Enlarge image

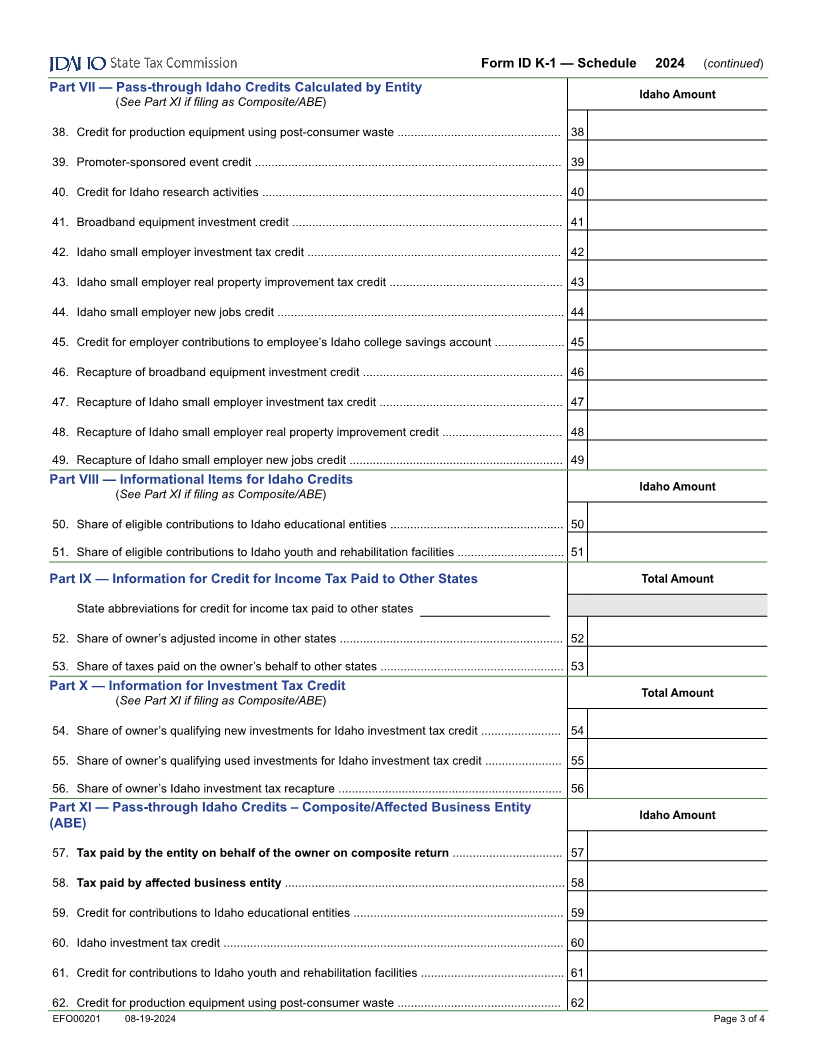

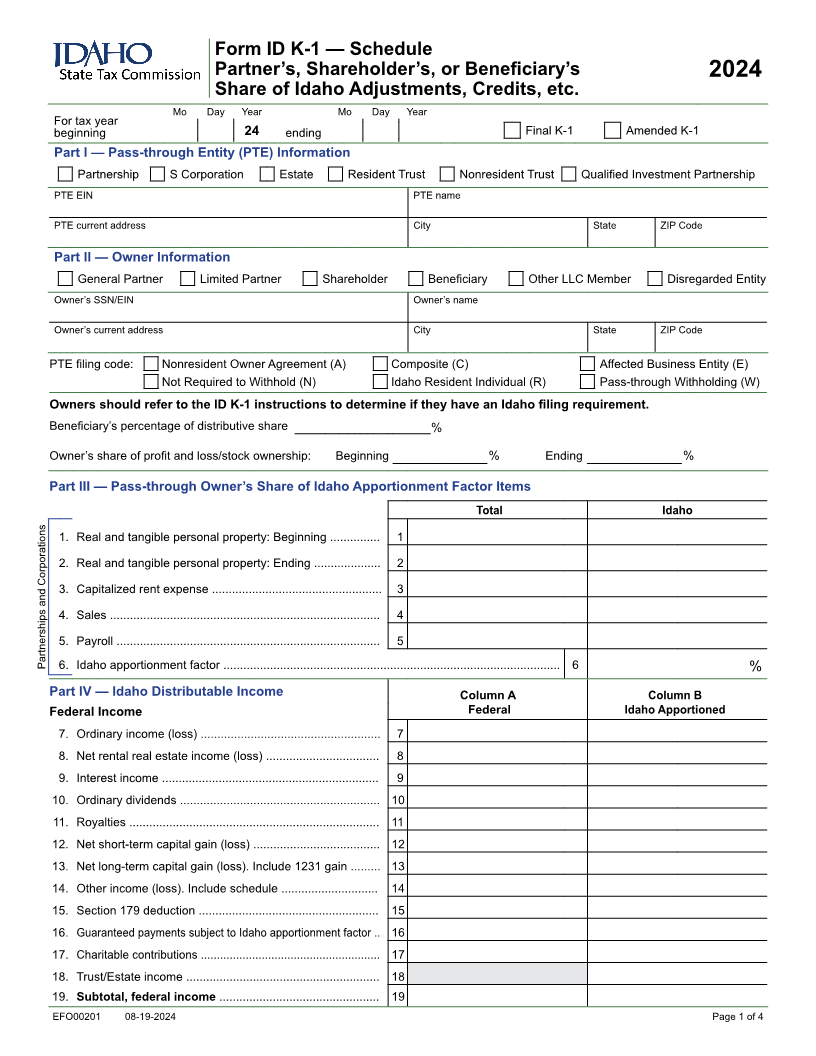

Form ID K-1 — Schedule

Partner’s, Shareholder’s, or Beneficiary’s 2024

Share of Idaho Adjustments, Credits, etc.

Mo Day Year Mo Day Year

For tax year

beginning 24 ending Final K-1 Amended K-1

Part I — Pass-through Entity (PTE) Information

Partnership S Corporation Estate Resident Trust Nonresident Trust Qualified Investment Partnership

PTE EIN PTE name

PTE current address City State ZIP Code

Part II — Owner Information

General Partner Limited Partner Shareholder Beneficiary Other LLC Member Disregarded Entity

Owner’s SSN/EIN Owner’s name

Owner’s current address City State ZIP Code

PTE filing code: Nonresident Owner Agreement (A) Composite (C) Affected Business Entity (E)

Not Required to Withhold (N) Idaho Resident Individual (R) Pass-through Withholding (W)

Owners should refer to the ID K-1 instructions to determine if they have an Idaho filing requirement.

Beneficiary’s percentage of distributive share %

Owner’s share of profit and loss/stock ownership: Beginning % Ending %

Part III — Pass-through Owner’s Share of Idaho Apportionment Factor Items

Total Idaho

1. Real and tangible personal property: Beginning ............... 1

2. Real and tangible personal property: Ending .................... 2

3. Capitalized rent expense ................................................... 3

4. Sales ................................................................................. 4

5. Payroll ............................................................................... 5

Partnerships and Corporations 6. Idaho apportionment factor ..................................................................................................... 6 %

Part IV — Idaho Distributable Income Column A Column B

Federal Income Federal Idaho Apportioned

7. Ordinary income (loss) ...................................................... 7

8. Net rental real estate income (loss) .................................. 8

9. Interest income ................................................................. 9

10. Ordinary dividends ............................................................ 10

11. Royalties ........................................................................... 11

12. Net short-term capital gain (loss) ...................................... 12

13. Net long-term capital gain (loss). Include 1231 gain ......... 13

14. Other income (loss). Include schedule ............................. 14

15. Section 179 deduction ...................................................... 15

16. Guaranteed payments subject to Idaho apportionment factor .. 16

17. Charitable contributions ........................................................ 17

18. Trust/Estate income .......................................................... 18

19. Subtotal, federal income ................................................ 19

EFO00201 08-19-2024 Page 1 of 4