13h .................................................................................................... 13i

14. Net income tax after other credits. Subtract line 13i from line 12 .............................................. 14

15. Credit allowable subject to limitation of tax. Enter the smaller of:

a. The amount from line 11 or

b. $750,000 ............................................................................................................................... 15

16. Broadband equipment investment credit allowed. Enter the smaller amount from

line 14 or line 15 here and on Form 44, Part I, line 5 .................................................................. 16

Credit Carryover

17. Total credit available subject to limitations. Enter the amount from line 11 ................................ 17

18. Broadband equipment investment credit allowed. Enter the amount from line 16 ............................. 18

19. Credit carryover to future years. Subtract line 18 from line 17. Enter the amount here

and on Form 44, Part I, line 5 ..................................................................................................... 19

EFO00038 08-14-2024