Enlarge image

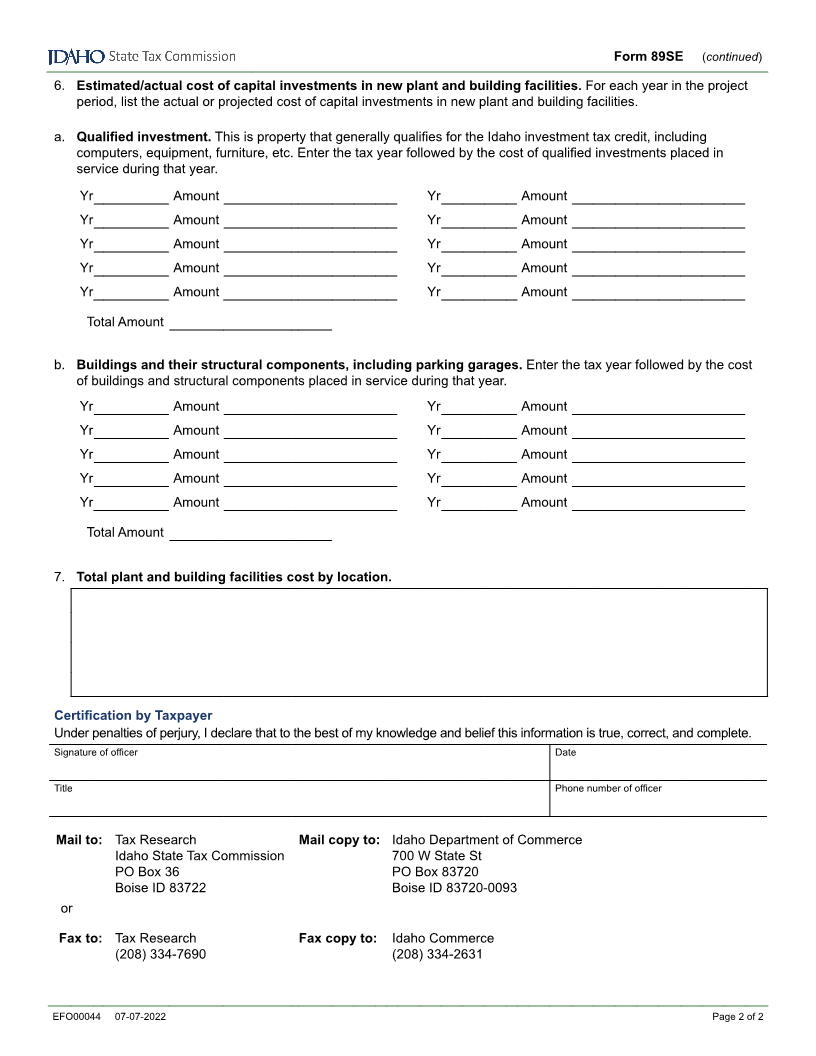

Form 89SE

Certification for Idaho’s Small Employer Tax Incentives

Business name Federal Employer Identification Number (EIN)

Current business mailing address Contact person and title

City State ZIP code Phone number of contact person

Qualifying for the Incentives

To claim the Idaho small employer tax incentives, you must certify that you’ve met or will meet all of the following tax

incentive criteria at the project site during the project period:

• Capital investment in new plant and building facilities of at least $500,000

• Increased employment by at least 10 new employees who each earn at least $19.23 per hour worked and receive

health benefits

• For new employment increases above the 10 new employees, the average wages of the additional new

employees is at least $15.50 per hour worked. See instructions for who’s included in this calculation.

The following information is required to certify that the proposed project will meet the small employer tax incentive

criteria during the project period. If you don’t provide the requested information, the Tax Commission may disallow any

tax incentives claimed under the Idaho Small Employer Incentive Act.

1. Description of qualifying project.

2. Estimated/actual start date of project. The start date is the earlier of the date the first physical change to the

project site occurs or the date new employees related to the project site are first employed in Idaho. The start date

can’t be earlier than January 1, 2006.

3. Estimated/actual end date of project. The project period can’t be longer than 10 years or end later than

December 31, 2030.

4. Location of the project sites. Identify the street address for each site. If more than one location, identify the

percent of the investment projected at each site once the project is completed.

5. Estimated/actual number of new jobs created during the project period. For each year in the project period,

enter the tax year followed by the number of new jobs created during that year.

Yr # of jobs Yr # of jobs

Yr # of jobs Yr # of jobs

Yr # of jobs Yr # of jobs

Yr # of jobs Yr # of jobs

Yr # of jobs Yr # of jobs

Total # of jobs

EFO00044 07-07-2022 Page 1 of 2