- 3 -

Enlarge image

|

Form PTE-12 — Instructions 2024 (continued)

approves it, the entity doesn’t include the Composite (C)

individual in a composite return or pay The nonresident individual owner is included

withholding to the Tax Commission on the in a composite return. If the owner isn’t an

owner’s behalf. individual,* the income can’t be included on a

• The entity includes the nonresident composite return, and code “C” can’t be used.

individual owner’s information on the Affected Business Entity (E)

PTE-12. Enter “A” in the Filing Code column.The entity has elected to pay tax at the entity

level.

Affected business entities

Only complete columns (a), (b), and (e). If the entity uses filing code “E,” it must apply to

The entity has elected to be taxed at the entity all owners.

level. Enter “E” in the Filing Code column. Not Required to Withhold (N)

The owner isn’t subject to backup withholding.

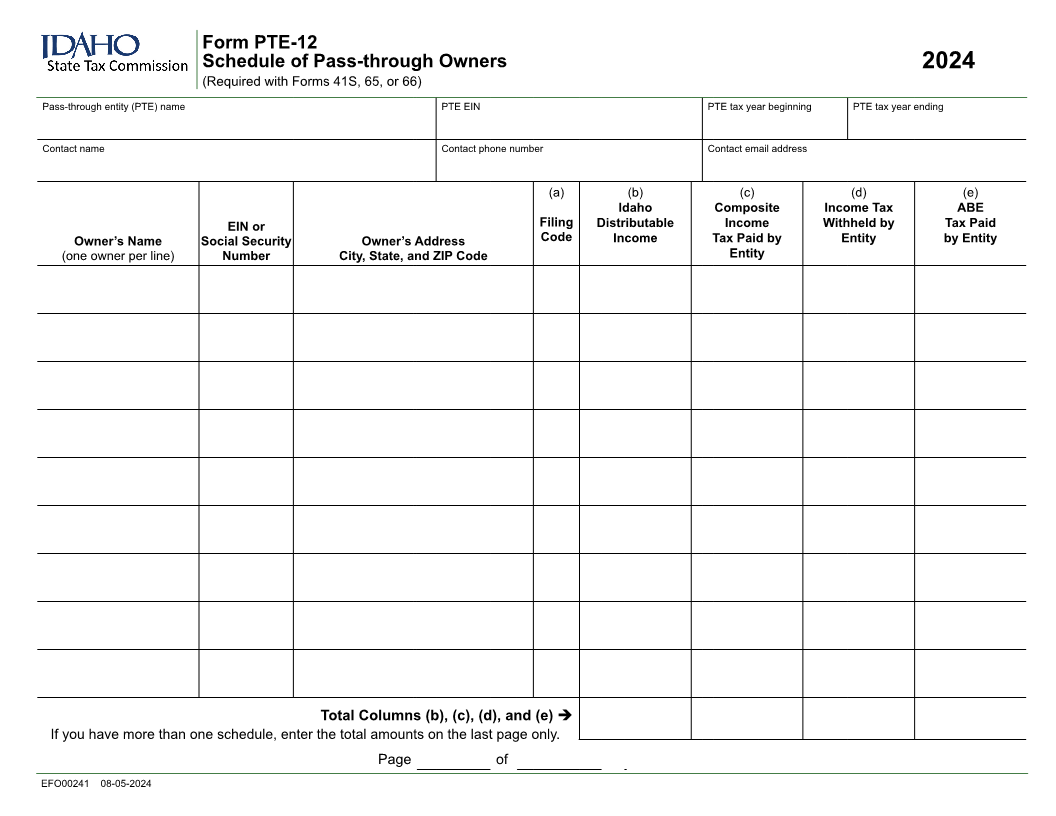

Specific Instructions Backup withholding isn’t required on income of

Heading less than $1,000. Don’t withhold on the income

Enter the entity’s name and Employer of owners and beneficiaries if they aren’t natural

Identification Number (EIN) in the space persons* (including corporations, partnerships,

provided. trusts, and estates).

Entity’s tax year beginning and ending Resident (R)

Enter the beginning and ending date of the The owner is an Idaho resident or part-year

entity’s tax year. resident filing an Idaho individual income tax

return.

Contact name and phone number

Enter the name, phone number, and email Withholding (W)

address of a person we can contact about the The entity is paying backup withholding on

information reported on Form PTE-12. behalf of a nonresident individual owner on

Form PTE-01.

Owner’s name and Social Security number or

Withholding can’t be paid on behalf of another

EIN

entity, and code “W” can’t be used.

Enter the name and corresponding Social

Security number or EIN of each owner as shown Column (b) Idaho Distributable Income

on the Idaho income tax return, one owner per Enter the Idaho distributable income for all filing

line. codes.

This is the amount computed on Form ID K-1,

Address

line 34. If the entity is a partnership, guaranteed

Enter the owner’s address, city, state, and ZIP

payments sourced to Idaho are included in the

code.

Idaho distributable income of the partner. (See

Column (a) Filing Code Guaranteed Payments Guidance at tax.idaho.gov).

Enter one of the following letters corresponding If the beneficiary is an Idaho nonresident, only enter

to the filing code for the owner. the nonresident beneficiary’s share of the distributed

Idaho-source income. Some sources of income

Agreement (A)

may not be Idaho-source income to a nonresident

The nonresident individual owner has provided

beneficiary.

an Idaho nonresident owner agreement

(Form PTE-NROA). *See General Instructions for definition of

“individual.”

By entering the “A” filing code, the entity

agrees that it received and approved

the agreement from the individual* and

acknowledges that the entity is liable for any

tax due if the individual doesn’t file a return

and pay the tax as agreed.

EIN00054 08-05-2024 Page 2 of 3

|