Enlarge image

Form PTE-NROA

Nonresident Owner Agreement 2024

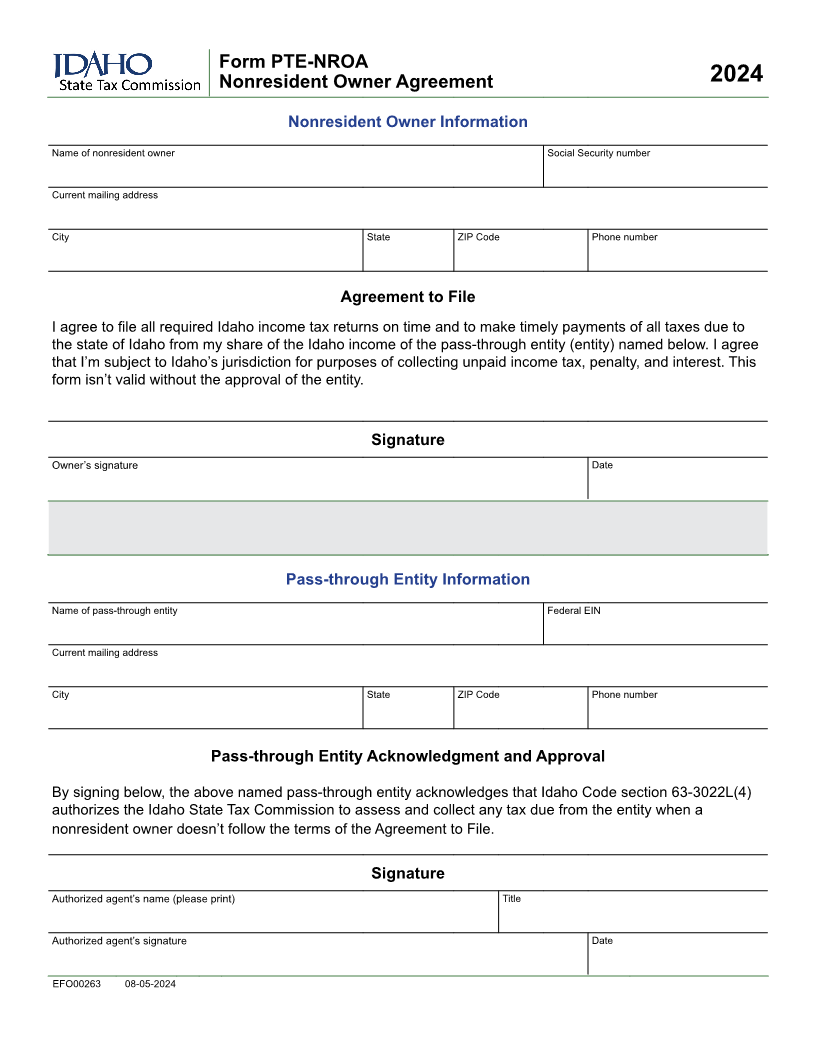

Nonresident Owner Information

Name of nonresident owner Social Security number

Current mailing address

City State ZIP Code Phone number

Agreement to File

I agree to file all required Idaho income tax returns on time and to make timely payments of all taxes due to

the state of Idaho from my share of the Idaho income of the pass-through entity (entity) named below. I agree

that I’m subject to Idaho’s jurisdiction for purposes of collecting unpaid income tax, penalty, and interest. This

form isn’t valid without the approval of the entity.

Signature

Owner’s signature Date

Pass-through Entity Information

Name of pass-through entity Federal EIN

Current mailing address

City State ZIP Code Phone number

Pass-through Entity Acknowledgment and Approval

By signing below, the above named pass-through entity acknowledges that Idaho Code section 63-3022L(4)

authorizes the Idaho State Tax Commission to assess and collect any tax due from the entity when a

nonresident owner doesn’t follow the terms of the Agreement to File.

Signature

Authorized agent’s name (please print) Title

Authorized agent’s signature Date

EFO00263 08-05-2024