Enlarge image

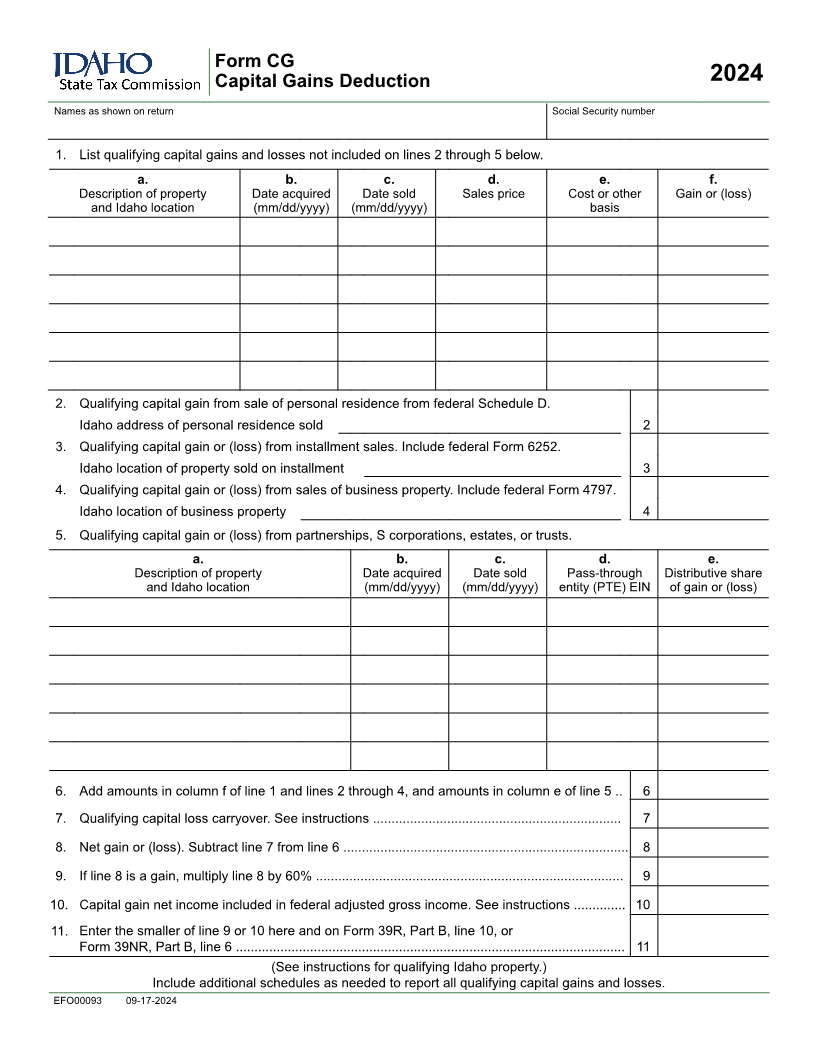

Form CG

Capital Gains Deduction 2024

Names as shown on return Social Security number

1. List qualifying capital gains and losses not included on lines 2 through 5 below.

a. b. c. d. e. f.

Description of property Date acquired Date sold Sales price Cost or other Gain or (loss)

and Idaho location (mm/dd/yyyy) (mm/dd/yyyy) basis

2. Qualifying capital gain from sale of personal residence from federal Schedule D.

Idaho address of personal residence sold 2

3. Qualifying capital gain or (loss) from installment sales. Include federal Form 6252.

Idaho location of property sold on installment 3

4. Qualifying capital gain or (loss) from sales of business property. Include federal Form 4797.

Idaho location of business property 4

5. Qualifying capital gain or (loss) from partnerships, S corporations, estates, or trusts.

a. b. c. d. e.

Description of property Date acquired Date sold Pass-through Distributive share

and Idaho location (mm/dd/yyyy) (mm/dd/yyyy) entity (PTE) EIN of gain or (loss)

6. Add amounts in column f of line 1 and lines 2 through 4, and amounts in column e of line 5 .. 6

7. Qualifying capital loss carryover. See instructions ................................................................... 7

8. Net gain or (loss). Subtract line 7 from line 6 ............................................................................. 8

9. If line 8 is a gain, multiply line 8 by 60% ................................................................................... 9

10. Capital gain net income included in federal adjusted gross income. See instructions .............. 10

11. Enter the smaller of line 9 or 10 here and on Form 39R, Part B, line 10, or

Form 39NR, Part B, line 6 ......................................................................................................... 11

(See instructions for qualifying Idaho property.)

Include additional schedules as needed to report all qualifying capital gains and losses.

EFO00093 09-17-2024