Enlarge image

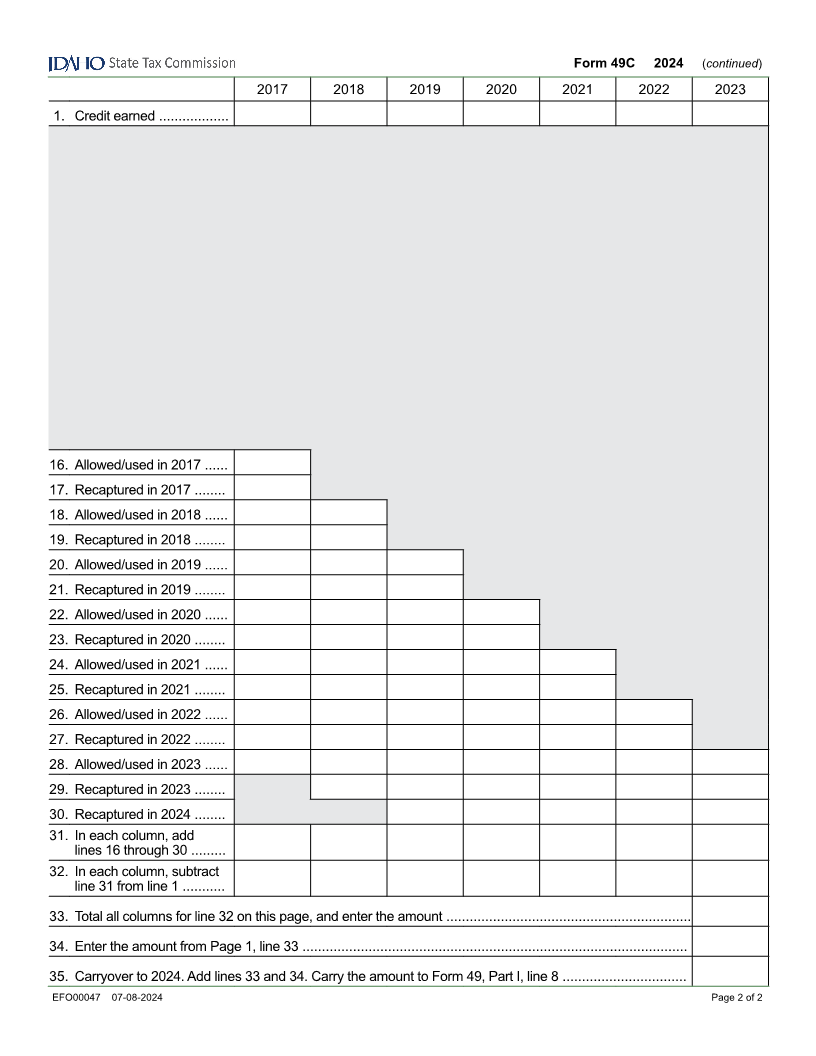

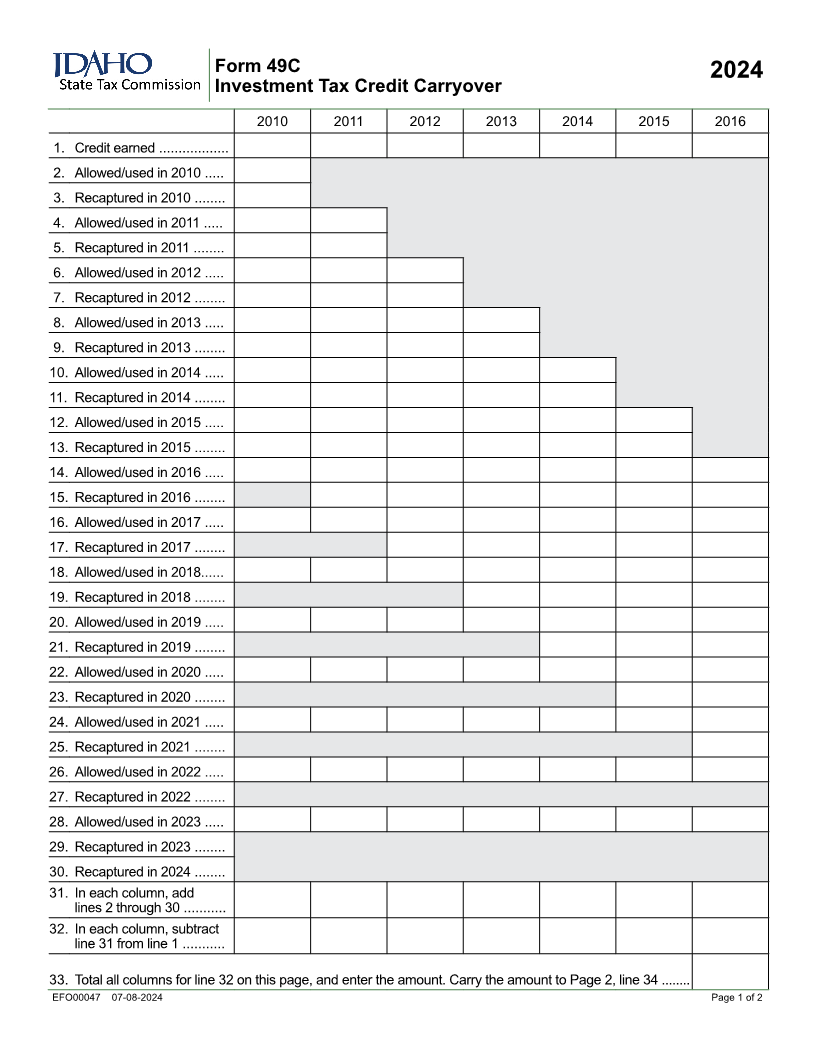

Form 49C

2024

Investment Tax Credit Carryover

2010 2011 2012 2013 2014 2015 2016

1. Credit earned ..................

2. Allowed/used in 2010 .....

3. Recaptured in 2010 ........

4. Allowed/used in 2011 .....

5. Recaptured in 2011 ........

6. Allowed/used in 2012 .....

7. Recaptured in 2012 ........

8. Allowed/used in 2013 .....

9. Recaptured in 2013 ........

10. Allowed/used in 2014 .....

11. Recaptured in 2014 ........

12. Allowed/used in 2015 .....

13. Recaptured in 2015 ........

14. Allowed/used in 2016 .....

15. Recaptured in 2016 ........

16. Allowed/used in 2017 .....

17. Recaptured in 2017 ........

18. Allowed/used in 2018......

19. Recaptured in 2018 ........

20. Allowed/used in 2019 .....

21. Recaptured in 2019 ........

22. Allowed/used in 2020 .....

23. Recaptured in 2020 ........

24. Allowed/used in 2021 .....

25. Recaptured in 2021 ........

26. Allowed/used in 2022 .....

27. Recaptured in 2022 ........

28. Allowed/used in 2023 .....

29. Recaptured in 2023 ........

30. Recaptured in 2024 ........

31. In each column, add

lines 2 through 30 ...........

32. In each column, subtract

line 31 from line 1 ...........

33. Total all columns for line 32 on this page, and enter the amount. Carry the amount to Page 2, line 34 ........

EFO00047 07-08-2024 Page 1 of 2